A retail trader is an individual who buys and sells financial instruments with their own money for personal gain rather than on behalf of an institution.

Over the last decade, technological change and social media have amplified the influence of retail traders, changing how markets behave and how newcomers learn to trade.

This article will break down who retail traders are, how they differ from institutional participants, why retail activity has grown, the practical opportunities and risks involved, empirical evidence on outcomes, and concrete steps to trade more sensibly.

Retail Trading in Plain Terms

A retail trader is a private person using a brokerage account or trading platform to transact stocks, exchange traded funds, options, futures, cryptocurrencies or foreign exchange for their own account.

Retail traders may be casual investors building a retirement pot, active traders seeking short term gains, or hobbyists exploring markets for intellectual interest.

They operate with personal capital, make decisions for themselves, and seldom enjoy the privileged access, bespoke data feeds or execution facilities available to large funds.

The modern retail trader: profiles and motivations

Retail traders are not a single type. Common profiles include:

Part time investors who buy and hold for long term goals.

Swing traders who hold positions for several days to weeks.

Day traders who open and close positions within the same trading day.

Options and derivatives speculators who use leverage to amplify returns.

Crypto traders attracted to high volatility and 24/7 markets.

Typical motivations:

Independence, supplementing income, learning and entertainment, or following thematic trends such as electric vehicles or artificial intelligence.

The precise mix of motives helps explain why retail trading remains so diverse.

Key Comparative Overview: Retail vs Institutional Traders

| Dimension |

Retail trader |

Institutional trader |

| Capital base |

Personal funds, often modest |

Large pooled funds, professional mandates |

| Data and research |

Public sources, free tools |

Proprietary research, analyst teams |

| Execution |

Standard retail routing via brokers |

Direct market access, algorithmic execution |

| Regulatory status |

Individual investor protections apply |

Regulated as professional entities |

| Market impact |

Limited per trade; can move small-cap names collectively |

Can move markets via large block trades |

This comparison shows where retail traders have structural disadvantages and where technology has narrowed gaps.

How technology and platforms created a retail revolution

Several technological shifts explain the surge in retail participation:

Zero commission trading and fractional shares lowered the cost barrier to entry.

Mobile apps made account opening and order placement simple and fast.

Social media, online communities and video platforms turned strategy discussion into a social pastime.

New asset classes, notably cryptocurrencies, created accessible high-volatility markets.

Together these changes did not just increase the number of retail accounts; they changed the tempo of markets and how information spreads.

For evidence of the structural change, major studies and industry surveys document increased retail volumes in recent years.

Empirical picture: what the data says about retail activity and outcomes

Key empirical facts to keep in mind:

Retail participation has risen materially in many markets.

Several academic and industry surveys show that individual investors now account for a substantial share of daily trades in equities and options.

Regulatory and market studies show high turnover among retail traders and that many retail trading accounts are short lived.

For example, regulatory datasets indicate a high attrition rate among active retail futures traders.

Large country-level studies show worrying loss rates in high leverage products.

A recent regulator study found that a large majority of retail derivatives traders in one jurisdiction experienced net losses over consecutive years.

Broad analyses of trader performance suggest that a sizeable portion of active traders do not achieve consistent profits.

Various reviews place the proportion of traders who lose money in a broad range, commonly cited as 70 to 90 percent for active short-term participants, though precise numbers depend on market, timeframe and product.

Because outcome statistics vary by product and jurisdiction, these results should be treated as indicative rather than definitive. The core lesson is that active trading is difficult and many newcomers underestimate the practical challenges.

Where retail traders can add value: opportunities that matter

Retail trading is not only risk. When done sensibly, it can deliver real advantages:

Personal control:

You can choose strategy, time horizon and instruments.

Learning and skill development:

Active participation teaches risk management and market structure.

Niche opportunities:

Small investors can access specific thematic trades or microcaps that institutions ignore.

Cost efficiency:

For buy and hold investors, low fees and fractional shares enable precise portfolio construction.

Follow these practical principles to capture these advantages: set clear goals, keep position sizes small relative to capital, and be intentional about the time you spend trading.

The major pitfalls: why many retail traders fail

Common failure modes include:

Excessive leverage.

Using margin or derivatives without fully understanding the risks multiplies losses.

Behavioural biases.

Overconfidence, chasing winners, cutting winners too early and averaging down are frequent problems.

Poor risk management.

Absence of stop losses, inadequate position sizing and neglect of diversification increase downside.

Information overload and noise.

Social media and real time price feeds encourage impulsive decisions.

Lack of a tested plan.

Many traders operate without a documented strategy or failure contingencies.

A disciplined approach to risk management and a commitment to continuous learning materially reduce these pitfalls. Empirical studies and regulator reports have repeatedly highlighted leverage and inexperience as central drivers of retail losses.

Regulation, investor protection and what to watch for

Regulators worldwide have taken notice of the retail phenomenon. Common responses include:

Enhanced disclosure rules for high risk products.

Margin and leverage limits for retail accounts in certain products.

Education campaigns and mandatory risk warnings.

Monitoring of social trading platforms and unusual market activity.

Retail traders should choose brokers that are regulated by credible authorities, understand the protection schemes available and read product disclosures carefully.

Where applicable, follow required minimum balances and be sceptical of claims promising fast or guaranteed returns.

A simple trading checklist for retail traders

| Step |

Question to answer |

| 1. Goal setting |

What is my objective: income, capital growth or learning? |

| 2. Capital allocation |

How much can I afford to risk and still sleep at night? |

| 3. Strategy choice |

Am I a long term investor, swing trader or day trader? |

| 4. Risk controls |

What is my maximum loss per trade and total risk exposure? |

| 5. Review |

How often will I review and refine the strategy? |

Risk controls and suggested limits

| Control |

Suggested approach |

| Position size |

No more than 1–3 percent of total capital per trade for active traders |

| Leverage |

Use minimal leverage; prefer cash accounts for beginners |

| Stop loss |

Define a stop loss before entering trade |

| Diversification |

Avoid concentrating more than 10–20 percent of capital in a single sector |

Frequently asked questions

Q1. Can retail traders consistently beat the market?

Some individuals have beaten the market, but doing so consistently is rare and depends on skill, discipline, a tested edge and sometimes favourable market conditions. Many retail traders underperform benchmarks after fees and taxes.

Q2. Are retail traders harmful to markets?

Retail traders are not intrinsically harmful. They add liquidity and diversity of opinion. However, collective, herding behaviour in small caps or options markets can cause outsized volatility that participants and regulators must manage.

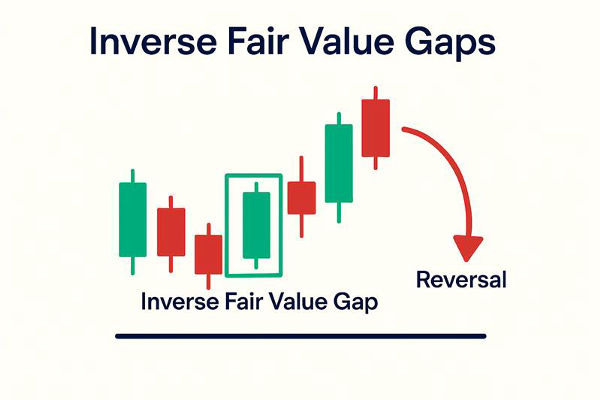

Q3. Which products are riskiest for retail traders?

Highly leveraged products such as futures, options and margin trading carry the greatest risk for inexperienced traders. Some derivatives require sophisticated risk controls and are unsuitable for many retail investors.

Q4. How can a new retail trader protect themselves?

Use regulated brokers, start with cash accounts, limit position sizes, avoid excessive leverage and commit to ongoing education. A simple written trading plan and a trade journal are two of the most effective early protections.

Conclusion

Retail trading is an important and growing feature of modern markets. It embodies the democratisation of finance but also carries real responsibilities. The combination of accessible technology and social media has opened enormous opportunities.

At the same time, empirical evidence warns that many retail participants suffer losses when they underestimate complexity, use excessive leverage or trade without a plan.

For anyone approaching markets, the sensible route is deliberate preparation, conservative risk management and a commitment to learning. Markets will always reward skill and patience more reliably than hope and haste.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.