Compared to the entire forex trading, choosing a forex order type is a very small step, but choosing the appropriate order type will result in twice the success of the trade with half the effort. Today, let's talk about common order types in forex trade.

1. What is an order?

First of all, let's understand what a forex order is. Simply put, it is an instruction or "voucher" used by forex trading service providers to execute a trade. When placing an order, traders need to be clear about four basic elements: direction (buy or sell), time (validity period of the order), price, trading volume/number of hands. Orders can be used to create new positions or to close existing positions. What we usually refer to as "order" refers to the act of placing an order, such as buying to build a position, selling to close a position, etc. Sometimes, orders also refer to entry orders and exit orders. If an order is completed, we say it has been executed. The order type is a way for traders to enter or exit the trade.

Understanding the differences between available order types can help traders determine which orders better meet their needs, thereby selecting the appropriate order types to help them achieve trading goals.

2. Basic order type

1、 Market order

A market price order is an order executed at the current market price. In other words, when a trader places a market price order, it means allowing the forex broker to buy or sell for the trader at any current market price.

Even if the trader places a market price order, the actual price at which the trade is executed may not be the same as the previous quote received by the trader. Some trading platforms allow traders to limit the maximum sliding point. If the market volatility has exceeded the set value, the order will be automatically cancelled; There are also some platforms that allow setting sliding point restrictions, but do not implement these restrictions in practical operations.

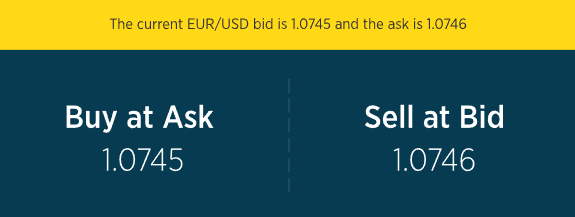

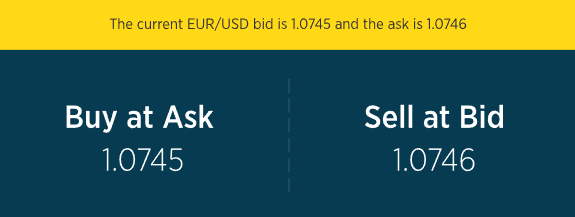

For example, the buying price for EUR/USD is 1.0745 and the selling price is 1.0746. If you want to purchase euros/dollars in the market, you can buy for 1.0746.

The biggest advantage of market price orders is that they are almost completed instantly, thus ensuring the execution of orders in forex transactions.

2、 Listing - Limit and Stop Orders

Limit Order

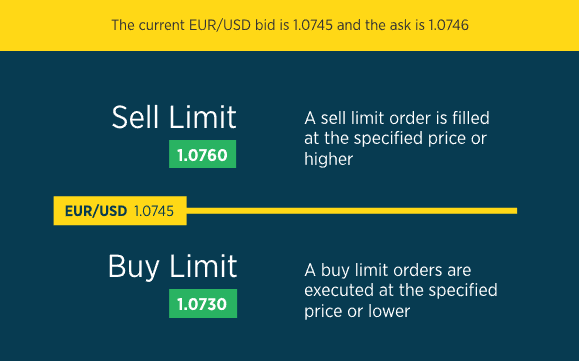

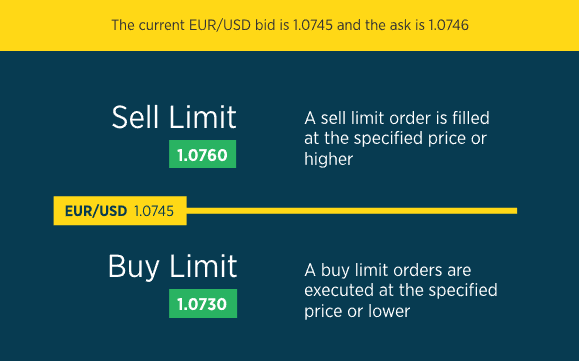

Refers to an order that is bought and sold at a specified price or a better price. When the market is at or below a certain price level, set a buying order; Set sales orders when the market is at or above a certain price level.

For example, the current quotation for EUR/USD is 1.0745/1.0746. Traders can set a Buy Limit Order or Sell LimitOrder), if the trader wants to sell their existing position when the price reaches 1.0760, they can set the selling price to 1.0760; If a trader wants to build a position and buy when the price reaches 1.0730, they can set the buying price to 1.0730.

Limit orders allow traders to flexibly define the entry and exit points for trading. However, it should be noted that limit orders do not guarantee that traders can build and close their positions, as if the specified price conditions are not met, the trader's order will not be executed.

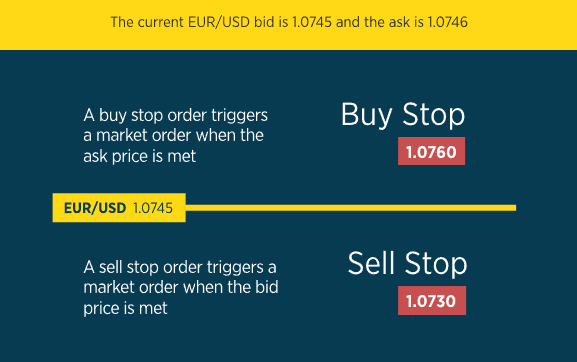

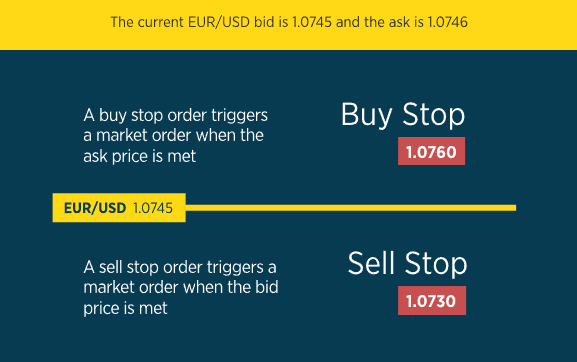

Stop Order

Stop loss orders are triggered in the event of losses and are mainly used for stopping losses. Generally, the purchase order is set above the market price or the sales order is set below the market price.

For example, the current quotation for EUR/USD is 1.0745/1.0746. Traders can set a Buy Stop Order or Sell StopOrder), for example, traders can set the buying price to 1.0760 and the selling price to 1.0730.

3、 Tracking Stop Order

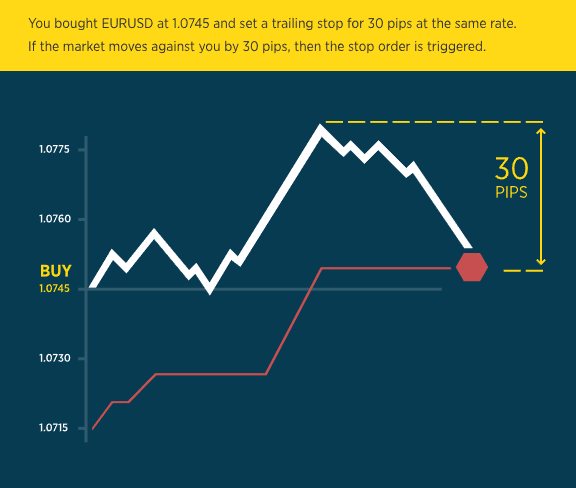

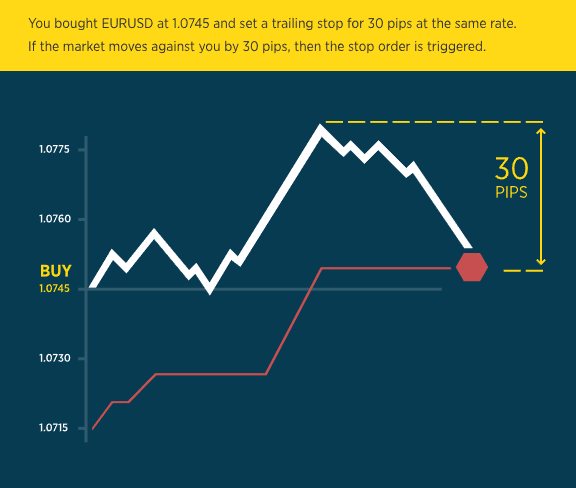

Tracking a stop loss, also known as a moving stop loss, tracks the direction of price changes that are beneficial to traders and maintains the initial price difference between the stop loss price and the current price. It follows the latest price and sets a certain point of stop loss. As long as the price fluctuates in the direction of profitability, the order remains valid. Once the price reverses to a certain extent, the stop loss will trigger and close the position. Tracking stop losses is a very good trading tool, especially in situations of high price fluctuations, which can ensure profitability.

For example, traders plan to buy euros/dollars at 1.0745 and set a 30 point tracking stop loss. This means that initially, the trader's stop loss level was 1.0715. If the price drops to 1.0730, the stop loss level becomes 1.0700.

As long as the price changes in the same direction as the trader's judgment, or even if the direction is opposite to the trader's judgment but does not reach 30 points, the order will always be valid. Once the price reaches the tracking stop loss level, the stop loss order will be automatically triggered and the position will be automatically closed.

3. Special order types

GTC orders (valid orders before cancellation)

GTC Order (Good TillCancelled means that the order will remain valid in the market until the trader decides to cancel it. Forex brokers cannot cancel this order at any time.

GFD orders (orders valid on the same day)

GFD order (Good forThe Day refers to being valid until the end of this trading day. Because the forex market is a 24-hour trading market, this usually means that after the New York market closes, the order will automatically be invalidated. However, it is still recommended that traders and forex brokers confirm this situation.

OCO order (selective commission order)

One Cancels the Other is a binding of stop loss orders and profit orders to ensure that when one of these two orders is executed, the other will automatically be invalidated.

For example, the current price of the euro/dollar in the market is 1.0745, and traders want to buy at 1.0825 after the exchange rate breaks through the resistance level, while also choosing to short when the price falls below 1.0645. In the case of traders choosing OCO orders, if the exchange rate reaches 1.0825, a buy order will be triggered, and the sell order of 1.0645 will be automatically cancelled.

OTO orders

OTO orders (One Triggers the Other), which means that the current order is triggered before it is possible to trigger an OTO order.

If the trader intends to set profit and stop loss targets in advance and has already planned to do so before trading, then an OTO order can be set.

For example, the current exchange rate of the euro/dollar is 1.0745, and traders believe that once it reaches 1.0845, the trend will turn around, but at most it will only fall to 1.0645. The problem is that the trader will be away for a week and will not have access to the internet for that week.

In order to seize the current market trend, traders can set a limit to sell orders at 1.0745, while setting a limit to buy orders at 1.0645 and a stop loss order at 1.0845. In OTO orders, if the sell order of 1.0745 is triggered, both limit price buy orders and stop loss orders may be executed.

4. Summary

The order types provided by different trading platforms may vary. Traders need to first understand and choose the order types available to brokers, and then choose the appropriate order types for forex trading according to their own needs.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.