Open positions refer to trading positions that have not yet been closed during the trading process. That is to say, these positions were bought or sold at a certain point in the past or current time, but there have been no liquidation operations yet.

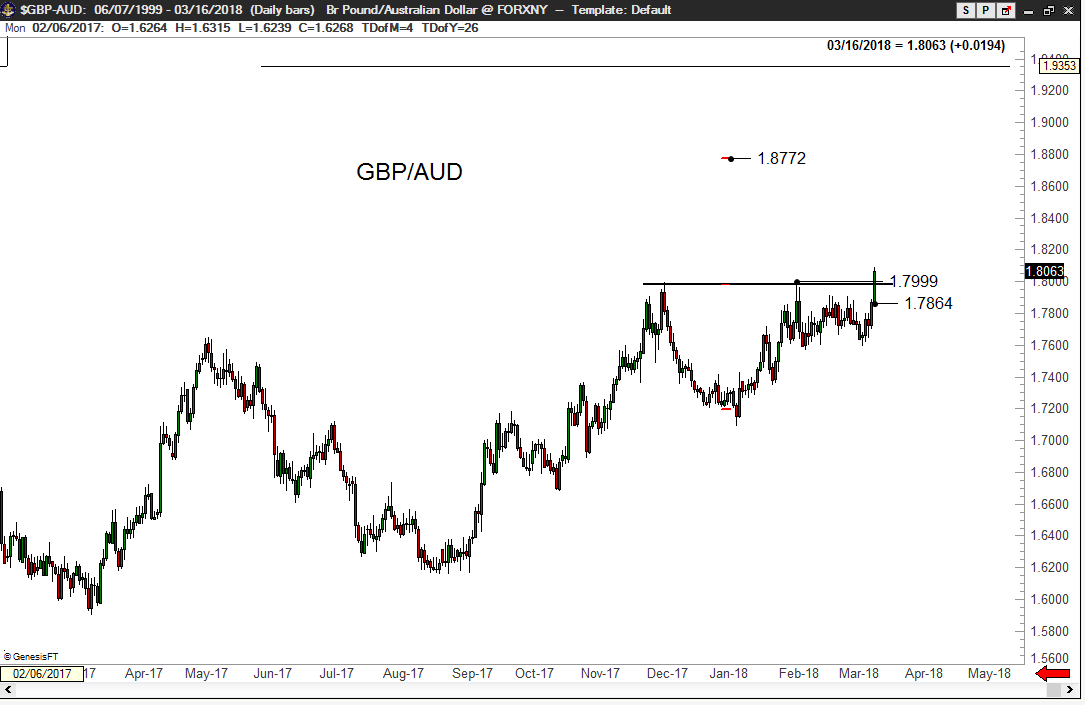

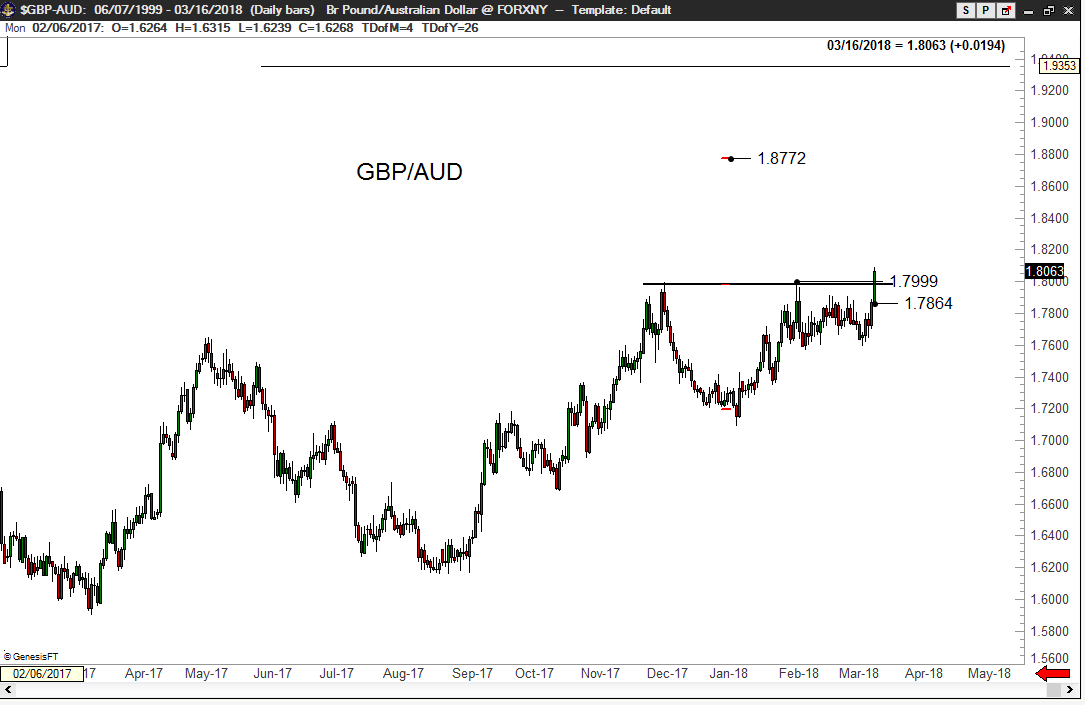

For example, if a futures trader buys a gold futures contract on a certain day and has not yet closed its position, then the trader holds an open position. Similarly, if a forex trader sells a currency pair at a certain point in time but has not yet carried out a liquidation operation, then the trader holds an open position.

Open positions are usually used to measure the risk exposure of a trader or institution, because they represent the current market exposure of the trader or institution. In some cases, open positions may increase traders' risk exposure and make them more vulnerable to market fluctuations.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.