What does Tracking Stop Loss mean?

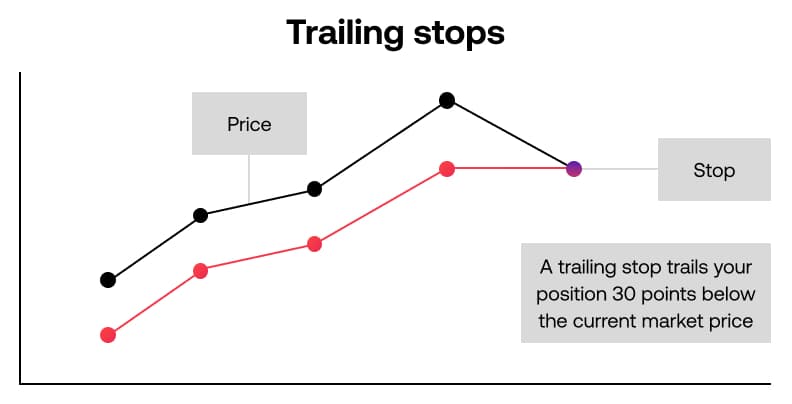

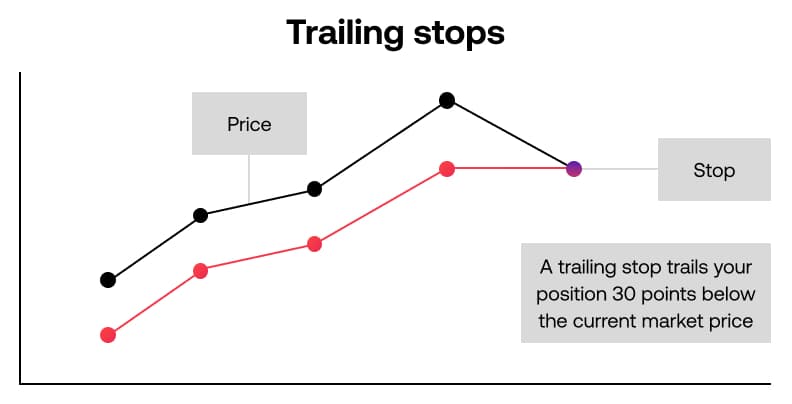

Generally, for tracking stops in the market, we can also refer to them as mobile stops. Its main meaning is that investors need to set a certain number of stops when tracking the latest market prices, which means that this mechanism is mainly triggered when the position is favorable for changes. Overall, it is an instruction set by investors at a stage when they are about to make a profit, as mentioned above.

The above content mainly introduces what is a tracking stop loss, and its main purpose can be said to be:

1. When the position becomes increasingly profitable, increase the stop loss trigger price;

2. Ensure that investors can still achieve a significant portion of their book value returns in the event of reverse market movements;

What are the Rules for Tracking Stop Loss?

1. Crocodile Rule: It mainly refers to the fact that when investors discover that their trading has deviated from the market direction, they must immediately stop losing without any delay.

2. Stop loss reasons: mainly due to subjective decision-making errors; Secondly, objective changes in the situation;

3. Retail patent: mainly because institutions cannot stop losses, and because they have too many chips, usually no one can proceed. Stop losses are the patent of retail investors.

4. Learn to short, be good at forgetting, stop winning and cover positions, and stop winning can actually be seen as a stop loss, and so on.

5. Common auxiliary stop loss methods include: maximum loss method, withdrawal stop loss, horizontal stop loss, etc.

For investors, tracking stop losses has certain advantages, mainly including the following aspects: firstly, it will not turn profits into losses in the future, which means that using tracking stop losses can continuously adjust the stop loss price as profits increase. Secondly, with limited losses and unlimited profits, it mainly refers to the closing of the stop loss position during a reverse price movement, which locks in the loss amount. At this time, it is either losing money or earning less.

For the setting method of tracking stop loss, there are mainly the following points that need to be noted: first, the activation of trading software; second, the color will change when it takes effect; third, when setting mobile stop loss, attention should be paid. Many trading platforms have two types of quotes: one is four decimal places, and the other is five decimal places.

What is the appropriate setting for tracking stop losses?

For example, if the decline is between 10-15%, the position can be cut, and the specific proportion needs to be determined based on one's own bearing capacity and market conditions. If a stock priced at 10 yuan has already risen to 12 yuan, we can set the stop loss position at 10% and issue a 10% pullback. If we don't return to this position, we can hold it all the time, and then adjust our profit limit. We need to constantly observe market changes.

For example, if a stock drops below 8 yuan and is eliminated, here is the specific price level, and the above scenario is the magnitude. Buying a stock worth 10 yuan has now risen to 12 yuan. If it falls below 11 yuan, it can be eliminated. If this stock did not decline, but instead rose, and the stock price became 13 yuan, then it can be reset. Once the stock price falls to 12 yuan, it can be eliminated. This is how we can change our stop loss and stop loss points based on the continuous changes in the market, and maximize our profits without regret.

For example, when a stock reaches a certain point in time, regardless of its price, we are eliminated. This is derived from the pattern interest law. This requires looking at the trend. Once you reach a critical point, you need to pay extra attention and be eliminated in a timely manner. Whether it's a stop loss position or a stop gain position, it can be applied.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.