When it comes to trading derivatives, simplicity can often be a strength. Vanilla options, much like their namesake flavour, are the most basic and widely understood form of options contracts. They're versatile, transparent, and accessible to both institutional and retail investors, making them a staple in the world of financial instruments.

This article unpacks what vanilla options are, how they function, and why they remain a cornerstone for risk management and speculation alike.

Understanding the Basics of Vanilla Options

Vanilla options are standardised contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These contracts come in two forms: call options, which allow the holder to buy the asset, and put options, which allow the holder to sell it.

Unlike exotic options, which often include complex features or conditions, vanilla options have straightforward terms and are typically traded on regulated exchanges.

Key Characteristics of Vanilla Options

There are a few defining features of vanilla options that make them distinct:

Strike Price: The agreed-upon price at which the asset can be bought or sold.

Expiry Date: The last day the option can be exercised.

Premium: The cost paid by the buyer to the seller for the option.

Underlying Asset: Can range from stocks and indices to currencies and commodities.

These core elements combine to create a flexible financial tool used in a variety of trading strategies.

Types of Vanilla Options

Vanilla options are generally divided into two categories:

-

Call Options

These give the holder the right to purchase the underlying asset at the strike price. They are commonly used when a trader expects the price of the asset to rise.

-

Put Options

These give the holder the right to sell the asset at the strike price. They are useful when the trader anticipates a decline in the asset's value.

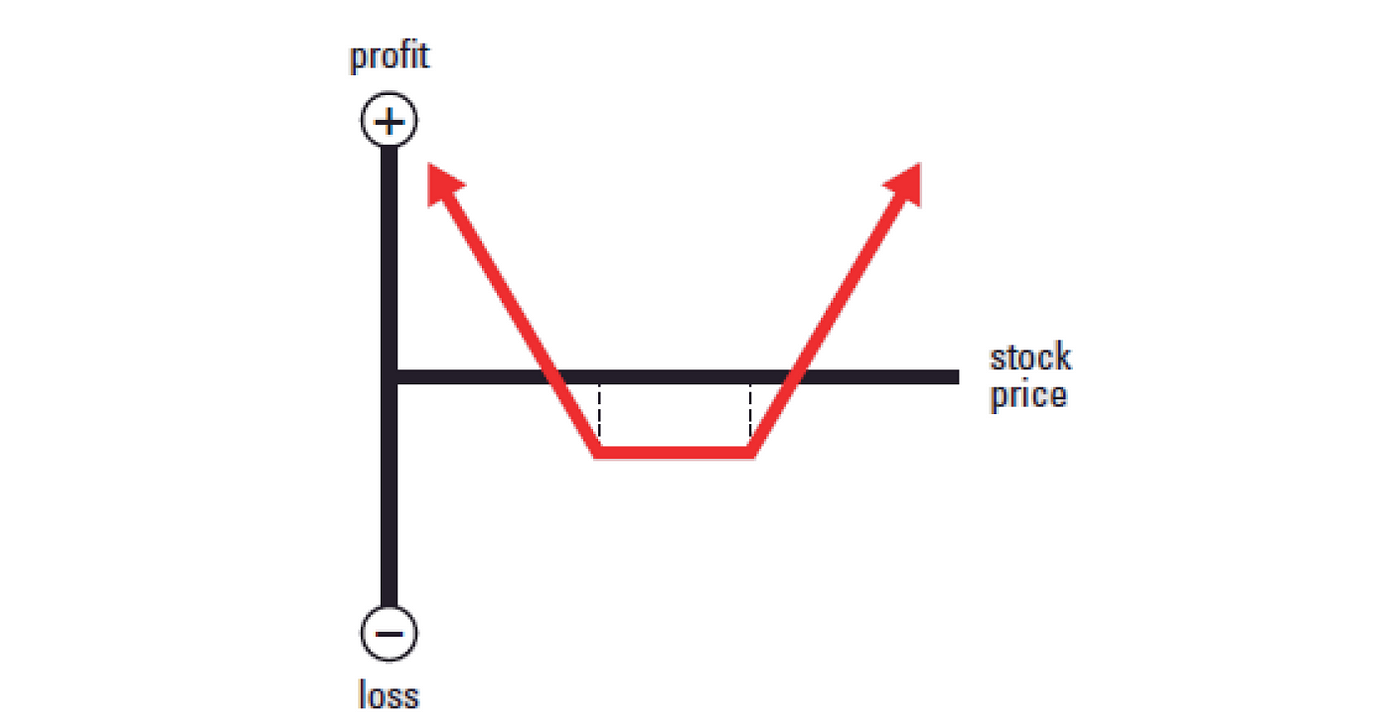

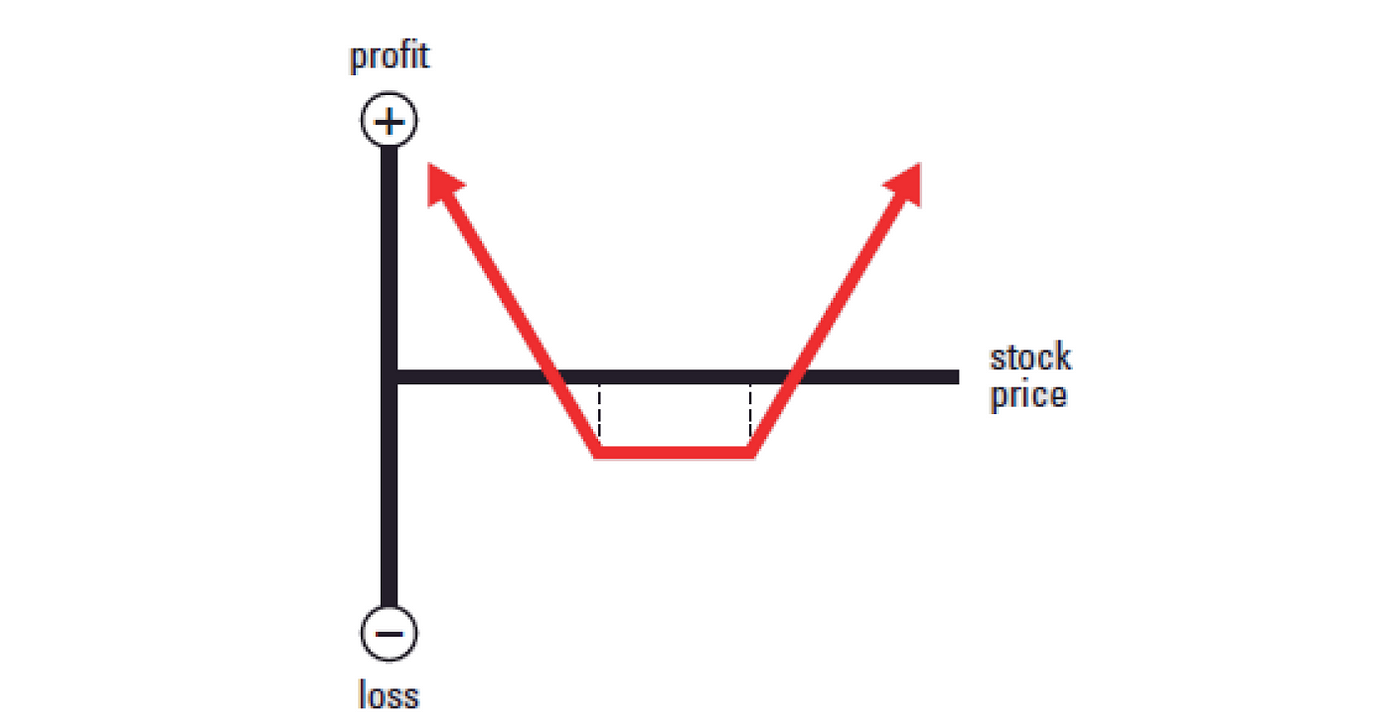

Each type of vanilla option can be used independently or as part of more complex strategies such as spreads or straddles, depending on the trader's objectives.

How Vanilla Options Work in Practice

Let's look at a simple example. Suppose an investor believes that a stock currently trading at £100 will rise in the next month. They purchase a vanilla call option with a strike price of £105, expiring in 30 days, and pay a premium of £2.

If the stock rises to £110, they can exercise the option, buy the stock at £105, and make a £3 profit per share (£110 - £105 - £2).

If the stock stays below £105, the option expires worthless, and the investor loses only the £2 premium.

This clearly defined risk and reward structure is part of what makes vanilla options attractive.

Benefits of Trading Vanilla Options

There are several reasons why vanilla options remain popular among traders:

Risk Management: They can be used to hedge positions or limit potential losses.

Flexibility: Suitable for bullish, bearish, or sideways markets.

Defined Risk: Maximum loss is limited to the premium paid.

Leverage: Traders can gain large exposure with relatively small capital.

These advantages make vanilla options particularly appealing for those looking to enhance their strategies without taking on excessive risk.

Common Strategies Using Vanilla Options

While the contracts themselves are simple, they can be combined in creative ways. Here are a few common uses:

Protective Puts: Buying a put option to hedge against a decline in a stock you already own.

Covered Calls: Selling a call option against a stock position to generate income.

Long Straddles: Buying both a call and a put at the same strike price to profit from significant moves in either direction.

All of these strategies use vanilla options as a foundation, highlighting their versatility.

Risks to Consider

Despite their simplicity, vanilla options are not without risks. The main drawback for buyers is the potential loss of the premium if the option expires out of the money. Sellers, on the other hand, may face unlimited losses depending on the direction of the market.

It's also important to understand that vanilla options have an expiration date. Timing plays a crucial role in profitability, and misjudging market direction or momentum can result in losses.

Vanilla Options vs. Exotic Options

Vanilla options are often contrasted with exotic options, which may have unusual payoff structures, barriers, or conditions. While exotic products may offer tailored solutions for complex needs, vanilla options are generally easier to understand, more liquid, and widely traded.

This makes them more accessible to individual investors and preferable for those who value clarity over complexity.

Final Thoughts

Vanilla options continue to be a cornerstone of the derivatives market for a reason. They provide traders and investors with a clear, flexible, and cost-effective way to speculate or manage risk. Whether used in simple directional bets or as part of multi-leg strategies, these instruments offer numerous opportunities without requiring advanced technical knowledge.

Understanding how vanilla options work and when to use them is an essential skill for anyone navigating modern financial markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.