What are the Sliding Points in Forex Trading

Forex slippage may be caused by network delays, unstable trading platforms, severe market fluctuations, insufficient market capacity, and other factors, which is inevitable. Sliding points are factors that must be fully considered when formulating forex trading strategies, and a comprehensive understanding of the sliding point market can also help improve investors' forex trading skills.

The forex sliding point mainly occurs in the entry and stop loss operations, and will not appear in the exit after profit. When entering the market, there is a price sliding point that traders can accept, but if there is a stop loss sliding point, the losses caused and the psychological burden on traders are relatively more severe.

The phenomenon of sliding points in forex trading has advantages and disadvantages in different situations. Those who prefer to set stop losses and short trades result in gains and losses, while those who prefer to set stop profits and short trades result in gains and losses. Those who prefer to hang orders often earn less or lose more than they gain.

Reasons for the Occurrence of Sliding Points in Forex Market

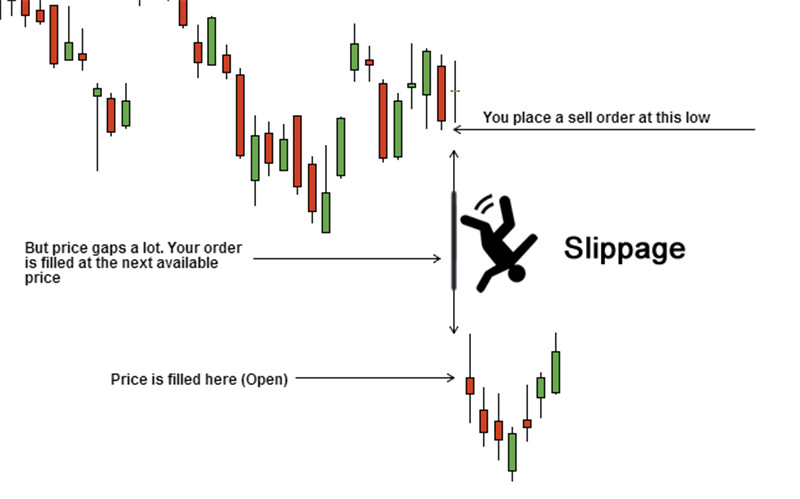

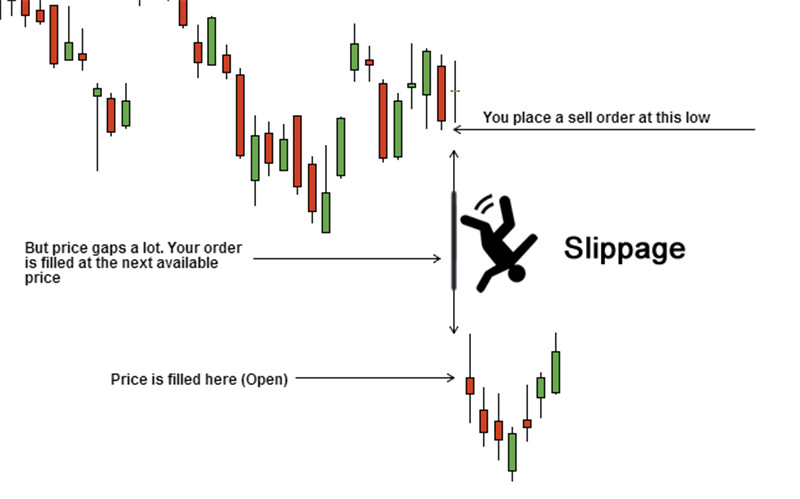

1. Market Quotation Gap

Under normal circumstances, liquidity is sufficient and market quotations are continuous. However, when the market fluctuates sharply or there is a large amount of direct entry and exit, a price fault will occur, leading to a sliding point.

2. Network Latency

Generally speaking, forex trading involves banks providing quotes to traders, and traders providing quotes to customers. When a customer makes a transaction, the transaction instructions arrive at the dealer's server and are forwarded to the banking system for transaction at the bank. During this transmission process, there is often a slight delay that may not be visible in normal times. However, once encountering a highly volatile market, if the server cannot handle it, a delay will occur and a sliding point will occur.

3. Insufficient Liquidity

Liquidity refers to the degree to which an asset or security can be bought or sold in the market. In low liquidity markets, the number of buyers and sellers is relatively small, and order execution may be affected, leading to slippage points.

4. Manipulation by Forex Brokers

Some slippage points are caused by malicious manipulation by some irregular and unethical forex brokers. Generally speaking, it is difficult for investors to distinguish what factors are causing the sliding point, which brings opportunities for some unscrupulous traders to obtain unfair benefits.

5. Excessive Trading Volume

If you place a large trading volume, your order may require multiple trade to complete, which can also lead to slippage points.

Classification of Sliding Points in Forex Market

1. Normal sliding point: Normal sliding point is caused by market fluctuations and insufficient liquidity. Under normal circumstances, brokers will do their best to ensure that your order is executed at the best price, but due to rapid market changes, sometimes it may not fully match your requirements.

2. Technical slippage: Technical slippage is caused by network latency, system errors, or other technical issues. This type of sliding point is usually small and has little impact on your trading.

3. Abnormal slip point: Abnormal slip point refers to a slip point that exceeds the normal range. This type of sliding point may be the result of artificial market manipulation or fraudulent behavior, so extra caution is needed. If you encounter abnormal sliding points, please contact the broker and seek a solution.

4. Positive sliding point: A positive sliding point refers to a transaction price that is more favorable. Although not very common, it may occur in rapidly changing markets.

5. Negative sliding point: A negative sliding point refers to a lower transaction price. This is the most common type of sliding point, which may occur when the market is volatile or low in liquidity.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.