When it comes to investing, large-cap stocks are often seen as the backbone of a solid portfolio. These are companies with market capitalisations above £8 billion, and they dominate industries like technology, healthcare, and consumer goods. They're the heavy hitters—stable, reliable, and positioned for long-term growth.

Traders flock to large-cap stocks for a reason: they offer a combination of consistency, growth, and relative security in the market. If you're looking for investments that provide steady returns without the wild swings associated with smaller companies, large-cap stocks could be exactly what you need. They're not just safe bets; they're also the companies shaping the economy. Understanding their appeal can be the key to building a well-balanced portfolio in 2025.

Defining Large Cap Stocks: What Sets Them Apart?

Defining Large Cap Stocks: What Sets Them Apart?

Large-cap stocks are typically defined as companies with a market capitalisation of £8 billion or more. market cap is simply the total value of a company's outstanding shares—calculated by multiplying the stock price by the number of shares in circulation.

But large-cap stocks are more than just big numbers on a balance sheet. These companies are usually well-established, often with decades of experience under their belts. Their size alone offers a sense of stability, but it's their strong market position, diverse revenue streams, and established customer bases that make them a reliable option for long-term traders. Simply put, they are the giants of the business world.

Because of their size, large-cap companies can weather market downturns more effectively than smaller companies. They have the resources to adapt, innovate, and pivot when needed, which makes them an attractive proposition for those seeking lower volatility compared to smaller, high-growth stocks.

Stability and Reliability: The Key Features of Large Cap Stocks

One of the biggest draws of large-cap stocks is their stability. Think of them as the heavyweights of the stock market—companies that have seen it all. While smaller companies might face dramatic swings in Stock Prices due to market sentiment or economic shifts, large-cap stocks tend to be much more predictable. This makes them an appealing choice for long-term traders who value consistency over quick gains.

Another factor that boosts their stability is their ability to pay dividends. Many large-cap stocks distribute a portion of their profits to shareholders, providing a steady income stream. This can be particularly valuable for those looking for passive income, like retirees, or anyone looking to reinvest those dividends back into their portfolios to fuel compound growth.

In addition to this, large-cap stocks tend to be diversified. This means they aren't overly reliant on a single product or service. When one part of the business faces a setback, the other segments can often pick up the slack, helping to smooth out the bumps for traders.

Top Large Cap Stocks to Consider in 2025

While it's easy to fall into the trap of using the same tired examples like Apple or Microsoft when talking about large-cap stocks, there are several lesser-known—but equally exciting—players making their mark.

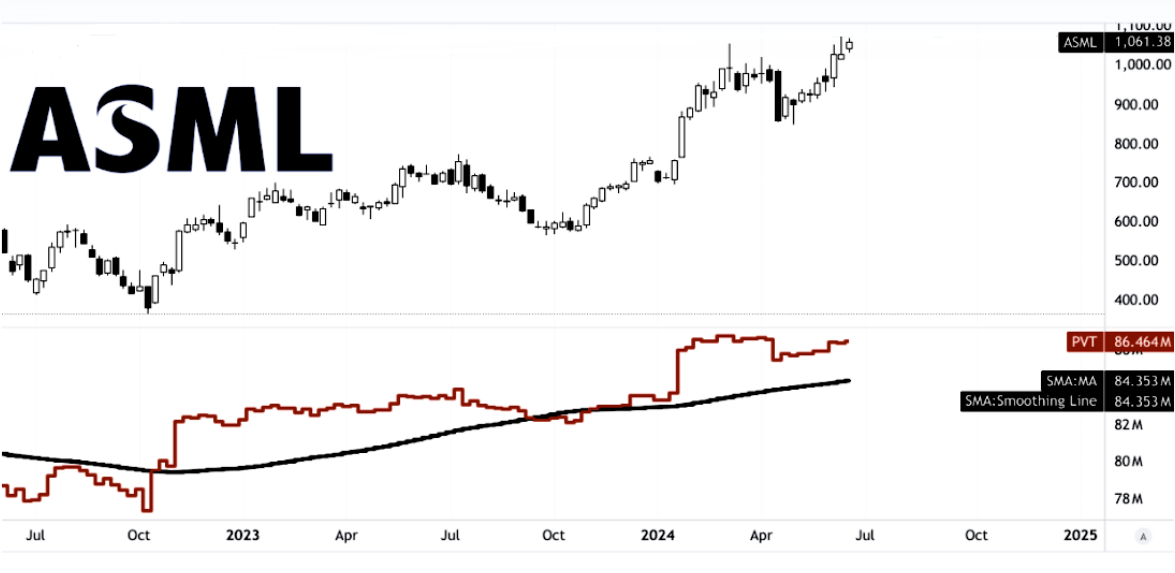

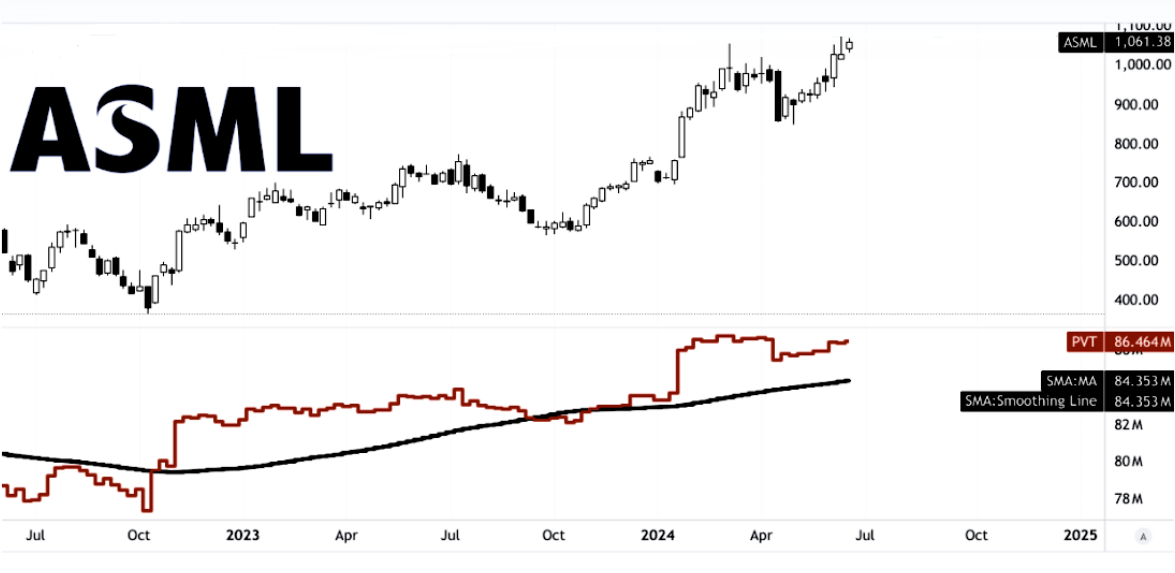

ASML (ASML)

This Dutch company might not be a household name, but it's absolutely vital to the tech industry. ASML manufactures advanced photolithography machines used in semiconductor production. With the growing demand for semiconductors in everything from smartphones to self-driving cars, ASML is positioned to benefit significantly from global tech trends, making it a strong contender in the large-cap space.

L'Oréal (OR)

L'Oréal (OR)

L'Oréal isn't just about beauty products; it's a global powerhouse in the cosmetics industry, with a market cap hovering around £180 billion. The company's ability to innovate—whether through new product lines or expanding its digital presence—has helped it maintain dominance, even as consumer habits evolve. In an age where sustainability and inclusivity are key to consumers, L'Oréal's forward-thinking strategies continue to resonate in the market.

Berkshire Hathaway (BRK.B)

Berkshire Hathaway (BRK.B)

While Warren Buffett's investment vehicle is often associated with financial success, Berkshire Hathaway's large-cap status deserves more attention. The company's diverse portfolio spans across sectors like insurance, energy, and retail, providing stability and growth potential. With its mix of large, well-established businesses and smaller, high-growth investments, Berkshire Hathaway remains an appealing option for those seeking diversity in their large-cap investments.

These examples reflect a shift from the usual suspects in the large-cap space, focusing on companies that are growing through innovation, adaptability, and strategic diversification.

These examples reflect a shift from the usual suspects in the large-cap space, focusing on companies that are growing through innovation, adaptability, and strategic diversification.

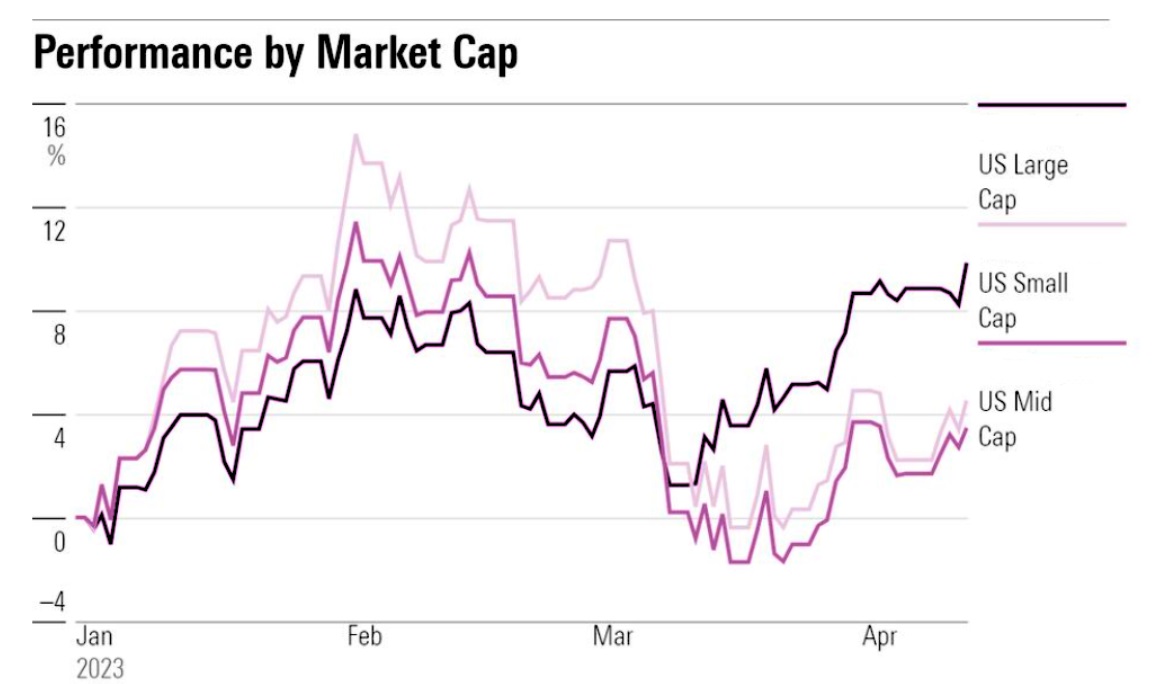

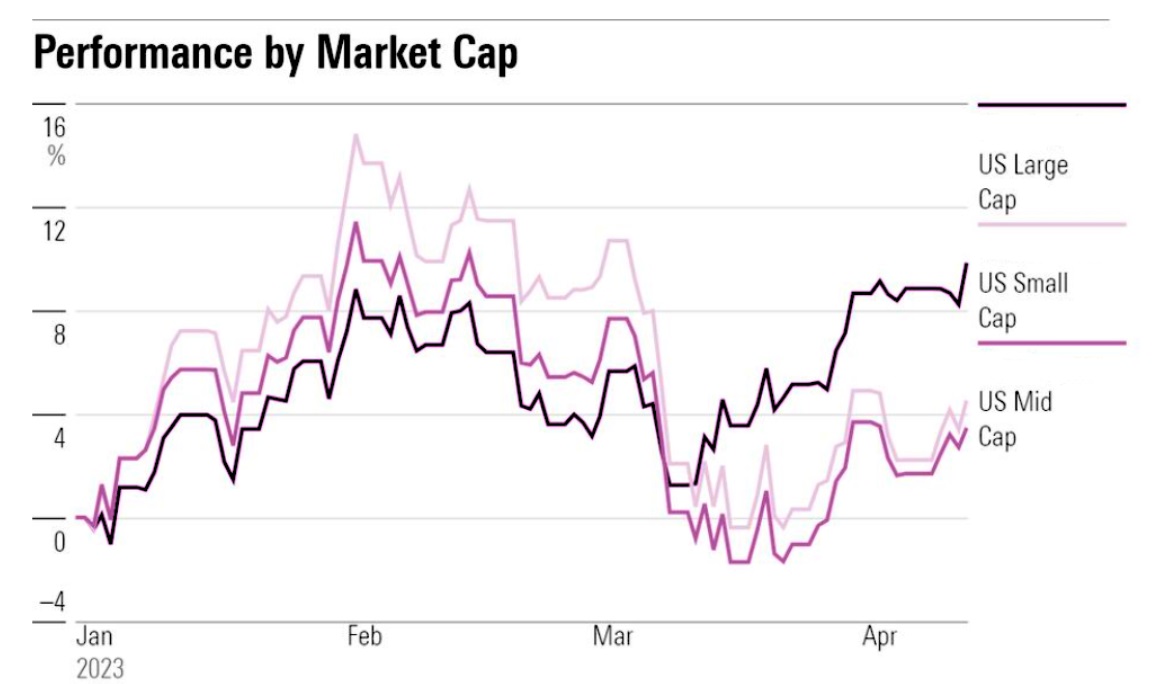

How Large Cap Stocks Perform in Different Market Conditions

One of the key benefits of large-cap stocks is their resilience during market fluctuations. While smaller companies might be more susceptible to significant stock price drops in times of economic uncertainty, large-cap companies are generally better equipped to manage downturns. This is because their size and resources allow them to weather financial storms more effectively.

For instance, during the early days of the COVID-19 pandemic, while many smaller businesses saw their stock prices plummet, companies like L'Oréal and Berkshire Hathaway managed to bounce back quickly. Their diversified business models and strong financial positions allowed them to not only survive but also thrive when the global economy began to recover.

During economic booms, large-cap stocks also stand to benefit. Their scale means they can expand more rapidly, enter new markets, and capitalise on new technologies or trends. So, whether the market is up or down, large-cap stocks tend to perform with a certain level of consistency that can provide peace of mind for traders.

Are Large Cap Stocks Right for Your Portfolio?

So, are large-cap stocks the right fit for you? The answer depends largely on your investment goals and risk appetite. If you're looking for a relatively stable investment that offers steady returns, large-cap stocks could be a solid choice. They are especially suited for traders with a long-term focus who want to reduce the overall risk in their portfolios while still capturing growth.

However, if you're after high-growth, high-risk opportunities, large-cap stocks may not provide the kind of explosive returns that smaller, emerging companies might. That's why it's often recommended to diversify your portfolio—mixing large-cap stocks with smaller, growth-oriented companies, bonds, or international investments can help balance risk while still allowing for potential upside.

In summary, large-cap stocks are a cornerstone of many successful portfolios, thanks to their size, stability, and ability to adapt to changing market conditions. If you're new to investing or simply looking for a more stable option, large-cap stocks could be just what you need to get started.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Defining Large Cap Stocks: What Sets Them Apart?

Defining Large Cap Stocks: What Sets Them Apart?

L'Oréal (OR)

L'Oréal (OR)  Berkshire Hathaway (BRK.B)

Berkshire Hathaway (BRK.B)  These examples reflect a shift from the usual suspects in the large-cap space, focusing on companies that are growing through innovation, adaptability, and strategic diversification.

These examples reflect a shift from the usual suspects in the large-cap space, focusing on companies that are growing through innovation, adaptability, and strategic diversification.