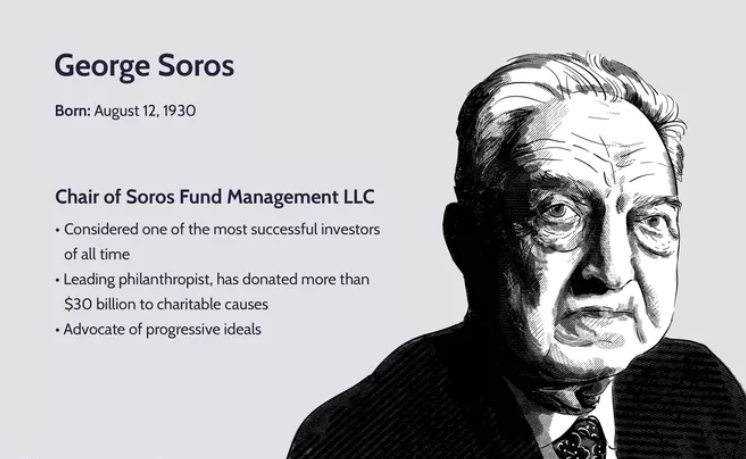

Speaking of George SorosSoros, many people are no strangers to him because he attempted to snipe at the Hong Kong Dollar during the 1998 financial crisis, betting that the exchange rate between the Hong Kong dollar and the US dollar would collapse due to the depreciation of the Hong Kong dollar, but ultimately failed. This was the classic operating model of hedge funds back then. In 1992, Soros also hit the pound and successfully forced the Bank of England to devalue it, which was also seen as his masterpiece.

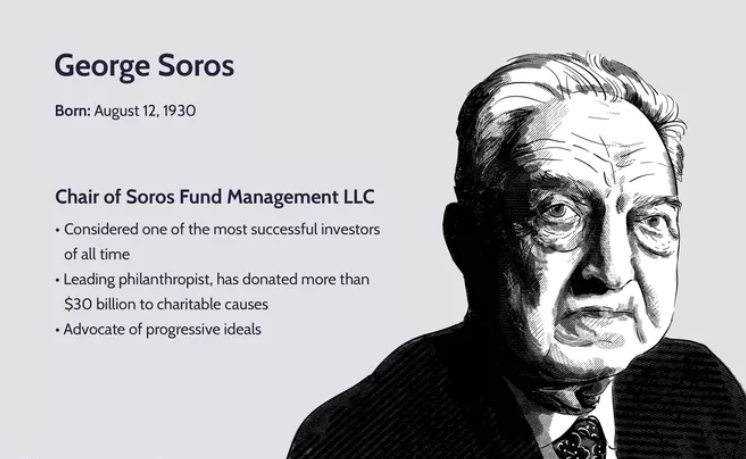

Soros is a legendary hedge fund manager widely regarded as one of the most successful investors of all time. Soros manages the Quantum Fund, which had an average annual return of 30% from 1970 to 2000. He's still SorosChairman of Fund Management LLC.

Soros, born in Hungary, is also known for his extensive charitable activities. He donated billions of dollars to various causes through the Open Society Foundation. He is a long-term supporter of liberalism and progressive cause, which makes him the target of various conservative conspiracy theory.

It is believed that as of June 2022, Soros had a value of over $8 billion and donated over $30 billion to charity. Most of the funds are used to fund education and health programs, human rights work, and the promotion of democracy. In recent years, he has been generous to the Democratic Party of the United States.

In this issue, EBC takes you closer to the Global Legends series - "The Man Who Broke the Bank of England" - the unbeaten myth of George Soros

The most successful investor of all time

1. Small trial ox knife, initial exhibition head corner

George Soros is a Jewish descendant who was born in Budapest in August 1930 and survived the Nazi occupation of Hungary in 1947Immigrated to the UK in the year of. Before starting his career in the banking industry, he obtained a doctoral degree from the London School of Economics.

He founded his first hedge fund in 1969, then named Double Eagle. Born on August 12, 1930 in Budapest, Hungary, under the real name GyomlrgySchwartz is one of the most well-known currency speculators and stock investors in the world.

In 1956, Soros moved to the United States and worked as a trader in New York, responsible for buying and selling stocks. In 1959, Soros switched jobs to the Fosan Company and engaged in arbitrage operations between the financial markets of London and New York until the late 1960s. Although he did not make a fortune during this period, he accumulated rich experience. In 1973, Soros teamed up with Rogers to establish Soros Fund Management Company. When he invested in defense stocks that year, he made a huge profit of 17%.

In 1975, Soros shorted Avon. In order to short Avon, Soros borrowed 10000 shares of Avon to sell at a market price of $120. As expected by Soros, Avon continued to plummet. Two years later, Soros bought back these 10000 shares of "Avon" at a market price of only $20 per share, earning a whopping $1 million.

The Battle of the Three Classics

1. Sniper the pound and become famous in the first battle

In 1992, the development of the German economy was in full swing, and the exchange rate of the German official currency, the Mark, against the US dollar, continued to rise.

Germany is thriving on this side, while the UK economy has been in a slump, requiring a low interest rate policy to stimulate economic growth. However, the German government raised the discount rate to 8.75% in July 1992, fearing inflation due to a huge fiscal deficit.

However, the British government is constrained by the European exchange rate system and must strive to maintain the exchange rate of the pound against the mark. And the trigger for a unprecedented crisis of sterling was also ignited: the high German interest rate caused a wave of selling sterling and buying marks in the foreign exchange market. For the past 200 years, the pound has been the world's main currency. However, in September 1992, speculators began attacking the weak currencies in the European exchange rate system, with the pound bearing the brunt.

On September 15, 1992, Soros appeared. He began to heavily short the pound, which plummeted against the mark, causing the British government to panic. On the morning of the 16th, the British government reluctantly announced a 2 percentage point increase in bank interest rates. A few hours later, it announced a 3 percentage point increase, raising the benchmark interest rate from 10% to 15% at the time. At the same time, it purchased a large amount of pounds, hoping to attract short-term capital inflows from abroad and increase demand for pounds to stabilize the pound exchange rate. However, at the same time as the Bank of England laid out its layout, Soros had already begun an air raid on the pound. A large number of pounds were sold and a large number of German marks were bought.

Although the Bank of England purchased about £ 3 billion in an attempt to turn the tide, it failed to stop the pound's avalanche of decline. On the 16th, the market closed with a significant drop of about 5% in the pound to mark ratio within one day, and the pound to dollar ratio also fell to a low of 1 pound to $1.738. Within the following month, it fell again by about 20%.

In the end, the British government had to declare that the currency defense war had ended in failure, and at the same time announced that the pound would withdraw from the European exchange rate system and begin to float freely. Soros and his quantum fund made over $1 billion in windfall profits during the sterling crisis.

The British call September 15th, the day they were forced to withdraw pounds from the exchange mechanism, "Black Wednesday".

In fact, Soros' foreign exchange war swept the world. In addition to the pound, he also shorted the Thai baht, Hong Kong dollar, and Japanese yen, and he himself is considered the initiator of the 1997 Asian financial crisis. Until recent years, the 90 year old master of short selling has been constantly vigilant in markets around the world, even when there is a slight stir.

2. Short the Thai baht

In 1997, most Southeast asian countries were immersed in the feast of asset appreciation, and short sellers certainly wouldn't miss this paralyzing opportunity. As the Thai baht has good liquidity in Southeast Asian countries, less risk, and huge asset foam, it soon lay down its gun.

After the Bank of thailand announced that there were liquidity issues in domestic financial institutions, Soros began to sell a large number of related stocks he had already bought, leading to a run on the Thai market. Shortly thereafter, he began to sell a large amount of Thai baht.

However, just when the situation of the Thai baht was out of control, the Bank of Thailand announced that it would abandon the fixed exchange rate mechanism and implement the floating exchange rate mechanism. On the day of the announcement, the exchange rate of the Thai baht against the US dollar plummeted by more than 17%, and the Philippine peso, Indonesian rupiah and Malaysian ringgit also fell under the influence of the Thai baht.

3. Flash attack on Hong Kong

In mid July 1997, Soros began to flash attack Hong Kong using similar methods, causing a large amount of speculative selling of the Hong Kong dollar. The Hong Kong dollar exchange rate fell near the psychological level of 7.75 Hong Kong dollars to the US dollar, causing chaos in the financial market. However, what Soros did not expect was that the Hong Kong government stepped in to rescue the market, and at the same time, the Hong Kong Monetary Authority significantly increased short-term interest rates. The overnight lending rates between banks skyrocketed, increasing Soros' speculative costs. In the end, Soros left the field unhappily under continuous bullish and suppressed blows.

The myth of invincibility has also been shattered

During the period from 1997 to the third quarter of 1998, the Russian economy was controlled by bureaucratic capital, with the stock market falling by over 70% and residents losing more than half of their savings. It can be said that the country's economy entered its darkest hour.

As a cunning speculator, Soros certainly wouldn't miss this opportunity and immediately embarked on a massive expedition.

The plan is still an old routine, buying rubles first and then selling them desperately. When the ruble collapses, it is his day to make money.

At the beginning of the plan, Soros was very successful. On August 13, 1998, Soros wrote an article in a Russian newspaper urging the Russian government to "take responsible action and devalue the ruble by 15%~25% at one time".

Russia knows that this is the ultimatum. If we do not comply, with the influence of Comrade Soros and the domestic situation, there may be widespread public anger. If we do, we may have to liquidate our property and live in the bridge cave under the Sanjiangkou Bridge in Ningbo in the future.

After comprehensive consideration, Yeltsin could no longer maintain economic stability and handed over power to Emperor Putin. After Putin the Great came on stage, he was simple and rough, making Soros dumbfounded.

Depreciation of 15%? I don't, I took the initiative to depreciate by 50% in one step. Soros thought to himself that these people are not fools. I haven't made much money yet, so I just earned 50%. I am almost overjoyed.

Watching these capital sounding the horn of attack, Putin directly announced the closure of the bond market and froze the repayment period of foreign investors' loans for 90 days.

Soros was dumbfounded, let's go or not. Not leaving? Keep as much as you invest. For example, Soros directly bought the equivalent ruble from Russia for $10 billion, and now Russia has directly closed its financial markets, leaving the money in Russia and unable to go out.

Putin's move is to die together. I broke the credit card myself, and Soros kept their money in Russia, but Russia can afford it, so life is just a bit difficult. After this battle, international speculators lost around $33 billion, while Soros lost $2 billion.

Soros' investment philosophy

Soros once said, "Financial markets are inherently unstable, and the international financial market is even more so. International capital flows have ups and downs, both bulls and bears. Money can be made wherever the market is chaotic. Identifying chaos can make you rich; the more chaotic a situation is, the more daring and meticulous investors will perform

In Soros' view, the herd behavior of speculators cannot be explained by the theory of price supply and demand in economics. The market is often impacted by group emotions from time to time. In the real world, the decision to buy or sell depends on what expectations people have.

In interviews with the media, he repeatedly stated that he does not believe in the completely free competition model established by traditional economic theory. He believes that market trends manipulate the development of demand and supply relationships, leading to price fluctuations. When investors observe financial markets, expectations play a crucial role. The starting point for making a buy or sell decision is precisely based on the expectation of future price trends, which are determined by the current buying or selling behavior

Soros is always looking for market changes in the market, looking for possible self advancing effects. Once the self advancing mechanism comes into effect, market prices will rise dramatically. He is very good at analyzing the factors that determine the ultimate fate of a certain industry or stock sector in the future from macro social, economic, and political factors. If he finds a huge gap between his viewpoint and the actual stock price, then profit opportunities often come.

Committed to charity and declared retirement

On January 22, 2015, Soros announced his complete retirement at the Davos Economic Forum dinner and entrusted the family fund to the then investment director. He stated that he would no longer manage investments and would fully promote charity. Soros' explanation is that "due to the coming into effect of new financial regulatory regulations in the United States, the overly strict information disclosure system makes him disinterested in continuing to manage assets for external investors.

Data shows that since the establishment of the predecessor of Quantum Fund in 1969, the funds managed by Soros have achieved an average return of 20% over the past 40 years. This rate of return is beyond the reach of almost all investment experts, except for Buffett (who had an average return of 20% in the previous 45 years). However, the world's evaluation of him is mixed. Soros was adept at speculation and greed, and in order to achieve his own interests, he spared no effort to disrupt the financial order, which brought down the Bank of England. He was also the initiator of the Asian financial crisis that broke out in 1997.

According to the news, Soros is currently transferring most of his personal wealth to the charity organization he founded, the Open Society FoundationFoundations, with a scale of nearly $18 billion. In other words, most of Soros' personal wealth is used for public welfare activities, rather than "money begets money" as in the past.

However, in 2017, approximately 130000 people signed on the White House petition website in the United States, demanding that Soros be identified as a "terrorist" and deprived of all of his property.

This petition states that Soros "deliberately and attempted to destabilize the United States and its people for a long time, and committed other violent acts against the United States and its people". Therefore, the signer of the petition believes that the federal government of the United States and the Department of Justice "should announce Soros as soon as possible that his company and its members are terrorists", and deprive him of all his property and assets according to the United States civil confiscation system.

George Soros is one of the most successful and controversial financial speculators in the world to date. He is very different from other great investors: Soros does not like diversified investments, he likes to bet all his money after seeing it right.

Finally, we conclude with Soros' famous quote:

Economic history is like an endless series, built on illusions and lies rather than truth. It points out a path to countless wealth. And what we need to do is distinguish which trends are based on mistakes, take advantage of the situation, and get out of it before it loses credibility

Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.