Fiat currency underpins modern economies. Despite its abstract nature, it governs everything from how we pay for our morning coffee to the formulation of national fiscal policies. In the following article, we explore fiat money in depth — tracing its historical roots, understanding its mechanics, evaluating its advantages, and recognising its limitations.

Definition & Legal Basis

Fiat currency is a form of money that is issued by a government and has no intrinsic value of its own. Unlike commodity money — such as gold or silver — it is not backed by a physical asset. Rather, its value derives from the trust and confidence of the people who use it, along with its legal status as an accepted medium of exchange.

In legal terms, fiat money is designated as legal tender. This means it must be accepted if offered in payment of a debt. Central banks and national treasuries regulate its issuance, while legal frameworks ensure its circulation. Governments mandate the use of their fiat currency through tax obligations, which guarantees a base level of demand and usage within the domestic economy.

Historical Evolution

The concept of fiat currency dates back to ancient China, where paper money was used under the Tang and Song Dynasties. However, it wasn't until much later in modern economic history that fiat money became the global standard.

For much of the 19th and early 20th centuries, the gold standard prevailed. Under this system, the value of currency was directly linked to a fixed quantity of gold. Governments held gold reserves and promised to exchange their currency for gold upon demand.

This model began to unravel during times of economic distress, particularly during the Great Depression and the two World Wars. Nations suspended the convertibility of paper money to preserve gold reserves and finance wartime spending. Eventually, the Bretton Woods system of 1944 pegged global currencies to the US dollar, which in turn was backed by gold.

The true shift to fiat money came in 1971. when President Richard Nixon ended the dollar's convertibility to gold. This "Nixon Shock" marked the official transition to a fiat system, where currencies were backed only by government decree. Since then, all major world currencies — including the US dollar, euro, yen, and pound sterling — have operated as fiat currencies.

How Fiat Money Works

Fiat currency functions on the basis of trust in governmental authority and economic stability. Central banks, such as the Bank of England or the European Central Bank, regulate money supply through a variety of tools: interest rate adjustments, open market operations, and reserve requirements.

When a central bank increases the money supply, it can stimulate borrowing, investment, and spending. Conversely, tightening the money supply can help combat inflation. Because fiat money is not tied to a finite resource like gold, policymakers have greater flexibility to respond to economic fluctuations.

However, this very flexibility requires responsible stewardship. Mismanagement of the money supply can lead to inflation or, in extreme cases, hyperinflation. Nonetheless, in most developed economies, a well-functioning fiat system enables smoother economic cycles and fosters stability.

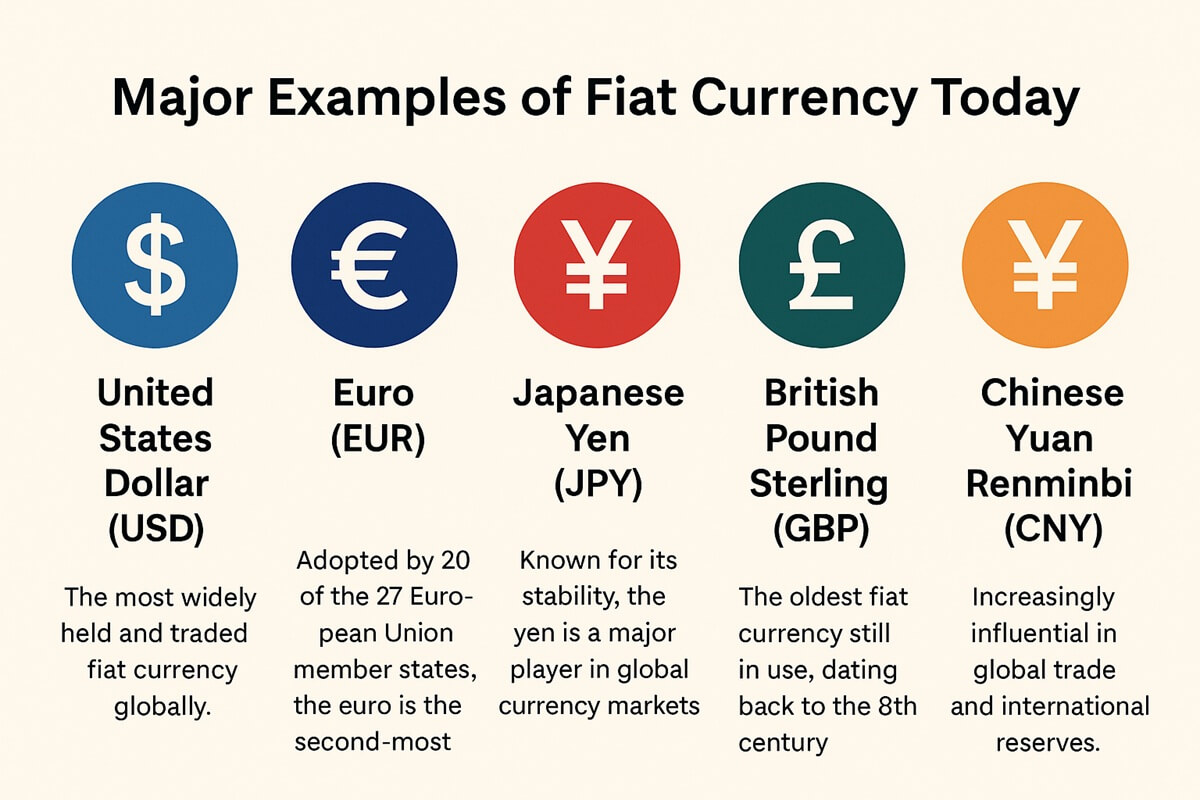

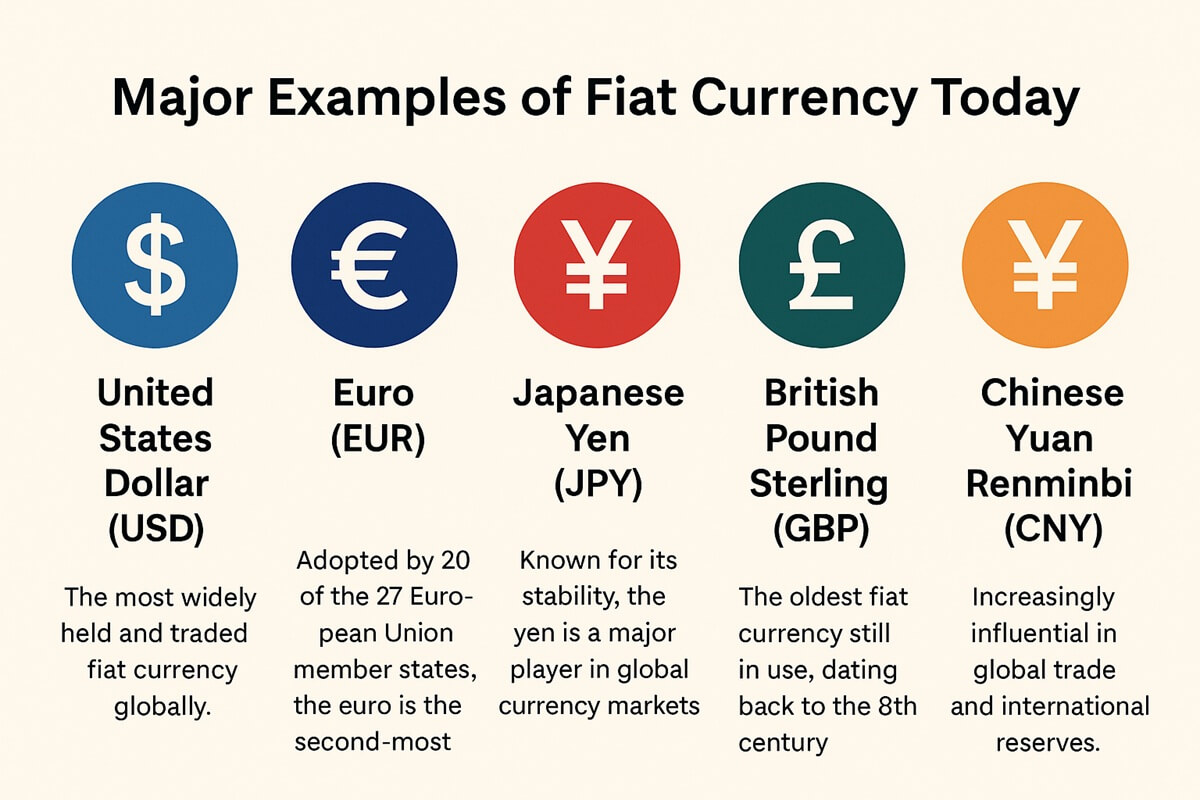

Major Examples Today

Virtually every country in the world uses fiat currency. Some of the most prominent examples include:

United States Dollar (USD): The most widely held and traded fiat currency globally. It serves as the world’s primary reserve currency.

Euro (EUR): Adopted by 20 of the 27 European Union member states, the euro is the second-most traded fiat currency.

Japanese Yen (JPY): Known for its stability, the yen is a major player in global currency markets.

British Pound Sterling (GBP): The oldest fiat currency still in use, dating back to the 8th century.

Chinese Yuan Renminbi (CNY): Increasingly influential in global trade and international reserves.

These currencies are not backed by physical commodities, yet they command trust because of the strength of the institutions that support them and the size of the economies they represent.

Advantages Over Commodity or Representative Currency

Fiat currency offers several compelling advantages over commodity-based or representative monetary systems:

Monetary Flexibility: Central banks can adjust the money supply to meet changing economic conditions. This allows for the implementation of countercyclical policies during recessions or booms.

Cost Efficiency: Producing fiat money is significantly cheaper than mining, storing, and safeguarding precious metals like gold or silver.

Avoidance of Resource Constraints: A gold standard ties economic growth to the availability of a finite resource. Fiat systems allow economies to expand without such physical limitations.

Rapid Crisis Response: Governments can inject liquidity into the economy quickly during crises (e.g., the 2008 financial crisis or the COVID-19 pandemic) without being restricted by gold reserves.

Supports Modern Banking: The entire structure of modern credit, fractional reserve banking, and financial markets depends on a flexible, centrally managed fiat system.

These features have made fiat currency the cornerstone of contemporary economic policy and financial architecture.

Risks & Limitations

Despite its many benefits, fiat currency is not without risks. Its main vulnerability lies in the potential erosion of trust — the very foundation of its value. If people lose faith in a government's ability to manage the economy or honour its debts, the currency can collapse.

Inflation & Hyperinflation: Overissuance of money can devalue a currency. Historical examples include Zimbabwe in the 2000s and the Weimar Republic in the 1920s, where hyperinflation rendered money worthless.

Debt Accumulation: Fiat systems may encourage excessive government borrowing, particularly when political pressures override economic prudence.

Moral Hazard: The ability to print money without backing can lead to irresponsible fiscal or monetary policy, particularly in less transparent political environments.

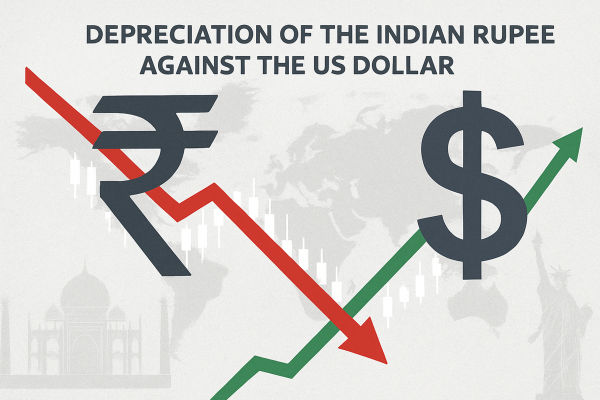

Currency Devaluation: In an interconnected world, deliberate or unintentional currency devaluation can lead to trade imbalances and geopolitical tensions.

Trust Dependency: Because fiat money isn't tied to a physical asset, it requires constant public and institutional confidence. Political instability, corruption, or economic mismanagement can rapidly undermine its value.

Ultimately, the effectiveness of fiat currency depends on the sound governance of monetary authorities and the resilience of the institutions that support it.

Conclusion

Fiat currency represents a profound evolution in human economic history. From its humble origins in ancient paper money to its role as the foundation of today's global financial system, it has enabled unprecedented economic flexibility, growth, and innovation. However, it also requires vigilance, responsible policymaking, and trust.

As the world navigates new challenges — including digital assets, central bank digital currencies (CBDCs), and alternative payment systems — the future of fiat money may look different from its past. Yet for now, it remains the beating heart of the global economy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.