Choosing between swing trading and day trading is a key decision for anyone entering the world of active trading. Both strategies offer unique opportunities and challenges, but which is more profitable?

The answer depends on your goals, risk tolerance, time commitment, and trading style. In this article, we compare swing trading and day trading, highlighting their differences, profit potential, and what traders need to succeed.

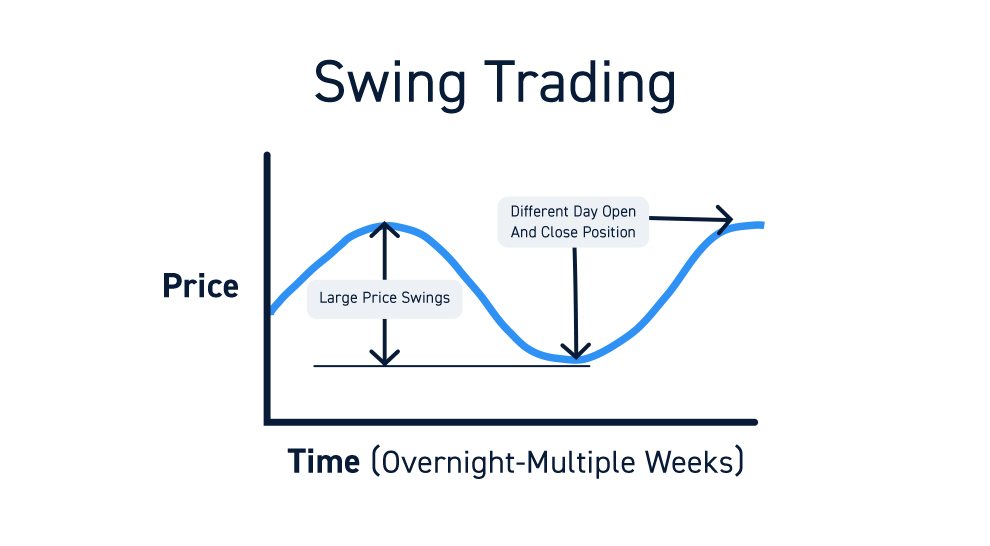

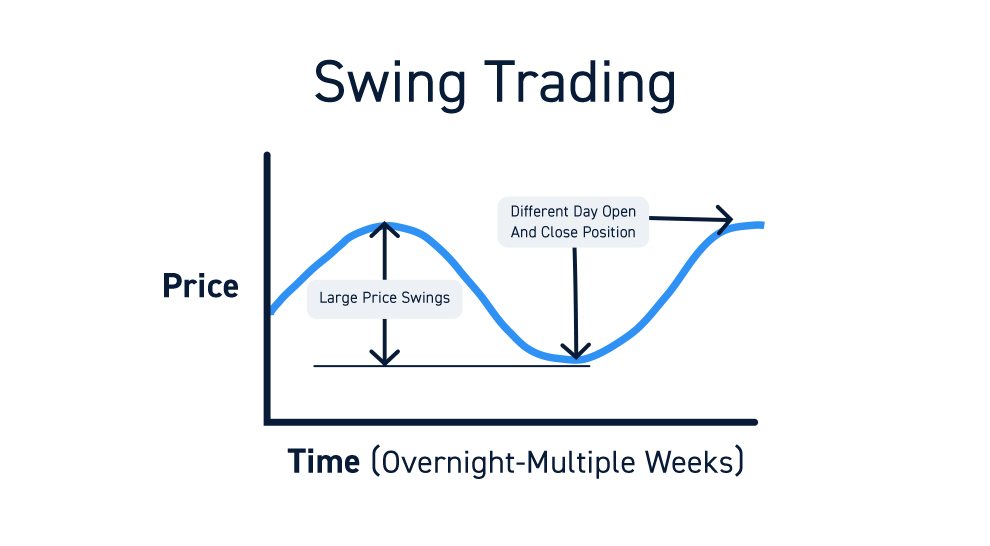

What Is Swing Trading?

Swing trading involves holding positions for several days to a few weeks, aiming to capture medium-term price moves or “swings” in the market. Swing traders use technical analysis, chart patterns, and sometimes fundamental data to identify entry and exit points. The goal is to profit from short- to medium-term trends rather than daily fluctuations.

Key features of swing trading:

Trades last from a few days to several weeks

Fewer trades per week compared to day trading

Positions are often held overnight, exposing traders to overnight risk

Requires patience and discipline to ride out short-term volatility

What Is Day Trading?

Day trading is the practice of opening and closing all trades within the same trading day, avoiding overnight exposure. Day traders focus on intraday price movements, using technical indicators, news, and real-time data to make quick decisions. The aim is to profit from small, frequent price changes.

Key features of day trading:

Trades last from minutes to hours, never overnight

High trade frequency—multiple trades per day

Requires intense focus and quick decision-making

Aims to avoid overnight risk but can be stressful and time-consuming

Profit Potential: Swing Trading vs Day Trading

Swing Trading Profitability

Swing trading can be highly profitable for those who are patient and disciplined. With fewer trades, transaction costs are lower, and traders have more time to analyse each position. Swing traders often target larger price moves, which can lead to higher profits per trade. However, holding positions overnight exposes traders to gaps and unexpected news, which can increase risk.

Pros:

Lower transaction costs due to fewer trades

More time to analyse and plan trades

Potential for larger profits per trade

Suitable for those with full-time jobs or other commitments

Cons:

Exposure to overnight and weekend market gaps

Requires patience to wait for trades to develop

Profits may be less consistent compared to day trading

Day Trading Profitability

Day trading offers the potential for frequent profits by capitalising on small price movements. Traders can avoid overnight risk and react quickly to market news. However, the high frequency of trades means higher transaction costs, and the need for rapid decision-making can lead to emotional mistakes. Consistent profitability in day trading requires significant skill, discipline, and often a larger capital base.

Pros:

No overnight risk—positions closed by end of day

Frequent trading opportunities

Can profit from both rising and falling markets

Immediate feedback on trading decisions

Cons:

High transaction costs due to frequent trades

Requires full-time focus and fast decision-making

Can be stressful and mentally demanding

Profits per trade are typically smaller

Which Is More Profitable?

There is no universal answer—profitability depends on the trader's skill, strategy, market conditions, and personal discipline. Some traders find swing trading more profitable due to its lower costs and less stressful pace, while others thrive on the fast action of day trading.

Key factors that influence profitability:

Market volatility: Both strategies benefit from volatile markets, but day traders rely more on intraday swings, while swing traders look for sustained trends.

Experience: Beginners may find swing trading more manageable, while experienced traders with strong discipline and risk management may excel at day trading.

Capital requirements: Day trading often requires a larger account to cover margin and transaction costs, while swing trading can be started with less capital.

How to Choose the Right Strategy

Time commitment: If you can dedicate full days to trading, day trading may suit you. If you have other commitments, swing trading offers more flexibility.

Personality: Swing trading rewards patience and planning; day trading suits those who thrive under pressure and enjoy fast-paced environments.

Risk tolerance: Day trading can be riskier due to leverage and frequent trades. Swing trading involves overnight risk but typically less emotional strain.

Tips for Success in Both Strategies

Have a trading plan: Define your entry, exit, and risk management rules.

Use stop-loss orders: Protect your capital from large losses.

Keep a trading journal: Review your trades to learn from mistakes and successes.

Stay disciplined: Stick to your strategy and avoid emotional decisions.

Continuous learning: Markets evolve—keep updating your skills and knowledge.

Conclusion

Swing trading and day trading each offer unique paths to profitability, but success depends on your goals, skills, and commitment. Swing trading may be more suitable for those seeking flexibility and larger moves, while day trading appeals to those who can dedicate time and thrive on rapid action.

Evaluate your resources and personality, and remember that consistent profits require discipline, planning, and ongoing learning.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.