While Wall Street fixates on mega-cap tech darlings and momentum-driven names, a quieter opportunity brews in the realm of small-cap value. The iShares Russell 2000 Value ETF (IWN) captures this overlooked segment, offering investors exposure to fundamentally sound but undervalued U.S. companies with long-term growth potential.

Often overshadowed by its growth-oriented peers, IWN stands out during market shifts—particularly in early economic recoveries, inflationary environments, or periods of heightened volatility. When deployed thoughtfully, it becomes more than just a passive index tracker; it acts as a tactical lever for diversifying risk, capturing factor premiums, and enhancing returns in a balanced portfolio.

Role in Asset Allocation

The IWN ETF is frequently positioned as a satellite holding rather than a core allocation within diversified portfolios. While broad-market ETFs like SPY or VTI offer exposure to the total U.S. market or large-cap equities, IWN carves out a distinct niche, focusing exclusively on U.S. small-cap value stocks.

The IWN ETF is frequently positioned as a satellite holding rather than a core allocation within diversified portfolios. While broad-market ETFs like SPY or VTI offer exposure to the total U.S. market or large-cap equities, IWN carves out a distinct niche, focusing exclusively on U.S. small-cap value stocks.

As such, it is often deployed to tilt a portfolio toward the "size" and "value" factors—both of which have been associated historically with higher long-term returns, albeit with elevated risk. Investors seeking factor diversification beyond simple market-cap weighting often use IWN to complement growth-heavy exposures. Additionally, it is a compelling choice for investors aiming to counterbalance tech-dominated portfolios or those seeking to capitalise on mean-reversion dynamics in equity style cycles.

For advisors building multi-factor strategies, IWN often sits alongside quality, momentum, or low-volatility ETFs, forming a holistic exposure suite that navigates diverse economic conditions.

Timing & Cyclicality

IWN's performance is intimately tied to macroeconomic cycles, interest rate trends, and investor risk appetite. Small-cap value stocks tend to outperform during early economic recoveries, when optimism rises, credit loosens, and industrial production picks up. They also show a strong historical correlation with rising inflationary expectations, which can erode the dominance of large-cap growth names that rely on future cash flows.

Given this cyclicality, some investors use tactical entry and exit points based on leading indicators such as:

In recent periods of rate hikes and inflation volatility, IWN has shown sensitivity to Federal Reserve policy—struggling during tightening cycles, yet rebounding strongly once the path of monetary policy becomes clearer.

Moreover, political cycles—such as midterm elections or pro-small-business legislation—can boost investor sentiment toward the Russell 2000 Value segment, making IWN an attractive short- to medium-term vehicle for those with a pulse on the broader macro landscape.

Balancing Risk via Diversification

While IWN offers the potential for outperformance, it also introduces unique risk characteristics into a portfolio. Small-cap stocks tend to be more volatile, less liquid, and more sensitive to economic shocks than their large-cap counterparts. However, these risks can be offset through diversified pairings.

For example:

Combining IWN with a quality-factor ETF (like QUAL) can help smooth drawdowns during market stress.

Allocating to IWN alongside international value ETFs may enhance geographic diversification while maintaining a value tilt.

Pairing IWN with high-yield bond ETFs has also been a strategy used to balance income and equity risk during volatile periods.

Investors focused on factor diversification often use tools like correlation matrices and maximum drawdown comparisons to determine the optimal allocation of IWN relative to other factors and geographies. In properly structured portfolios, IWN can serve as a volatility enhancer and long-term return booster, especially when managed with discipline.

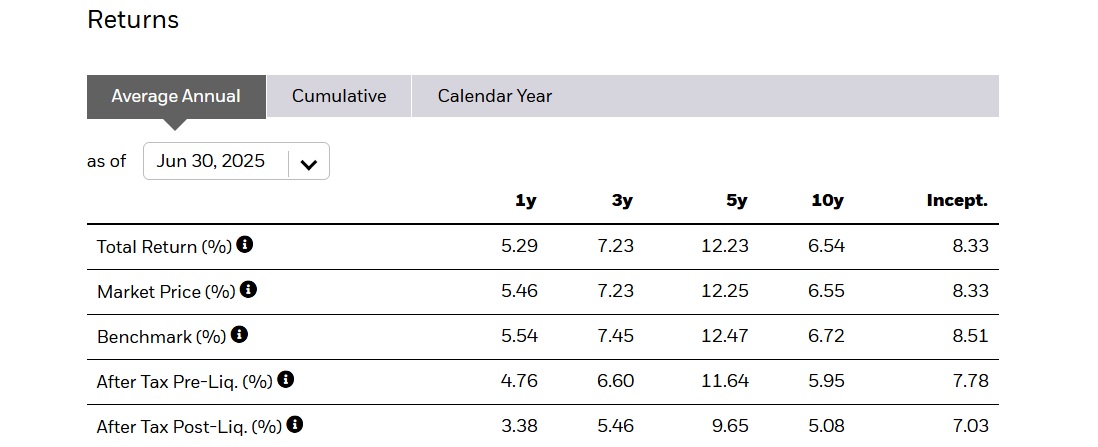

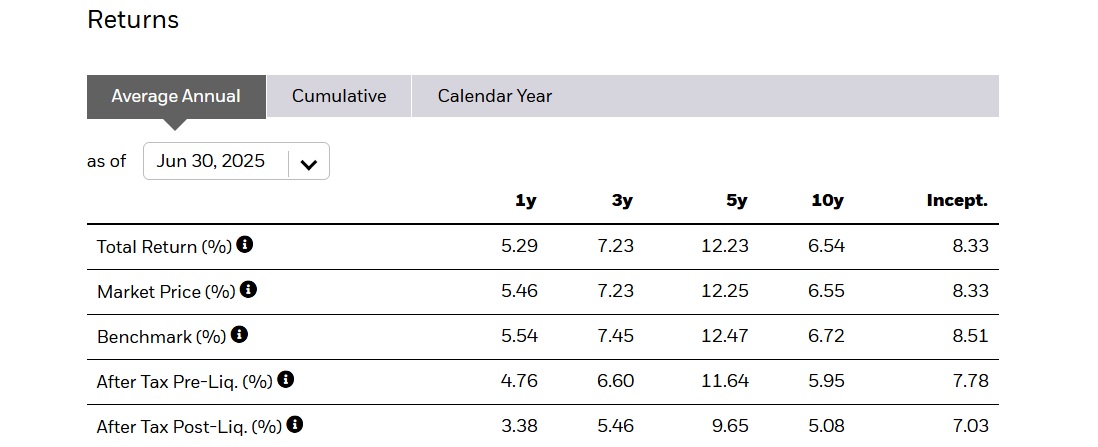

Performance Scenarios & Historical Context

Historically, IWN has shown periods of significant outperformance relative to large-cap benchmarks, particularly in years following market downturns or recessions. For instance, after the 2008 financial crisis, IWN surged ahead of the S&P 500 for several years as small businesses led the economic rebound.

Historically, IWN has shown periods of significant outperformance relative to large-cap benchmarks, particularly in years following market downturns or recessions. For instance, after the 2008 financial crisis, IWN surged ahead of the S&P 500 for several years as small businesses led the economic rebound.

However, the past decade has also witnessed prolonged periods of underperformance, especially as large-cap tech stocks drove index-level returns. Between 2010 and 2020. the value premium eroded, and IWN lagged behind broader market benchmarks like the S&P 500 and even its sibling ETF, IWM (which includes both growth and value components of the Russell 2000).

More recently, from late 2022 through 2024. IWN began to narrow the performance gap, especially amid concerns about overvalued tech giants and a renewed interest in cyclical sectors like energy, industrials, and financials—areas where IWN is heavily concentrated.

Despite periods of relative weakness, the long-term historical evidence for small-cap value remains robust. According to Fama-French data, the size and value factors have both added excess returns over decades, suggesting that investors with a multi-year horizon may be rewarded for their patience.

Factor Risk Management

IWN represents a multi-factor play in and of itself: exposure to both small-cap and value risk premiums. However, these factors can move in and out of favour, requiring a disciplined monitoring process.

Value stocks tend to lag during periods of momentum-driven growth rallies, especially when interest rates are low and capital is cheap. Conversely, they shine when earnings dispersion increases and investors become more discerning about fundamentals.

Investors should be mindful of:

Shifts in factor leadership (e.g. value to growth)

Economic regime changes

Interest rate expectations

Earnings revisions in small-cap sectors

Using quantitative tools like rolling alpha analysis, Sharpe ratio comparisons, and factor exposure breakdowns, investors can adjust the allocation to IWN based on evolving market conditions. Risk-aware investors may also choose to hedge or limit exposure during high-volatility periods or rebalance incrementally over time.

Investor Suitability & Final Recommendations

IWN is not a one-size-fits-all solution. It is most suitable for:

Long-term investors seeking exposure to value and small-cap factors

Tactical allocators aiming to exploit cyclical rotations

Diversified ETF users who can balance IWN with lower-volatility or quality-oriented instruments

Factor-based investors constructing multi-dimensional portfolios

However, it may not be appropriate for:

Investors with low risk tolerance

Those requiring high liquidity in all market environments

Short-term traders who might be exposed to whipsaw risk in illiquid small caps

In conclusion, the iShares Russell 2000 Value ETF (IWN) offers investors a strategic tool to access one of the most enduring sources of excess return in modern portfolio theory. While the path of performance may be bumpy, the potential for long-term reward remains strong—particularly for those with a conviction in value investing and a willingness to embrace small-cap volatility. Used wisely, IWN can be a powerful complement to a diversified, forward-looking investment strategy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.