Oil retreats on dollar strength

2023-05-04

Summary:

Summary:

The dollar gained with Treasury yields as investors digested Friday’s data and waited for the Fed’s decision due on Wednesday as well as key upcoming economic data.

The dollar gained with Treasury yields as investors digested Friday’s data

and waited for the Fed’s decision due on Wednesday as well as key upcoming

economic data.

U.S. manufacturing pulled off of a 3-year low in April, and construction

spending increased more than expected in March.

Wall St indexes closed slightly lower, barely affected by JP Morgan’s

acquisition of First Republic Bank’s most assets.

Commodities

Weak data from China was also in focus with PMI declining to 49.2 from 51.9

in March, below 50-point mark for the first time since December 2022.

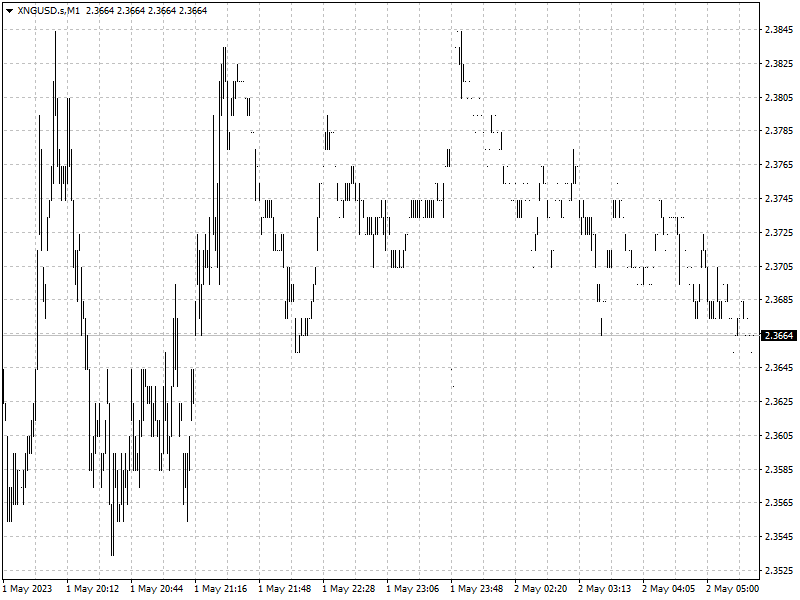

WTI settled down 1.46% at &75.66 and Brent ended at &79.31, down 1.3%

on the day. Oil prices rose by 2% on Friday boosted by Big Oil’s earnings.

ExxonMobil's profits hit record high and more than doubled in the first three

months of this year.

The Fed is set to raise rates again this week. Oil’s strong rally came to an

end as the dollar steadied and economic outlook remains weak.

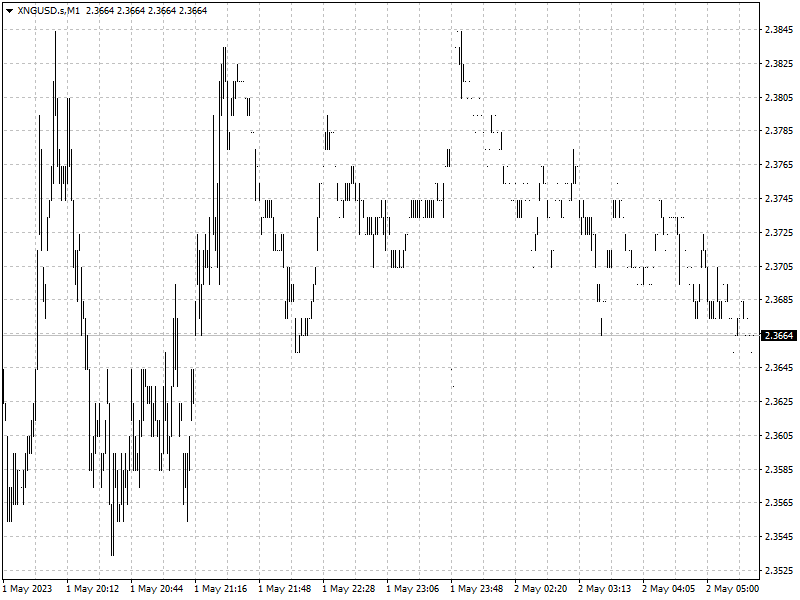

Forex

The dollar edged higher, on track for third straight daily gain, against the

yen after the BoJ kept its ultra-dovish policy.

ISM Manufacturing PMI edged higher to 47.1 from 46.3 as new orders improved

slightly and employment rebounded, but activity remained subdued.

‘The higher the Fed has to increase interest rates and the longer they have

to keep them there, we increase the risk of a recession and the risk of a deeper

and longer-lasting recession,’ said Matt Stucky, senior portfolio manager at

Northwestern Mutual Wealth Management.