Oil prices rose to their 10-month high, after China cut banks' cash reserve

requirements in a bid to revive its economy, and on expectations that major

global tightening cycles were nearing their end.

The ECB raised interest rates to an all-time high but signalled It had nearly

done its job. The Fed and the BOE will meet next week with the former expected

to keep its policy on hold.

However, the recent rebound in energy prices has raised concerns that ‘high

for longer’ argument will be validated and inflict more pains on wobbly

economy.

Hedge funds have been buying Crude Oil futures for the past two or three

weeks as supply woes have been outweighing dire economic outlook and rising US

crude inventories.

The OPEC saw solid demand and pointed to a 2023 supply deficit if production

cuts are maintained its updated forecast.

The IEA expects saudi arabia's and Russia's extended oil output cuts to

result in a market deficit through the fourth quarter but it warned that peak

fossil fuel demand will manifest itself this decade.

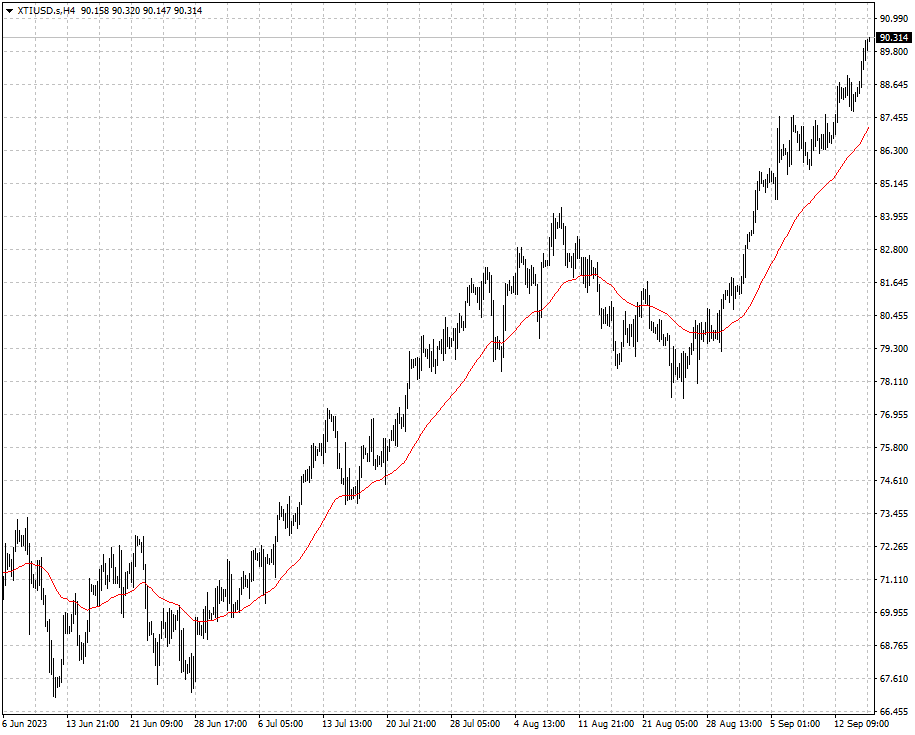

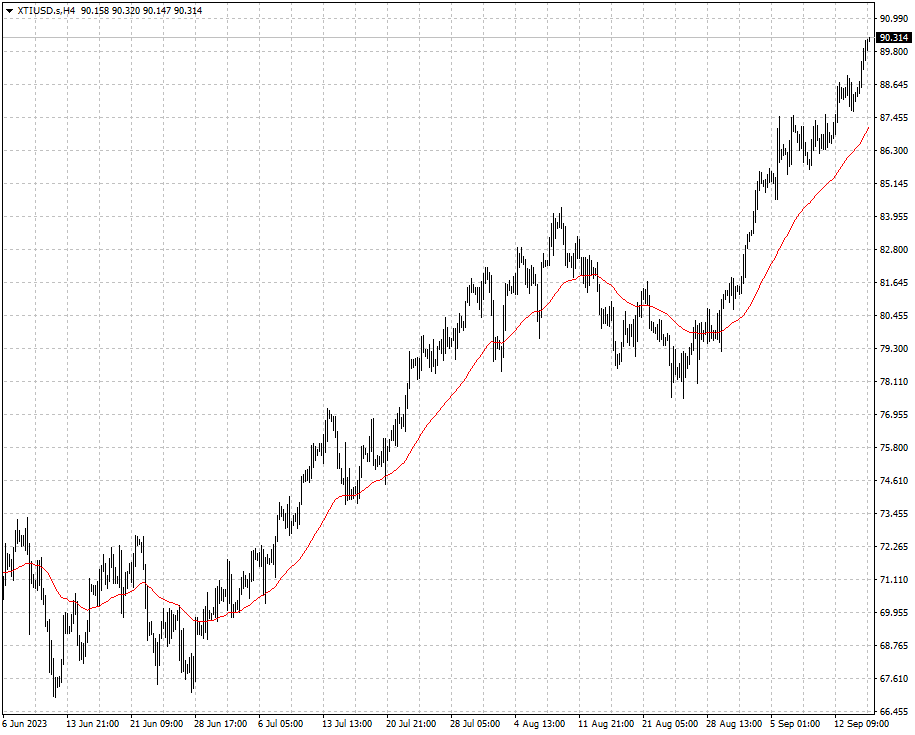

If WTI manages to steady above $90, its upside momentum could gain traction

leading to further gains. The EMA 50 continues to be a key support level to

watch.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.