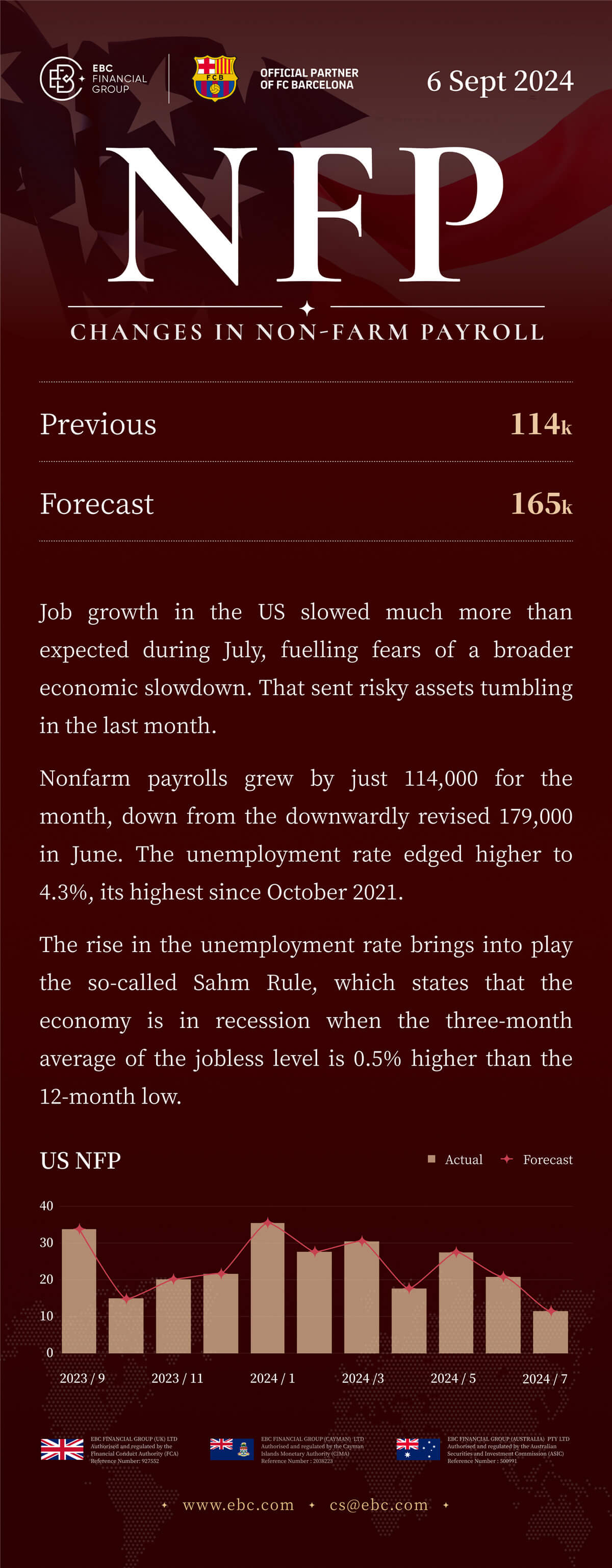

Aug NFP

6/9/2024 (Fri)

Previous (Jul):114k Forecast: 165k

Job growth in the US slowed much more than expected during July, fuelling

fears of a broader economic slowdown. That sent risky assets tumbling in the

last month.

Nonfarm payrolls grew by just 114,000 for the month, down from the downwardly

revised 179,000 in June. The unemployment rate edged higher to 4.3%, its highest

since October 2021.

The rise in the unemployment rate brings into play the so-called Sahm Rule,

which states that the economy is in recession when the three-month average of

the jobless level is 0.5% higher than the 12-month low.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.