Investors take profits from Hong Kong stocks

2025-07-25

Summary:

Summary:

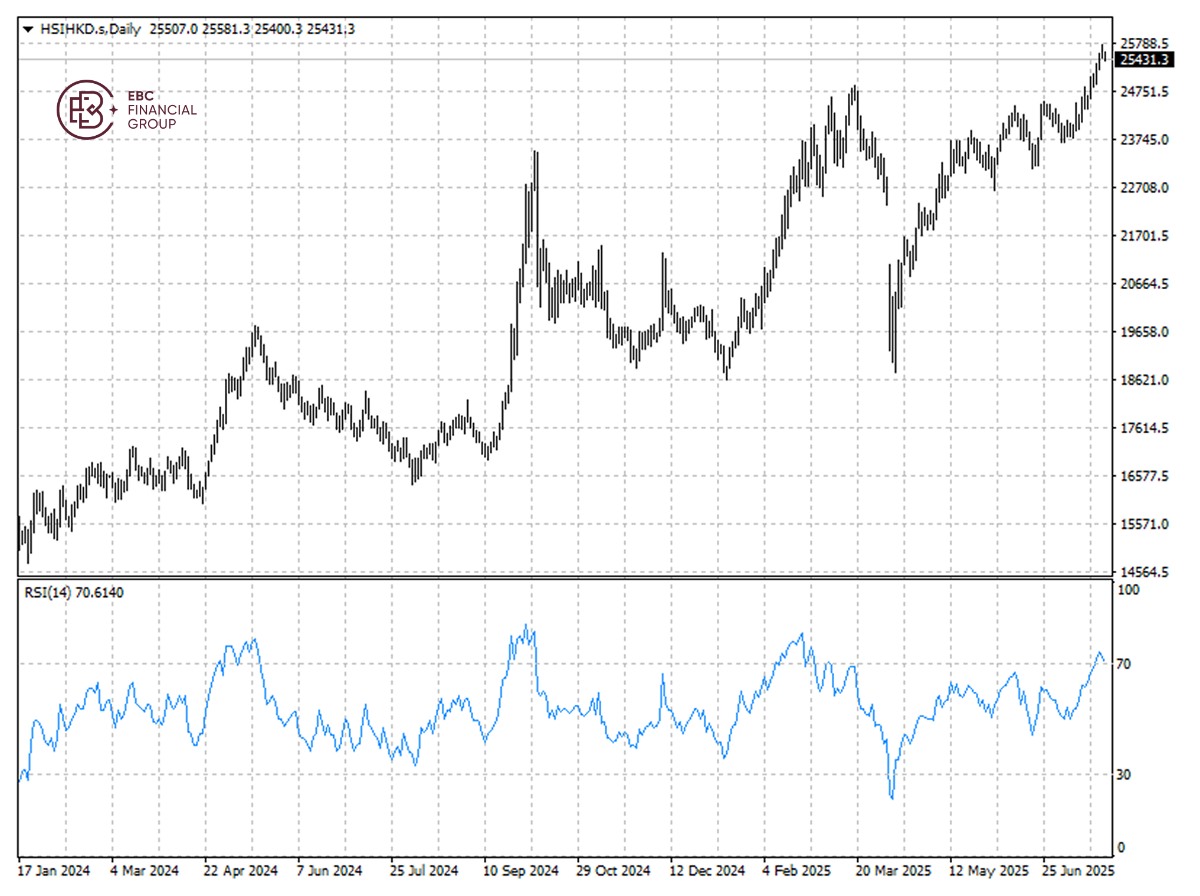

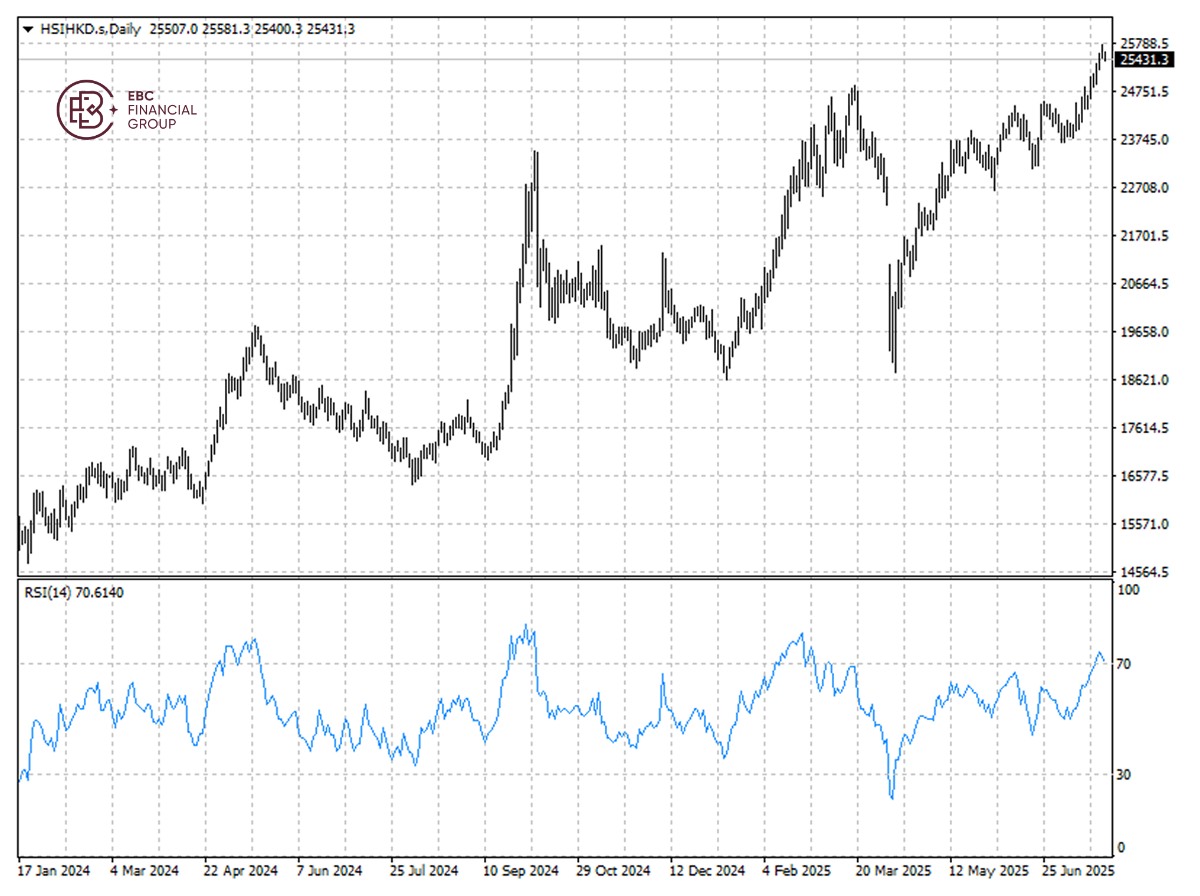

Asian markets dropped on Friday, with the Hang Seng down over 1%, as investors locked in profits ahead of Trump's tariff deadline next week.

Asian markets eased from highs on Friday, with the Hang Seng index down more

than 1%, as investors locked in profits ahead of a crucial week that includes

Trump's tariff deadline.

Hong Kong's equity benchmark is trading at its highest level in years, thanks

to a rally sparked by a breakthrough in AI earlier in the year as well as strong

demand from mainland investors.

The index jumped 20% in the first six months, among the world's best

performers. The A50 Index just hit a new high for the year this week, driven by

a plan to build the world's biggest hydropower station.

Hedge funds focused on Chinese equities posted double-digit returns in the

first half of the year, outperforming global peers While near-term volatility

may rise as the deadline for a tariff truce approaches, they stay bullish.

Investor sentiment has also improved as geopolitical tensions between China

and the US begin to ease. Nvidia and AMD's renewed sales of some AI chips to

China reinforced the perception.

TikTok may come up in trade talks with China next week, but if Beijing does

not approve a divestment deal for ByteDance, the app will soon go dark in the

US, US Commerce Secretary Howard Lutnick said.

The Hang Seng index is on course to get out of overbought territory, but the

low of 25354.3 is expected to provide solid support. The uptrend may well

continue further down the line.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.