The oil and gas industry has long been a cornerstone of the global economy, powering everything from transportation to industrial production. While the sector has faced growing pressure from the rise of renewable energy, oil stocks continue to be a major focus for traders, particularly those seeking stability and strong dividends. With many of the world's largest oil companies generating substantial cash flows, they remain attractive even in a changing energy landscape.

The Oil and Gas Industry: A Sector in Transition

The Oil and Gas Industry: A Sector in Transition

For decades, oil and gas have been the dominant energy sources, driving economic growth across industries. Companies involved in exploration, production, refining, and distribution have built massive global operations that ensure energy security for nations worldwide. However, as concerns about climate change and sustainability gain traction, the industry is undergoing a transformation. Governments are imposing stricter regulations on carbon emissions, and consumers are increasingly looking towards cleaner alternatives.

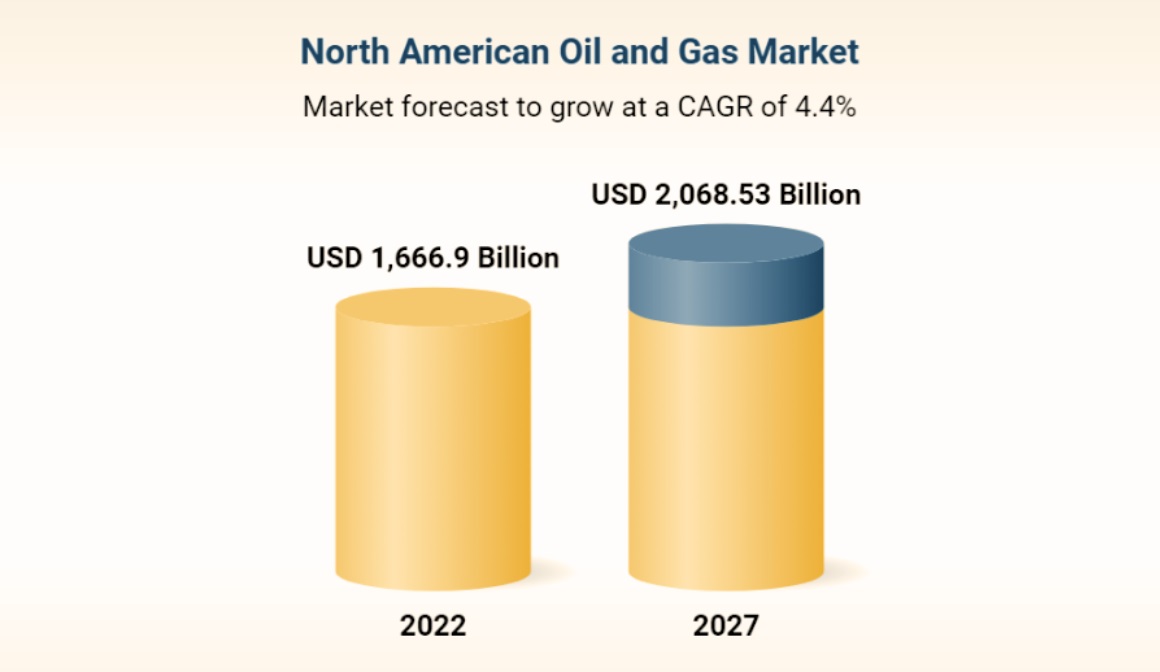

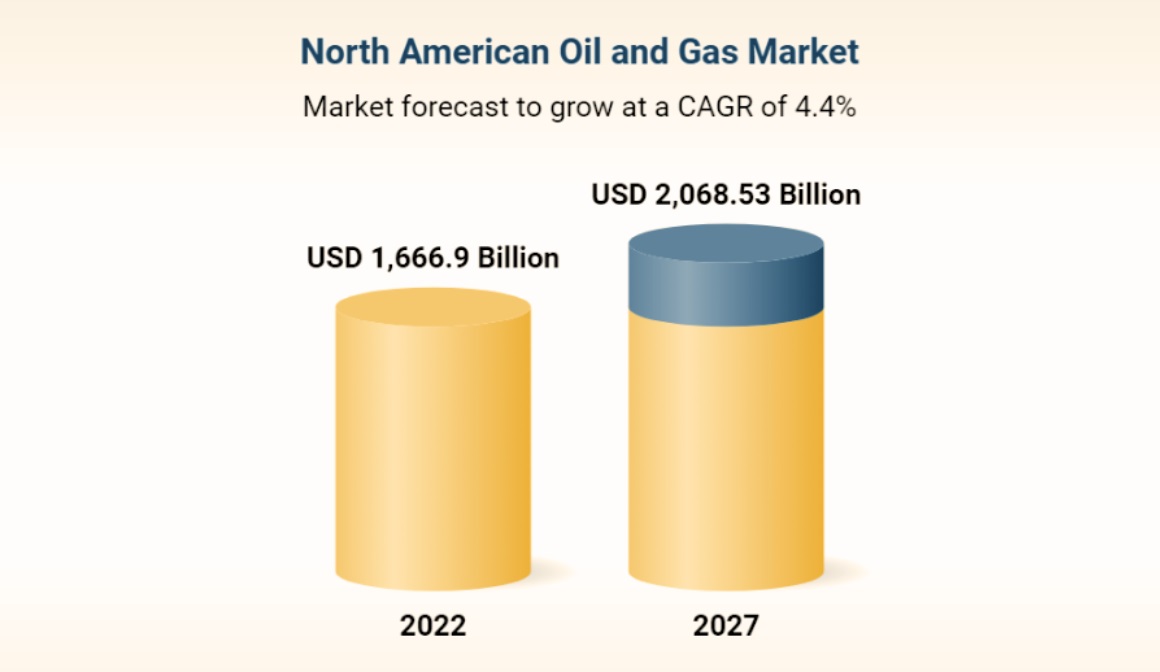

Despite these changes, oil demand remains robust. The International Energy Agency (IEA) predicts that oil consumption will continue to grow in the near term, particularly in developing economies. At the same time, supply disruptions, geopolitical tensions, and production cuts from major oil-producing countries often lead to price volatility, creating opportunities for traders.

For those looking to invest in oil stocks, understanding how different companies operate is key. Some focus on exploration and production, extracting crude oil from reserves, while others are involved in refining and distribution. Integrated oil companies, such as ExxonMobil and Shell, manage the entire process from extraction to retail fuel stations. Each segment has its own risk-reward profile, making it important for traders to choose stocks that align with their financial goals.

Oil Stocks with Strong Dividend Yields

One of the biggest attractions of oil stocks is their dividend potential. Many oil companies generate substantial free cash flow, allowing them to return significant capital to shareholders. This makes oil stocks particularly appealing to income-focused traders who prioritise stability and long-term returns.

Take Chevron, for example. As one of the largest energy companies in the world, Chevron has a history of paying reliable dividends, even during downturns. Its diversified operations and disciplined capital management have enabled it to maintain a strong balance sheet, which is crucial for sustaining dividend payouts. Similarly, BP has remained a favourite among dividend traders, despite recent volatility in the energy sector. The company has adjusted its strategy to balance traditional oil production with investments in renewable energy, ensuring long-term sustainability.

Another noteworthy name is ExxonMobil. With a commitment to shareholder returns, Exxon has consistently paid dividends for decades, making it a solid option for those seeking passive income. However, investing in oil stocks isn't just about dividends—it's also about understanding the broader market dynamics that influence oil prices.

Fluctuations in crude oil prices can impact profitability, so companies with lower production costs and strong financial health tend to perform better. This is why traders often look at factors like debt levels, cash reserves, and operational efficiency when choosing oil stocks. A company with a high dividend yield may seem attractive, but if it's not backed by sustainable earnings, it could face challenges in maintaining payouts during economic downturns.

The Future of Oil Stocks in a Renewable Energy World

While oil stocks continue to play a significant role in investment portfolios, the industry is undeniably shifting towards cleaner energy sources. Many oil giants are now investing heavily in renewables, recognising that the energy transition is inevitable. Shell, for instance, has set ambitious targets to expand its renewable energy portfolio, investing in wind, solar, and hydrogen projects. Similarly, TotalEnergies is rapidly diversifying its business, aiming to generate a larger share of its revenue from non-oil sources.

For traders, this shift presents both challenges and opportunities. Companies that successfully integrate renewables into their operations could emerge as industry leaders in the future. On the other hand, firms that resist change may struggle as governments tighten regulations and demand for fossil fuels eventually declines.

Oil isn't going anywhere anytime soon. The shift to renewable energy is a gradual process, meaning oil stocks are expected to remain significant for years to come. Many analysts suggest that oil companies with strong financial positions and adaptable strategies will be best placed to manage this transition. Traders seeking exposure to the energy sector might find value in a balanced strategy, combining traditional oil stocks with companies at the forefront of renewable energy.

In conclusion, trading in oil stocks requires a deep understanding of both the industry's current landscape and its future direction. While the sector faces undeniable challenges, strong dividend-paying oil companies remain attractive for long-term traders. The key is to focus on financially sound companies that are not only profitable today but are also taking steps to adapt to the changing energy landscape.

For those willing to navigate market fluctuations, oil stocks can provide both income and growth opportunities. Whether you're drawn to their dividend potential or their role in a diversified portfolio, keeping an eye on industry trends and regulatory shifts will help you make informed investment decisions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The Oil and Gas Industry: A Sector in Transition

The Oil and Gas Industry: A Sector in Transition