The floating profit and loss of stocks refers to the profit and loss of the

stocks currently held under the change of market price. In stock trading,

floating profit and loss is an important concept that can help investors

determine the current profitability of the stock and decide whether to sell or

continue to hold it.

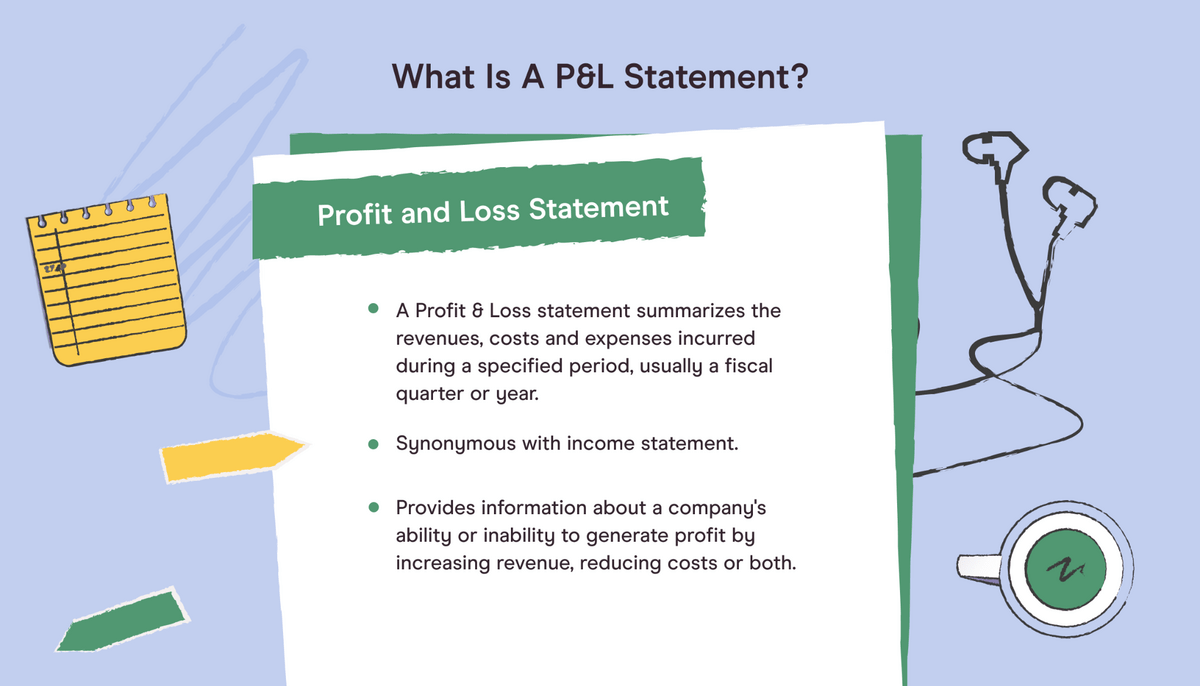

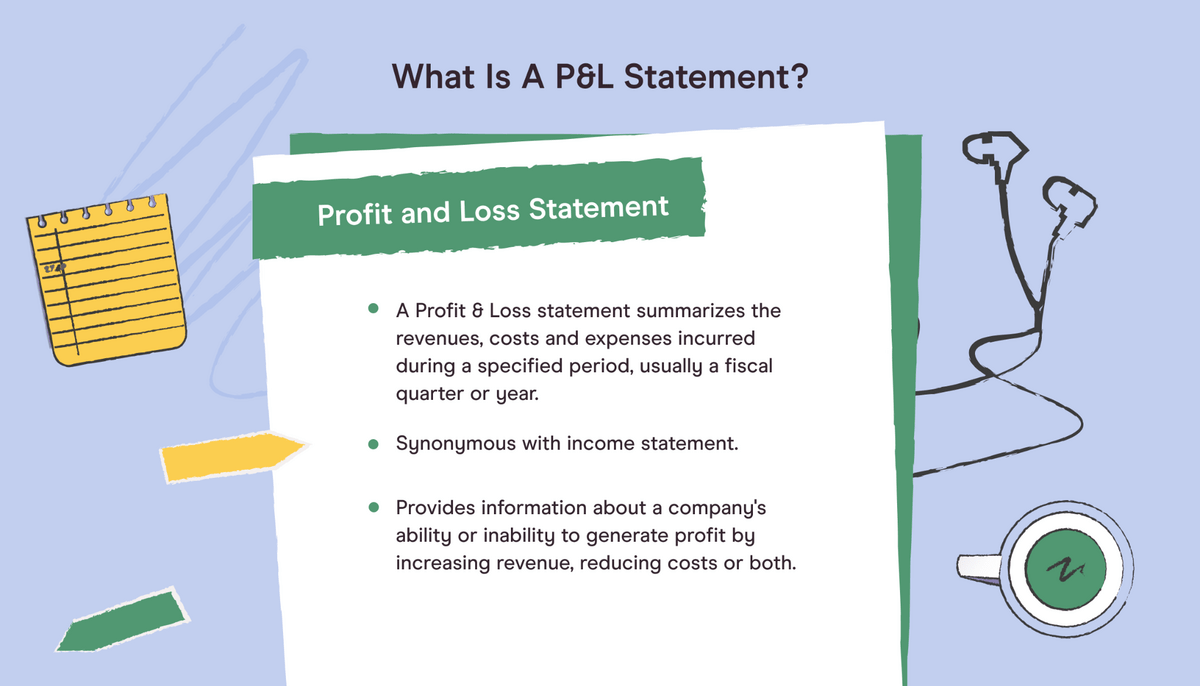

1、 What is Floating Profit and Loss

The meaning of floating profit and loss in stocks is the potential profit and

loss calculated based on the initial transaction price of the holding contract

and the settlement price of the day. Floating profit and loss is an unrealized

loss and gain, which is generally not recognized as investment income through

the accounting principle of income realization.

2、 How to Calculate Floating Profit and Loss

Calculate floating gains and losses. It refers to the settlement institution

directly calculating the floating profit and loss of a member's open position

contract based on the settlement price of the transaction on that day, and

determining the amount of guarantee payable for the open position contract

through this calculation.

The calculation method for floating profit and loss is as follows: Floating

profit and loss=(settlement price on the day - opening price) × open interest ×

Contract unit - handling fee.

If it is a positive value, that is to say, a long floating profit or a short

floating loss, that is, if the stock price rises after a long position is

established, it indicates a long floating profit, or if the price of a short

position rises after it is established, it indicates that the short floating

state is designated as a loss. If it is a negative value, it indicates a long

floating loss or a short floating profit. In other words, the price drops after

a long position is established, indicating a long floating loss, or the price

drop after a short position is established reflects a short floating profit. If

the amount of margin is not enough to maintain the open position contract, the

settlement institution will notify the meeting to make up the difference before

the next day's market opening, which means paying the margin. Otherwise,

compulsory measures will be implemented to close the position. If there is a

floating profit, members are not allowed to propose the profit portion. If the

future liquidation contract provides liquidation, the floating profit can be

converted into actual profit.

If you want to calculate the floating profit and loss ratio, you need to

calculate the percentage obtained by comparing the floating profit and loss to

the principal.

Divide the profit and loss per share by the cost price at which you purchased

the stock, and then multiply by 100% to obtain your floating profit and loss

ratio.

It is extremely common for stock market trading to have gains and losses, and

it is important to master how to calculate stock gains and losses. Now, let me

introduce to friends how to calculate stock gains and losses and profit and loss

ratios.

1、 Formula for calculating profit and loss

The calculation formula is: Profit and Loss Amount=(Market Value - Selling Expenses+Accumulated Selling Liquidation Amount+Current Day Selling Liquidation Amount) - (Accumulated Buying Liquidation Amount+Current Day Buying Liquidation Amount)

The calculation of profit and loss amount is not related to the cost price type of the account.

The selling fee can be used to calculate the maximum commission rate set at the counter.

2、 Formula for calculating profit and loss ratio

The calculation formula for the profit and loss ratio of the stock market is (existing stock price - cost stock price)/cost stock price * 100%=profit and loss ratio.

If you want to calculate the profit and loss amount of the stock on that day, that is, you need to calculate the profit and loss rate of all personal holding stocks in the stock accounts on that day. Investors can view the daily gross profit, deficit, and overall profit and loss on their accounts, without the need for manual calculations. If investors want to search for previous transaction records, please go to the historical bill generated by the transaction to check.