The world of electric vehicles (EVs) has evolved rapidly in recent years, shifting from a niche market into a mainstream, global industry. A few decades ago, EVs were mostly limited to the imaginations of futurists and enthusiasts. Today, they're increasingly common on roads around the world, with consumers, governments, and car manufacturers all contributing to the growing demand for cleaner, more sustainable transportation. This shift is powered by multiple factors, from stricter environmental regulations to technological advances in battery efficiency and a clear global trend toward reducing carbon emissions.

For traders, the EV market represents an exciting opportunity, but also a complex one. At the heart of it are the electric vehicles themselves, which rely on advanced technologies like lithium-ion batteries and electric drivetrains. However, the broader EV industry encompasses a wide range of companies, including automakers, battery manufacturers, charging infrastructure providers, and even software companies developing the systems that manage and optimise EV performance.

When it comes to EV stocks, understanding the landscape means recognising that it's not just about the cars. It's about everything that supports their development, production, and the ecosystem that makes them viable on a mass scale. Investing in this sector requires looking beyond the obvious automakers and considering the broader supply chain, which includes everything from the raw materials for batteries (such as lithium and cobalt) to companies working on autonomous driving technologies and renewable energy solutions.

Top EV Stocks and ETFs for Diversified Exposure

Now that we have a better understanding of the EV market's scope, the next step is identifying specific companies and investment vehicles that offer exposure to this growing industry. A simple way to get started is by looking at the top EV stocks, which are the companies driving the most innovation in space.

Tesla is often the first name that comes to mind when you think about EVs, and for good reason. As one of the leaders in electric car production, Tesla has not only captured a significant market share, but also developed a brand that's synonymous with cutting-edge technology. Its stock has been a top performer over the past decade, though it can also be quite volatile, as it's heavily influenced by both the broader market and trader sentiment around Elon Musk's leadership.

That said, there are other automakers making strong strides in the EV space, such as Rivian, Lucid Motors, and NIO. Rivian, for instance, has attracted significant investment and is focusing on electric trucks and SUVs, tapping into a segment that's largely untapped by Tesla. Lucid Motors, on the other hand, has set its sights on the luxury EV market, aiming to compete directly with high-end brands like Mercedes-Benz and BMW with its premium sedan, the Lucid Air. NIO, a Chinese company, is often referred to as the "Tesla of China" and has rapidly expanded its presence with a growing range of EV models.

For those looking for diversification, Exchange Traded Funds (ETFs) are a smart choice. These funds allow traders to gain exposure to a broad spectrum of EV-related companies without betting all their money on one stock. Popular EV ETFs include the Global X Lithium & Battery Tech ETF and the iShares Global Clean Energy ETF. These funds invest in companies involved in the development of lithium batteries, charging infrastructure, and other green technologies that support the EV industry.

Analysing Market Trends and Future Projections

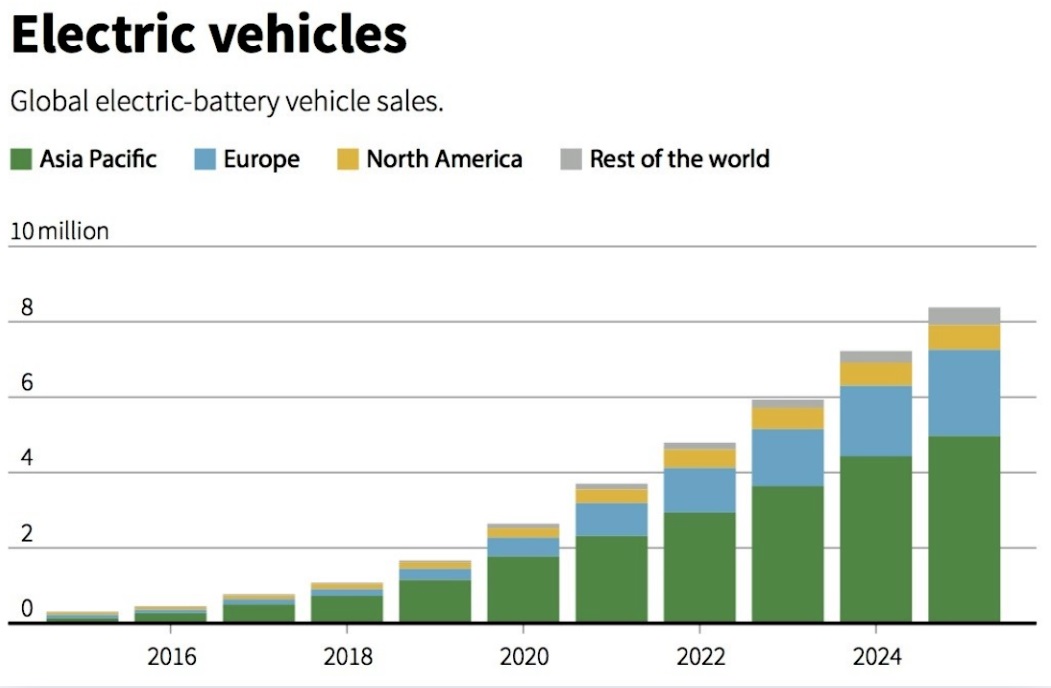

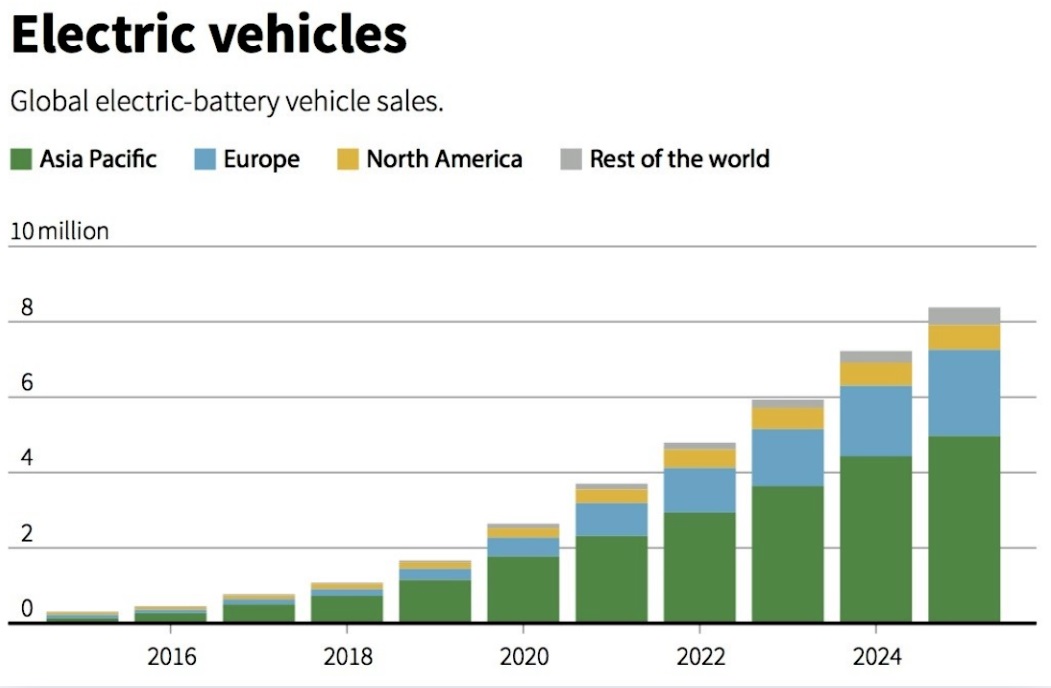

The market for electric vehicles is growing at an unprecedented rate, and this trend shows no signs of slowing down. In fact, many analysts predict that the global EV market could be worth over $800 billion by 2027. with a compound annual growth rate (CAGR) of more than 20%. This explosive growth is primarily driven by the push for decarbonisation, government incentives for EV adoption, and rising consumer demand for more sustainable options.

One of the key market trends that traders should be aware of is the expansion of EV charging infrastructure. While the number of electric vehicles on the road has increased, there's still a significant gap when it comes to public charging stations. Companies that build, manage, and operate charging networks, such as ChargePoint and Blink Charging, are set to benefit as more people switch to EVs and demand more accessible charging points.

Another crucial factor driving growth in the EV market is the decline in battery costs. Over the past decade, the price of lithium-ion batteries has fallen dramatically, making EVs more affordable for the average consumer. This trend is expected to continue as technology improves, allowing for longer ranges and faster charging times, both of which are crucial for mass adoption.

On a macro level, government policies and environmental regulations are having a profound impact on the EV sector. Many countries, particularly in Europe and North America, are offering incentives for consumers to purchase EVs, such as tax rebates or subsidies. At the same time, governments are implementing stricter emissions regulations for internal combustion engine (ICE) vehicles, making it more difficult for traditional car manufacturers to compete with EVs. This has prompted companies like Volkswagen and General Motors to shift their focus toward electric vehicle production, accelerating the industry's transformation.

Tips for Building a Balanced EV Stock Portfolio

While the growth potential of EV stocks is undeniable, it's important to approach investing in this space with caution. Like any emerging industry, there are risks involved, and not every company in the EV sector will succeed. To build a balanced EV stock portfolio, consider these tips:

Diversify across different areas of the EV ecosystem

Rather than putting all your money into one automaker, think about diversifying your investments across different parts of the EV market. This might mean investing in a mix of car manufacturers, battery producers, charging infrastructure providers, and even raw materials companies. Doing so helps mitigate risks by spreading your exposure to various industries that are all connected to the EV revolution.

Consider the long-term horizon

The EV industry is still in its early stages, and many of the top players are still scaling their operations. It's important to keep a long-term perspective when investing in this space. Stocks like Tesla or NIO may experience short-term volatility, but if the broader trend towards EV adoption continues, these companies could stand to benefit greatly over the next decade.

Pay attention to regulatory changes

Government incentives and regulations are critical drivers of the EV market. Staying up to date with new policies, such as emission standards or subsidies for EV buyers, will help you better understand the growth trajectory of different companies. Companies that align themselves with these regulatory trends are likely to see more growth in the long term.

Stay informed about technological advances

Technology is at the heart of the EV revolution, so keeping an eye on advancements in areas like battery technology, autonomous driving, and renewable energy integration will help you make informed investment decisions. Companies that stay ahead of the curve in these areas will likely have a competitive advantage.

In conclusion, the EV stock market offers exciting opportunities for traders, but it's important to approach it with careful consideration and a long-term perspective. By understanding the industry landscape, diversifying your investments, and keeping track of key trends and regulatory changes, you can build a well-rounded portfolio that's poised to benefit from the electric vehicle revolution.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.