Leverage is a financial tool that allows investors to use less capital to

control larger trading positions. It increases the scale and potential returns

of investment by borrowing funds. Leveraging can increase investment returns,

but it also increases investment risks.

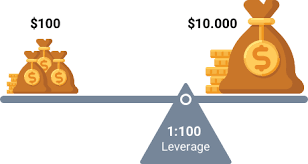

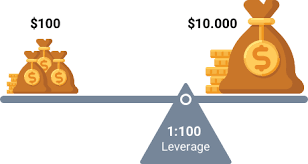

In forex trading, leverage is usually expressed in proportion,

such as 1:100 or 1:200. This means that investors only need to provide a small

portion of the transaction amount as margin, while brokers will provide the

remaining funds. For example, if investors choose a leverage ratio of 1:100,

they only need to provide a 1% margin, and the broker will provide the remaining

99%.

Leveraged trading can enable investors to gain greater profits during market

fluctuations. For example, if investors use a leverage ratio of 1:100 for

trading, their investment size will increase by 100 times. This means that even

if the market volatility is only 1%, investors' profits will increase by 100%.

However, the same fluctuations may also result in losses of the same

proportion.

Although leveraged trading can bring high returns, it also carries high

risks. If the market is unfavorable, investors may lose more than their initial

investment. In addition, leveraged trading may also lead to excessive trading

and emotional decision-making as investors may overly rely on leverage to pursue

high returns.

Therefore, when using leveraged trading, investors should be very cautious

and ensure that they understand their risk tolerance. They should develop

effective risk management strategies, such as setting stop-loss and stop-profit

orders, to limit potential losses. In addition, investors should also choose

regulated brokers to ensure the safety of their funds.

How Much Trading Leverage is Appropriate?

Choosing the appropriate trading leverage is determined based on an

individual's investment goals, risk tolerance, and trading experience. Here are

some considerations:

1. Investment objectives

Determine whether your investment goal is to pursue stable returns or higher

returns. A lower leverage ratio may be more suitable for investors seeking

stable returns, while a higher leverage ratio may be more suitable for investors

seeking higher returns.

2. Risk tolerance

Understand your level of risk tolerance. If you have a low tolerance for

risk, you may need to choose a lower leverage ratio to reduce potential loss

risk. On the contrary, if you have a high tolerance for risk and are willing to

take on greater risks, you can consider choosing a higher leverage ratio.

3. Trading experience

Experience and knowledge about forex trading can also affect the

leverage ratio you choose. If you are a novice trader, it is recommended to

choose a lower leverage ratio to reduce risk. With the accumulation of

experience and an understanding of the market, you can gradually increase your

leverage ratio.

It is important to remember that a higher leverage ratio may bring greater

profit potential, but it also increases the potential risk of losses. Therefore,

selecting the appropriate trading leverage requires comprehensive consideration

of one's own situation and taking appropriate risk management measures, such as

setting stop-loss orders and reasonable position planning. It is best to consult

a professional investment advisor or broker before choosing a leverage ratio to

obtain more accurate advice and guidance.