The analysis methods of forex trading are mainly divided into

two categories: fundamental analysis and technical analysis. The commonly used

analysis methods mainly include Fundamental analysis, technical analysis, and

emotional analysis.

1. Fundamental Analysis

Fundamental analysis is one of the main methods used in trading forex. It studies and judges the market situation through the analysis of

economic, political, social, and other factors that may affect the supply and

demand of assets. Due to the improvement of the US economy, the US dollar is

continuously strengthening. With the improvement of the US economy, if the

economy grows too fast or even expands, the Federal Reserve may need to control

it by raising interest rates.

This includes the following methods:

1. Economic data analysis: Pay attention to the economic indicators of

relevant countries, such as GDP, inflation rate, interest rate, employment data,

etc., to infer the economic situation.

2. Political and Geopolitical Analysis: Pay attention to the political

dynamics, elections, trade policies, geopolitical risks, etc. of relevant

countries to predict their impact on the forex market.

3. central bank Policy Analysis: Pay attention to the central bank's monetary

policy decisions, interest rate decisions, and the impact of policy statements

on the forex market.

2. Technical Analysis

The research object of technical analysis is determining market behavior,

determining market development trends, and then formulating financial derivative

trading strategies based on the cyclical changes in forex. Technical

analysis is mainly based on similar patterns that have been formed in history,

believing that the price of currency will repeat past trends, thus forming one's

own trading perspective. But even if A and B are focusing on the same technical

form in forex trading, the next trend will also be different based on

the trader's own experience.

This includes the following methods:

1. Chart analysis: Identify and analyze price trends, price patterns, support

and resistance levels, and other chart forms to predict future price trends.

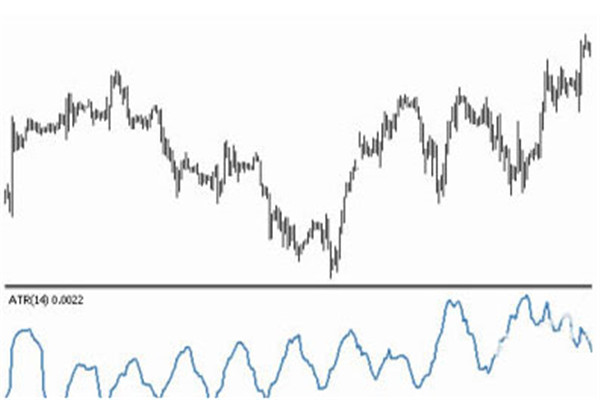

2. Technical index analysis: use various technical indicators, such as moving

averages, relative strength indicators (RSI), and stochastic oscillators, to

help judge Market trends and price reversals.

3. Volatility analysis: pay attention to the volatility of the forex market and help predict market volatility through volatility indicators

(such as volatility channels, Bollinger Bands, etc.).

3. Emotional Analysis

forex sentiment analysis is a way to determine the direction of

the market by analyzing the emotions of traders, as the market to some extent

reflects the traders' feelings towards the market. Even if you firmly believe

that the US dollar will rise but other people in the market are bearish towards

the US dollar, you will be powerless to handle the decline of the US dollar.

The main focus is on the following factors:

The emotions and market psychology of forex market

participants

Market investors' trading confidence and market expectations

Overall, the purpose of the three analysis methods in forex

trading is to solve the same problem and predict the direction of currency price

changes, but from different perspectives. Technical analysis is to study the

consequences; Fundamental analysis investigates the antecedents of market

movement; and emotional analysis is to find the traces of price fluctuations by

analyzing people's emotions.