Imagine scooping up every banknote, every cent in every savings account, every share certificate, every gold bar and every Bitcoin, putting them in one giant pile. How big would it be?

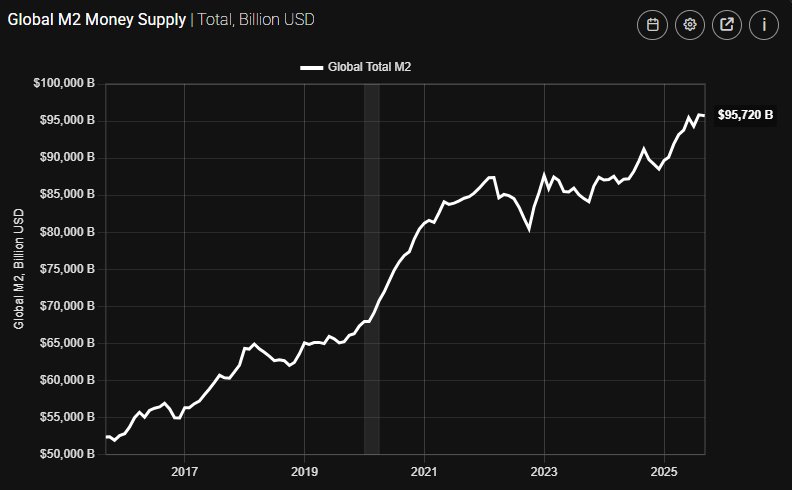

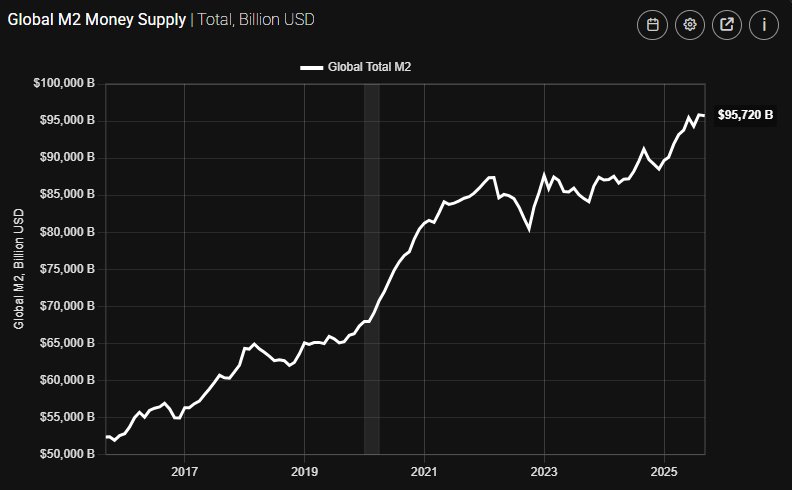

People throw around jaw-dropping totals like "$583 trillion" or "over $1 quadrillion", but those numbers mean very different things depending on what you count. As of 2025, there's roughly U.S. $96 trillion in liquid money (M2) and around U.S. $471 trillion in total global wealth worldwide, according to UBS and IMF data. [1]

Below, we break it down with verified 2025 estimates, explain the difference between money and wealth, and highlight why these numbers matter to markets, investors, and your wallet.

How Much Money Is in the World in 2025? Quick Snapshot

| Category |

Approx. 2025 Value |

What This Means |

| Physical cash (M0) |

~US $8–9 trillion |

Banknotes & coins in circulation |

| Broad money (M2, global) |

~US $96 trillion |

Cash + deposits + near-money; liquidity fueling real spending |

| U.S. M2 |

~US $22 trillion |

U.S. broad money. It is key since USD is the world’s reserve currency |

| Global financial assets (stocks, bonds, cash) |

~US $305 trillion |

Financial assets held by households & institutions |

| Global personal wealth (financial + real assets) |

~US $471 trillion |

UBS estimate of total personal wealth across 56 markets |

| Gold (all above-ground) |

~US $25–28 trillion |

Value of ~216 000 tonnes at ~$3 900–$3 980 / oz |

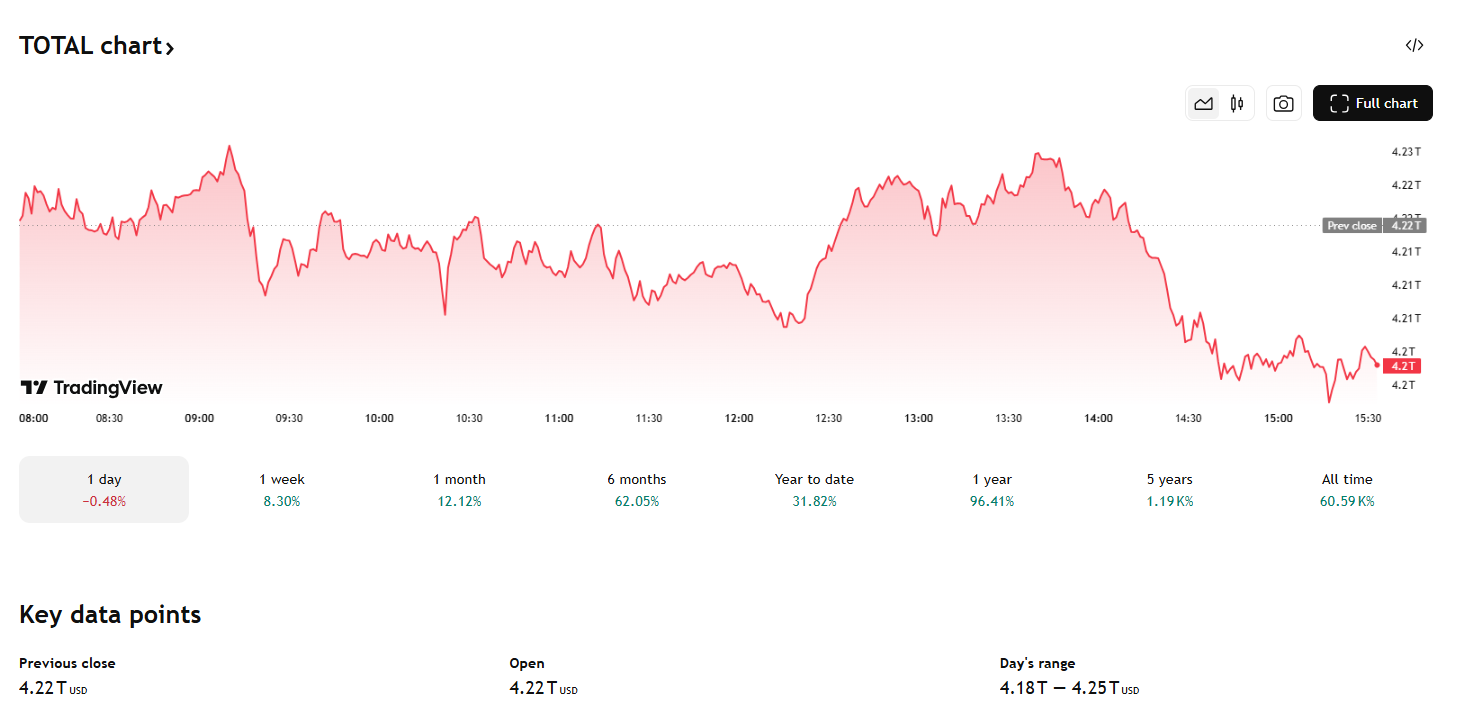

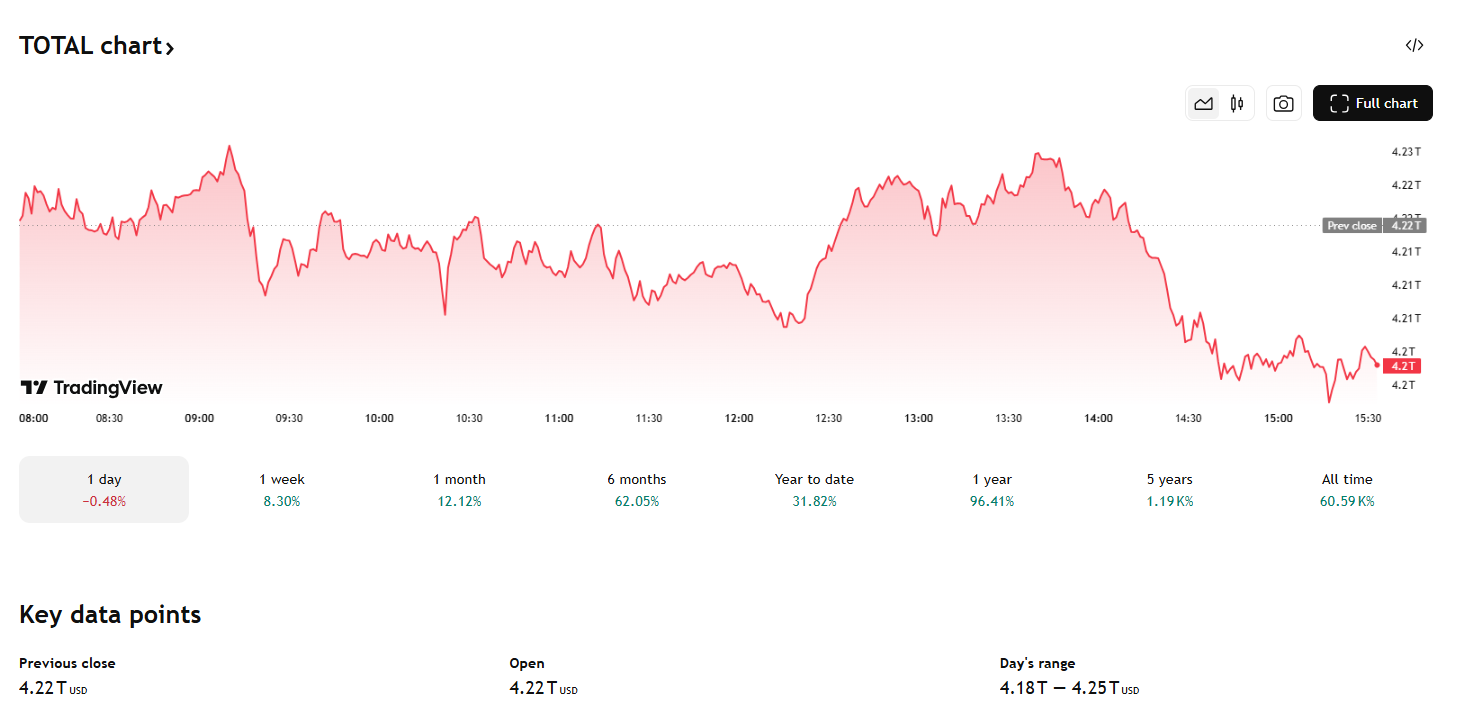

| Crypto market cap (Oct 2025) |

~US $4.0–4.4 trillion |

Bitcoin & altcoins market value |

| Global public + private debt (2024) |

~US $251 trillion |

Not money per se, but shapes liquidity and risk |

The bottom line: Most "money" isn't physical cash. The liquid money people use daily (M2) is on the order of tens of trillions.

While total global wealth, if you count property, pensions and business equity, runs into the hundreds of trillions.

For example, if you add broad money + financial assets + gold + crypto + real estate, you can produce a gigantic aggregate. Different credible sources give different totals depending on the scope:

Global M2 (liquidity): ~$96T.

Global financial assets: ~$305T.

Global personal wealth (UBS): ~$471T.

Gold (all mined) at current prices: ~$25–28T.

Crypto (Oct 2025 snapshot): ~$4+T.

Carelessly adding categories can lead to totals of US$600–700 trillion, which is why some popular headlines mention figures like $600T.

That's not wrong per se; it's just a different question (it asks "what is the total dollar value of all assets and money combined?"), and it's sensitive to valuation choices, exchange rates and what you include.

What We Mean by "Money": M0, M1, M2

Before being amazed at the huge sum of numbers, you need definitions.

M0: Cash in your wallet and central-bank reserves: think coins and notes.

M1: Money you can spend immediately: M0 plus checking accounts.

M2: Broad money: M1 plus savings accounts, small time deposits and retail money-market funds. It is the common "how much money is in the system" figure for economists.

Wealth and assets: Everything valuable people own: stocks, bonds, property, pensions, and private businesses. These are not the same as money but represent stored value.

A simple analogy is that M0 represents the actual cash on a dining table; M2 stands for the restaurant's complete cash register and bank account, while "wealth" refers to the establishment's property, brand name, and franchise.

What Is M2 and Why Is It the Clearest "Money" Metric?

Economists and central banks watch M2 because it's the pool of money that can be mobilised relatively quickly into spending or investments. Aggregating M2 across major economies gives a usable global snapshot.

Why this matters: changes in M2 affect credit conditions, consumer spending and ultimately, inflation and asset prices.

Additionally, the United States' M2 is crucial because the U.S. dollar is the dominant global reserve and settlement currency.

U.S. M2 has climbed over the pandemic era and into 2025 to the low-to-mid US$20-trillion range (Federal Reserve data). That scale affects global liquidity conditions.

Because many global trade, loans and commodity contracts are USD-denominated, movements in the U.S. money supply can ripple across markets worldwide.

Financial Assets vs Money: Global Financial Wealth

If we stop at M2, we miss a much larger picture: the financial assets and real assets. These are the "wealth": figures quoted in headlines.

Global financial wealth reached around US$305 trillion in 2024. [2]

Total personal wealth across 56 markets was estimated at US$471 trillion in UBS's Global Wealth Report 2025 (coverage >92% of world wealth). UBS reports a 4.6% rise in global wealth in 2024.

Why the gap matters: M2 (~$96T) is the liquid fuel; global wealth (~$300–470T) is the stock of baked-in value that people hold. When asset prices rise faster than M2, it can reflect "wealth inflation" without equivalent liquidity for everyone.

How Much Is Gold Worth in 2025?

The World Gold Council and other industry sources estimate ~216,000 metric tonnes of gold have been mined and remain above ground (estimates vary). At 32,150.75 troy ounces per tonne, multiplying by today's price produces the gold market value.

With gold trading near $3,900–$3,980/oz in Oct 2025, the total value of all above-ground gold is on the order of US$25–28 trillion, depending on which tonnage estimate you use.

Note: Gold isn't counted in M2 as it's a store of value historically used as "real money" and a hedge. Compared with global M2, gold's market value is meaningful but far smaller than total financial wealth.

How Big Is Crypto in 2025?

Crypto lovers and newsrooms often ask: "How much of the world's money is crypto?" Short answer: still small relative to global wealth, but large enough to matter.

For context, in early October 2025, the crypto market cap surged past US$4 trillion amid a sharp Bitcoin rally (Bitcoin alone >US$2.4T at that moment).

Crypto is primarily viewed as a speculative asset and a different form of value storage for the time being, rather than as money in the M2 context.

Debt and Derivatives: The Quadrillion Confusion

Moreover, when people throw around quadrillion-dollar totals, they often include debt and the notional amounts of derivatives. Those numbers can be misleading if used as "how much money exists".

Global debt (public + private) was roughly US$251 trillion in 2024, according to the IMF's Global Debt Monitor. That represents obligations, not cash in hand, but it shapes liquidity and systemic risk. [3]

Derivatives notional totals (the headline figure people cite) are even larger, not equivalent to money. They represent the face value of contracts, not the cash transferred on settlement. The BIS provides consolidated derivatives statistics to put these in context.

Therefore, significant debt/derivative sums are important for stability, but they do not imply that there is an actual stack of money supporting them.

Why These Numbers Matter to You?

1. Monetary Policy

Central banks monitor M2 and credit because large increases in liquid money can feed inflation and asset bubbles.

2. Asset Prices

When central banks inject liquidity or cut rates, some of that money often finds its way into stocks, real estate and alternative assets, inflating valuations.

3. Crisis Risk

During a liquidity squeeze, trillions of assets may be present, but there is only a small amount of cash to buy them; this disparity can worsen market declines.

4. Inequality & Policy:

Large aggregate wealth doesn't mean economic security for most; distribution shapes living standards and political debate.

Frequently Asked Questions

1. Does "Money in the World" Include Wealth Like Real Estate and Stocks?

It depends on how you define "money." If you include all assets (real estate, equities, private businesses), you're talking about global wealth, not just money supply. Wealth estimates in 2025 currently range in the hundreds of trillions of dollars.

2. Why Is the Global Money vs Wealth Gap So Large?

Most value is locked in illiquid assets (real estate, equities), while M2 represents immediate spending power.

3. Does "More Money" Always Mean Inflation?

No. Inflation depends on money velocity, output capacity, and expectations, not just the quantity of money.

4. How Much Cash (Physical Currency) Exists in the World?

Physical cash or M0 is estimated to be around US$8–9 trillion globally.

Conclusion

In conclusion, the world's real liquid money globally totals around US$96 trillion, whereas the combined worldwide wealth nears US$471 trillion. It is a reminder that most value exists not as cash, but as assets built on trust, credit, and confidence.

For policy and markets, M2 is the key signal. For society and equity, wealth distribution tells the real story.

Gold and crypto, while impactful, constitute only modest portions of the global value landscape, as their significance arises from scarcity and perception, rather than size.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.ubs.com/lu/en/wealthmanagement/insights/global-wealth-report.html

[2] https://www.bcg.com/publications/2025/global-wealth-report-2025-rethinking-rules-for-growth

[3] https://www.imf.org/external/datamapper/GDD/2025%20Global%20Debt%20Monitor.pdf