AI is disrupting the trading world, how we approach markets, data and decisions. With advanced data analysis, predictive algorithms and automation, AI is turning trading on its head, faster and more precise way to navigate the financials. But how is AI changing trading? Let’s find out how it’s changing strategies, efficiency and giving traders an edge in today’s financial markets.

AI Trading is Changing Data Analysis

Data is the foundation of trading and AI can analysis it at lightning speed and at scale. Traditional analysis takes time and misses key information, but with AI traders get a new edge: to see trends in real time.

Big Data Processing: AI can process huge amounts of historical and real-time data, patterns that human traders can’t catch as they happen.

Natural Language Processing (NLP): By analyzing text sources like news, social media and financial reports, AI can gauge public sentiment on certain stocks, currencies or commodities. Traders can adjust to market sentiment and anticipate changes.

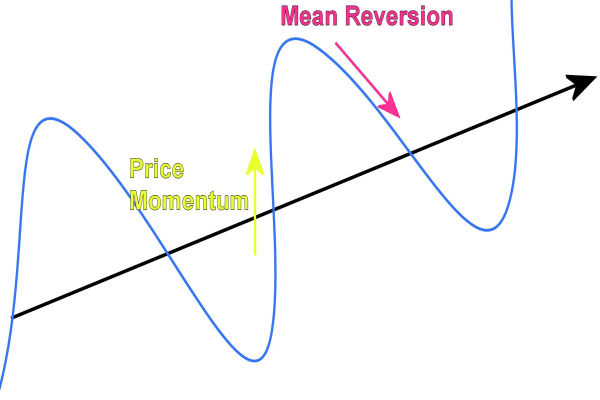

Pattern Recognition and Predictive Analysis: With machine learning, AI can recognize and learn from past trends and current data to forecast price movements, so traders can make timely and informed decisions.

What is AI Trading?

AI trading, also known as algorithmic trading, is changing the financials by using advanced computer algorithms to execute trades. These complex algorithms analysis huge amounts of market data, historical price movements, market trends and economic indicators to identify patterns and make trading decisions. By predicting market trends with great accuracy, AI trading systems allow traders to build robust trading strategies that can adapt to changing market conditions. This not only increases efficiency but also the effectiveness of trading, making it a game changer in the financials.

AI Trading Tools and Technologies

AI trading tools and technologies are reshaping the trading landscape, offering precise market analysis, pattern identification, and automated trade execution. These tools—ranging from machine learning algorithms to natural language processing and big data analytics—work together to provide a powerful, all-in-one trading solution. AI trading platforms use these advanced capabilities to create sophisticated strategies, track market trends, and automate trades. Among the popular tools are trading bots, signal systems, and strategy builders, each designed to analyse market data, identify trends, and execute trades with speed and accuracy. These AI-powered tools empower traders to stay competitive in today’s fast-paced financial markets.

AI Powered Algorithmic Trading Strategies

AI is changing the trading landscape by powering various strategies. Here are some of the popular AI driven strategies that traders are using:

Algorithmic Trading: AI allows for an ai trading system that makes trade based on set rules. These systems or “trading bots” react to market signals in milliseconds, perfect for strategies that require quick actions.

Automated Risk Management: AI systems can automate risk management with stop-loss and take-profit orders, to minimize losses and lock in gains. They can adjust these limits based on real-time data, giving traders more control over their investments.

Sentiment Analysis for Market Insights: AI can scan online content like news and social media to gauge public sentiment on certain currencies or stocks. Traders can spot trends driven by public opinion and act before the market moves.

Scalping with AI: Scalping is a strategy that aims to profit from small price movements, often requires quick execution. AI powered scalping algorithms can make multiple trades in seconds, profit from small price movements without much market risk.

Sentiment

Sentiment analysis is a powerful AI trading tool that scans the vast amount of news articles, social media posts and other information sources to gauge the overall market sentiment. By analyzing the sentiment on individual stocks, sectors or the market as a whole, sentiment analysis gives valuable insights that can be used to predict market trends and make informed trading decisions. This kind of analysis helps traders to understand the market’s mood and anticipate the shift, so they can act fast and smart. By using sentiment analysis, traders can get an edge, make better decisions that’s in line with the market sentiment.

Benefits of AI in Market Data Trading

Speed and Efficiency: AI analysis data in real-time, so traders can act fast on trends. Fast response to market changes can increase profit and reduce risk. AI can also manage market volatility by adapting fast to sudden market moves and black swan events.

No Emotional Bias: Since AI is based on data, it doesn’t have emotional bias—fear or greed—that can cloud human judgment.

24/7 Market Access: AI bots can trade 24/7, so traders can capture opportunities in markets worldwide, even outside regular hours.

Higher Accuracy Over Time: Since AI learns from data, it gets better over time, so traders get more accurate predictions.

Challenges and Risks of AI Trading and Risk Management

Initial Costs: Accessing or developing top-notch AI trading systems can be costly, so it’s more accessible to institutions or experienced traders.

Data Quality Matters: AI models are based on data, so if the input data is bad, the AI’s prediction will be bad. High quality and relevant data is key.

Risk of Over-Reliance: While trading algorithms and automation is useful, relying only on AI can miss out on market nuances. Traders need to stay informed and not follow blindly the AI.

Cybersecurity

In AI trading, cybersecurity is a big risk that can’t be ignored. AI trading systems with complex algorithms and high-speed data network are vulnerable to cyber-attacks that can result in big financial losses. To mitigate these risks, traders must implement robust cybersecurity measures like encryption, firewalls and intrusion detection systems. Also, AI trading systems must be updated and patched regularly to prevent potential vulnerabilities. By prioritizing cybersecurity, traders can secure their AI trading systems and their trading operations.

Over-Reliance on Historical Data

While historical data is a valuable resource in AI trading, over-reliance on it is a common trap. Historical data is useful in predicting market trends but not always a reliable indicator of future performance since market conditions change fast. To avoid this trap, traders should use a combination of technical and fundamental analysis when developing trading strategies. Continuous monitoring of market conditions and adjusting strategies accordingly is key to stay relevant and effective. By balancing historical data with real-time analysis, traders can develop more robust and adaptive trading strategies that can navigate the financial markets better.

The Future of AI in Trading

AI in trading is still in its infancy and future will bring more complexity and accessibility. AI can impact the stock market by analyzing historical data, identifying trends and influencing investor’s strategy in stock trading:

Better Predictive Models: AI algorithms will get even better at forecasting market moves as machine learning improves.

More Tools for Retail Traders: As AI becomes more affordable, retail traders will have access to AI tools that were previously only for institutions.

Integration with Quantum Computing: As quantum computing develops, it will make AI process even more data, more accurate.

Regulatory Changes: As AI becomes bigger in trading, regulators will introduce policies to ensure fair use, transparent and stable markets.

AI is opening up new opportunities in trading, giving traders faster insights, automated risk management and better accuracy. But while AI is a tool, trading successfully requires balance between AI driven strategies and human judgment. With proper management and clear trading strategy, AI can be a powerful asset in the ever changing world of trading, to stay ahead of the game.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.