The GBP/EUR currency pair has been a focal point for traders and economists, reflecting the economic interplay between the United Kingdom and the Eurozone.

As two of the most traded currencies globally, their exchange rate dynamics offer valuable insights for traders. Thus, understanding historical trends between GBP and EUR can help traders anticipate future movements and make informed decisions.

In this article, we will explore the historical trends of the pound to euro exchange rate and examine how these trends influence experts' predictions for this currency pair in 2025 and beyond.

Historical Overview of GBP/EUR Exchange Rates

1. Pre-Euro Era: GBP vs. European Currencies

Before the euro officially launched in 1999, the British Pound (GBP) was compared with individual European currencies such as the Deutsche Mark (DEM), French Franc (FRF), and Italian Lira (ITL). The pound was relatively strong, supported by the UK's independent monetary policy and London's status as a financial hub.

2. 1999–2007: Euro Adoption and Initial Volatility

The euro was introduced in 1999 and began being used for electronic transactions before becoming physical currency in 2002. During this period:

GBP/EUR Average: The Pound traded roughly between 1.40 and 1.60.

The UK decided not to join the eurozone, and the Pound's strength reflected investor confidence in the UK's independent monetary system.

The Euro initially weakened due to scepticism about its long-term viability, benefiting the GBP.

3. 2008–2010: Global Financial Crisis

During the 2008 financial crisis, the GBP weakened sharply, falling from around €1.35 to under €1.10.

The UK's heavy reliance on financial services and housing magnified its exposure to the global downturn.

In contrast, the euro remained relatively stable during the early stages, deemed as a safer currency due to Germany's economic leadership.

4. 2011–2015: Eurozone Debt Crisis

Between 2010 and 2015, the euro was impacted by sovereign debt crises in Greece, Portugal, Spain, and Italy.

Investors feared potential defaults and eurozone fragmentation, which led to a modest GBP recovery to around €1.20–1.40.

The ECB's implementation of aggressive monetary policies, including negative interest rates and bond-buying programs, further weakened the euro.

5. 2016–2020: Brexit Volatility

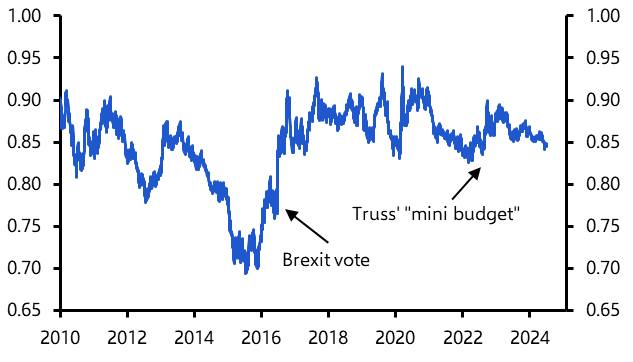

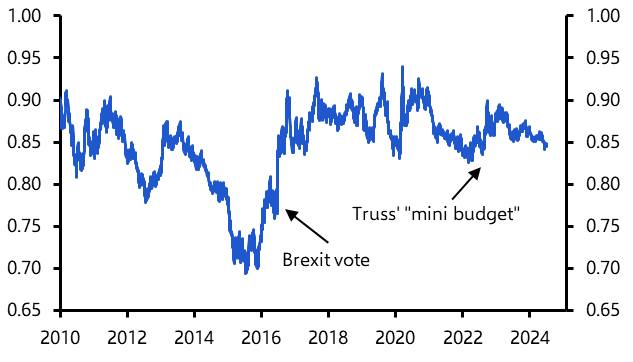

The June 2016 Brexit vote was a turning point:

GBP plunged from €1.30 to below €1.15 within days.

Markets feared economic instability and trade barriers.

From 2016 to 2020, the pair was volatile, fluctuating between €1.06 and €1.18 due to Brexit negotiation headlines and political instability in the UK.

6. 2021–2023: COVID-19 Recovery and Monetary Divergence

The UK economy rebounded faster than many eurozone countries post-pandemic, briefly strengthening the GBP.

By 2022, soaring inflation forced the Bank of England (BoE) to raise interest rates more aggressively than the European Central Bank (ECB).

GBP/EUR touched €1.20 in mid-2022 but retraced on recession fear.

7) 2024: Weakening Euro

ECB interest rate hikes paused in mid-2024, while the BoE held rates longer due to sticky inflation.

Political uncertainty in Europe, especially in Germany and France, weakened the euro.

GBP/EUR ended 2024 around €1.19.

Trading Implications: What Can Traders Learn?

GBP/EUR Characteristics:

Generally stable compared to other pairs (low volatility),

Sensitive to interest rate differentials,

Strongly driven by macro fundamentals like inflation and GDP data.

What to Watch:

BoE and ECB policy meetings and forward guidance,

Inflation readings in the UK vs EU,

Political developments (elections, fiscal policy, EU cohesion),

Energy prices and supply chains, especially in winter.

Strategies for Traders:

Carry Trade: When GBP rates are higher than EUR, traders may go long to earn yield differentials.

Range Trading: The currency pair often fluctuates within narrow ranges, making it ideal for technical trading strategies.

Fundamental Long-Term Play: Monitor macroeconomic divergences for trend opportunities.

Recent Pound to Euro Trends and Data

As of May 2025, the GBP/EUR exchange rate has shown notable movements:

Average Exchange Rate in 2025: Approximately 1.1888 EUR per GBP.

Highest Rate: 1.2120 EUR on February 27, 2025.

Lowest Rate: 1.1518 EUR on April 12, 2025.

These fluctuations reflect ongoing economic adjustments and market responses to policy changes in both the United Kingdom and the Eurozone.

Forecast for GBP/EUR Exchange Rate

1. 2025 Outlook

Key Drivers:

ECB expected to cut rates by 50–75 basis points in H2 2025, which could weaken the euro.

The BoE is likely to pause or begin modest rate cuts.

UK growth is forecast at 1.1%, slightly above the eurozone average of 0.9%.

Risk factors: UK general election and European fiscal tightening.

Analyst Viewpoint:

Predict the GBP will slightly strengthen against the euro in late 2025.

Forecasts consolidation around €1.19, citing balanced risks.

2. 2026 Forecast

What May Happen:

Slowing UK consumer demand may dampen GBP strength.

EU stimulus measures may boost eurozone GDP, leading to a modest recovery in the euro.

Political clarity following the UK elections could stabilise the Pound.

Risks:

Any energy supply disruptions or geopolitical escalations in Europe (e.g., Russia–Ukraine, Middle East) could lead to a weaker euro.

A possible referendum on Scottish independence or trade-related tensions could put pressure on the British pound (GBP).

3. 2027 Forecast

Key Assumptions:

Central bank policies normalise, and interest rate differentials narrow.

Markets may refocus on long-term debt and fiscal risks.

The UK's debt-to-GDP ratio may increase, pressuring the GBP in the long term.

The euro could recover lost ground if economic reform packages, particularly in southern Europe, prove successful.

Expert Projections:

Conclusion

In conclusion, the GBP/EUR exchange rate tells a story of economic evolution, political upheaval, and shifting monetary regimes. Since the euro's launch, through Brexit, Covid, and the resulting inflation, traders have experienced significant events that impacted the pair.

Looking ahead into 2025–2027, most experts expect modest GBP strength in 2025, followed by consolidation or a slight euro recovery through 2027.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.