The best traders hone their skills through practice and strategy, and also engage in self analysis to identify key factors that can benefit them, and learn how to exclude fear and greed from the equation. These are the skills that any forex trader should practice. The two most intuitive points are, firstly, that forex trading can be a combination of multiple products, diversifying investments and enabling risk hedging. Secondly, both beginners and experienced forex traders must bear in mind that practice, investment knowledge, and self-discipline are key to profitability and maintaining leadership. Here are the 9 trading techniques summarized for you in this article.

Setting Goals and Trading Style

Before embarking on any journey, you must have an understanding of your destination and how to get there. Therefore, it is necessary to clarify clear goals and ensure that your trading method can achieve these goals. Each trading style has different risk situations and requires a good mindset and methods to successfully trade.

For example, if you don't like closing positions overnight, you can consider daytime trading. On the contrary, if you prefer to do long-term trading and believe that you are more likely to benefit from trading appreciation within a few months, then you may be more like a position trader. As long as you ensure that your personality is suitable for the trading style you engage in, personality mismatches can lead to stress and certain losses for traders.

Choose Reputable Broker and Trading Platform

Choosing a reputable and reliable broker is the most important, and spending time studying the differences between brokers would be very helpful. You need to understand the strengths and weaknesses of each broker and choose the right one for you. We can follow the following objective standards to assess and evaluate the key factors of brokers, such as financial regulatory agencies, funds, and the reliability of trading platforms.

Additionally, please ensure that your broker's trading platform is suitable for your trading style.

Those active traders who enjoy large and frequent trading always hope to obtain a stable trading platform that never or rarely breaks the line. On the other hand, those passive or conservative traders who do not pay attention to the market all day are concerned about more flexible trading platforms. In terms of trading conditions, ease of use means that the set orders and stop loss orders can be executed in real-time. One click trading, as well as stop loss, Limit Order, and other types of management advantages, are also factors that traders need to consider.

Choose Appropriate Analysis Method

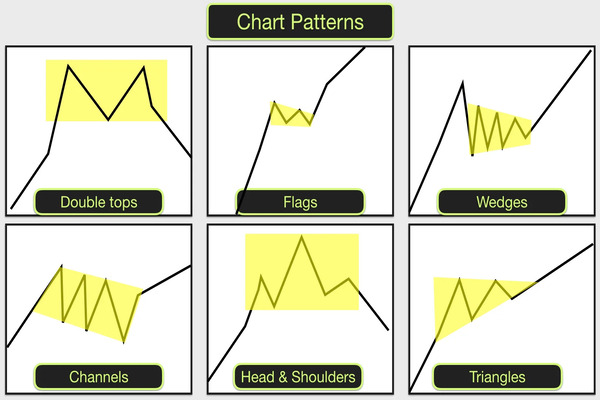

Before you enter any market as a trader, you need to know how to make decisions to execute trades. For example, what type of information are you good at analyzing in order to make a relatively accurate decision on whether to buy or sell. Some traders choose to monitor macroeconomic fundamentals and charts to determine the optimal time to execute trades, while others excel in using technical analysis to assist.

Of course, you can also combine many influencing factors to analyze decisions, and your analysis system should keep up with the constantly changing pace of the market. But regardless of which method you choose, it is best to maintain consistency and ensure that your method is adaptive.

Identify Buying and Selling Points

Many traders are confused by conflicting information when observing charts from different time periods. For example, some products may display buying opportunities on weekly charts, but may display selling signals on daily charts.

Therefore, you need to find the trading direction in the weekly chart and use the daily chart to determine the entry time, making sure to synchronize the two. In other words, if the weekly chart gives you a buy signal, you can wait until the daily chart also confirms that there is a buy signal before selling, keeping the time synchronization between the two.

Calculate Your Expectations

Expectations are the formulas you use to determine how reliable your system is. You should go back and measure whether all your trades are winners or losers, and then determine how much profit there is when you are a winner and how much loss there is when you are a loser.

Take a look at your past ten trades. If you haven't done actual trades yet, you can try simulating trades, tracing back to where you bought and sold in your trading history, and then write down these results.

Although there are some methods to calculate the percentage of profits earned, there is no guarantee that you will be able to earn this amount every day because market conditions may change. Here is an example of calculating expected values.

Expected formula:

Expected value=(winning rate * average profit) - (losing rate * average loss)

Expected example:

If you make 10 trades, of which 6 are winners and 4 are losers, your profit ratio will be 6/10 or 60%

If you make $2400 in six trade, your average profit will be $400 (2400/6)

If your loss is $1200, then your average loss will be $300 (1200/4)

Calculate the relative expected value from this

Expected value: (. 60 * 400 USD) - (. 40 * 300 USD)=120 USD

So on average, a trader's expectation of trading ten times is to earn $120.

Risk Return Rate

Before trading, it is important to determine the level of risk you can tolerate in each trade and how much money you can actually earn. The risk return rate helps traders determine whether they have the opportunity to earn profits in the long term.

Assuming you receive a trading signal that the index may rise by 200 points, in order to successfully complete this trade, you set the stop loss level to be within 150 points. At this point, the risk return ratio can be calculated as 200/150, with an RRR of 1.33. Therefore, in this trade, for every $1 lost, we have the opportunity to receive $1.33.

Once the RRR is determined, you can compare this expected rate of return with the frequency of your trading profits and calculate whether it is worth taking the time to make the trade. Our goal is to strike a balance between RRR and profit loss ratio.

If you lose 9 out of 10 trade, it is obvious that a RRR of 1.33 is not enough. The result of doing so is likely to be a loss of $9 and a profit of only $1.33, which is not worth the loss.

Set A Stop Loss

Risk can be mitigated through stop loss orders, which exit positions at specific exchange rates. Stop loss orders are an important risk management tool as they can help traders set risk limits for each trade and prevent significant losses.

Using the above example, imagine that traders have a very large stop loss order for each trade, which means they are willing to risk losing $1200 per trade, but can still earn $600 per winning trade. One loss may turn two successful trade into nothing. If the trader experiences a series of losses due to being hindered by unfavorable market trends, then a much higher and unrealistic profit ratio is needed to compensate for the losses.

Although it is important to have a percentage based winning trading strategy, managing risks and potential losses is also crucial so that your account is not completely depleted.

Stable Mindset

Once you inject funds into your account, your funds are in danger in the market. To put it another way of thinking, this money itself is funds other than living expenses, equivalent to a vacation payment, charity payment, or other money available for your leisure. Once the vacation is over, your money will be spent. You should have the same attitude towards trading, and psychologically, you can accept small losses, which is also the key to risk management. By focusing on your trading and accepting harmless losses, rather than constantly struggling with a particular point, frequently manipulating or repeatedly calculating the net value of each order, it may be easier to make a profit.

Review Trading Records

Rethinking records is a great way to learn. You can print out a chart and list all the factors that affect the trade, including the fundamentals that affect your decision. Mark your entry and exit points on the chart. You can analyze any relevant factors, including subjective emotional reasons. Is it because of your panic mentality? Are you too greedy? Are you full of anxiety? Only when you can objectify your trading will you summarize the rules, rather than using subconscious habits or emotions to influence your execution direction.

If you can master the above 9 trading skills, when you act according to the plan and execute well, a positive positive feedback mode will be formed. Sometimes you may also bear some losses, but don't rush, trade according to the plan and rhythm, and you will be grateful for your continuous exploration and improvement.

Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.