Gold remains a cornerstone of many trading and investment portfolios, but how you access gold's price movements can make a significant difference to your strategy and results. Three popular ways to gain exposure to gold are Contracts for Difference (CFDs), gold futures, and gold exchange-traded funds (ETFs).

Each offers unique benefits, risks, and trading mechanics. Here's how gold CFDs compare to gold futures and ETFs—so you can choose the right approach for your goals.

Gold CFDs: Flexible and Accessible Trading

Gold CFDs are derivatives that allow you to speculate on gold price movements without owning the physical metal. When you trade a gold CFD, you enter a contract to exchange the difference in gold's price from the time you open to when you close the trade. CFDs are typically traded over-the-counter (OTC) via online brokers.

Key features:

No physical delivery: Trades are cash-settled, with no actual gold changing hands.

No expiry: Unlike futures, gold CFDs do not have a set expiration date—you can hold your position as long as you meet margin requirements.

Leverage: CFDs often offer higher leverage than futures or ETFs, with some brokers providing up to 1:500, amplifying both potential gains and losses.

Long and short: You can profit from both rising and falling gold prices, making CFDs attractive for active traders.

No storage or security risk: Since you don't own physical gold, there are no concerns about storage or insurance.

Risks:

The main risk with gold CFDs is leverage. While it allows you to control large positions with a small deposit, it also increases the risk of significant losses. Overnight financing fees (swap rates) may apply if you hold positions beyond a trading day.

Gold Futures: High Leverage and Standardisation

Gold futures are standardised contracts traded on regulated exchanges. They obligate the buyer to purchase, and the seller to deliver, a specific amount of gold at a set price on a future date.

Key features:

Standardised contracts: Each contract represents a fixed quantity of gold (e.g., 100 ounces for standard contracts, 10 ounces for micro contracts).

Leverage: Futures require an initial margin deposit, often around 5% of the contract value, enabling control of large positions with less capital.

Expiry dates: Futures have set expiration dates, requiring settlement or rollover to maintain exposure.

Physical delivery option: While most traders close positions before expiry, futures can result in physical delivery of gold.

Exchange-traded: Futures are traded on highly regulated venues, ensuring transparency and liquidity.

Risks:

Futures are high-risk due to leverage and potential for margin calls. If the market moves against you, you may need to deposit additional funds to maintain your position or risk liquidation. Futures contracts also require active management around expiry dates.

Gold ETFs: Simplicity and Liquidity

Gold ETFs are funds traded on stock exchanges that aim to track the price of gold. When you buy shares in a gold ETF, you gain exposure to gold’s price without owning the metal directly.

Key features:

No leverage (by default): ETFs are typically bought and sold like stocks, without leverage unless you use margin in your brokerage account.

High liquidity: ETFs can be traded throughout market hours with tight bid-ask spreads.

No expiry: You can hold ETF shares as long as you like, making them suitable for long-term investors.

Management fees: ETFs charge annual expense ratios, usually 0.25%–0.40%, which can erode returns over time.

No physical delivery: Investors do not take possession of gold; the ETF provider manages the underlying holdings.

Risks:

While ETFs are convenient and liquid, they are subject to tracking errors (where the ETF price diverges from gold's spot price), fund management fees, and, in rare cases, fund closure risk.

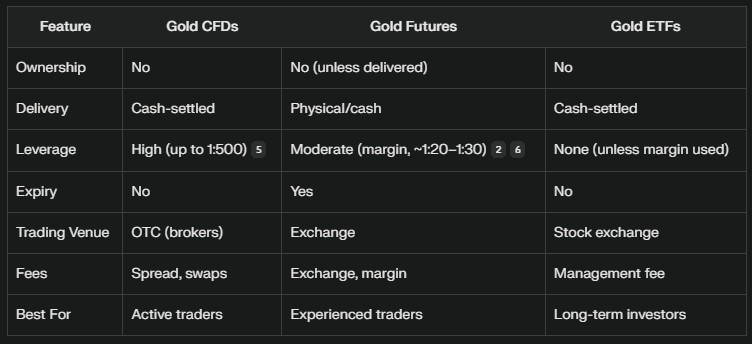

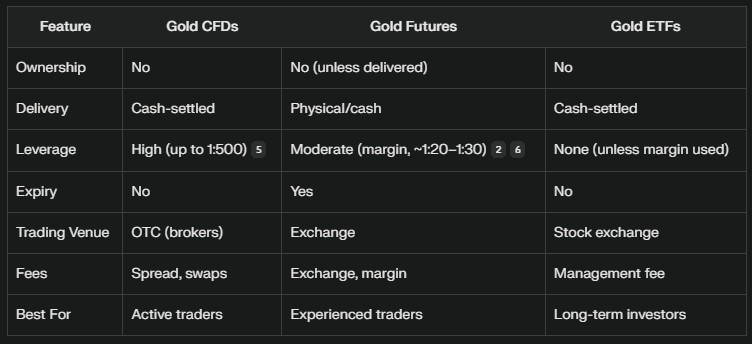

Comparing Gold CFDs, Futures, and ETFs

Choosing the Right Gold Instrument

Gold CFDs are ideal for traders seeking flexibility, high leverage, and the ability to profit from both up and down moves in gold prices. They suit those comfortable with short-term trading and managing leverage risk.

Gold futures appeal to experienced traders who want direct access to regulated exchanges, high leverage, and standardised contracts. Futures require active management and a clear understanding of margin requirements.

Gold ETFs are best for investors seeking a simple, cost-effective way to track gold's price over the long term, with the convenience of trading like a stock and without the complexity of leverage or contract expiry.

Final Thoughts

Understanding the differences between gold CFDs, futures, and ETFs is essential for building a gold trading or investment strategy that matches your goals and risk tolerance.

Whether you're an active trader or a long-term investor, weigh the benefits and risks of each instrument to make the most of gold's enduring appeal.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.