Institutional investors are growing increasingly worried about the outlook

for European stock markets as earnings reports for the second quarter largely

disappointed, according to the Bank of America’s monthly survey.

While 44%of European companies exceeded expectations for the last quarter,

misses were reported by 30%companies, according Morgan Stanley. EPS for listed

European companies in aggregate are expected to decline 1.8 % this year.

A net 71% of global fund managers expect stock markets in Europe to weaken in

the coming months, up from 66 per cent in July, and a net 29% consider stocks in

the region overvalued – the highest in three years.

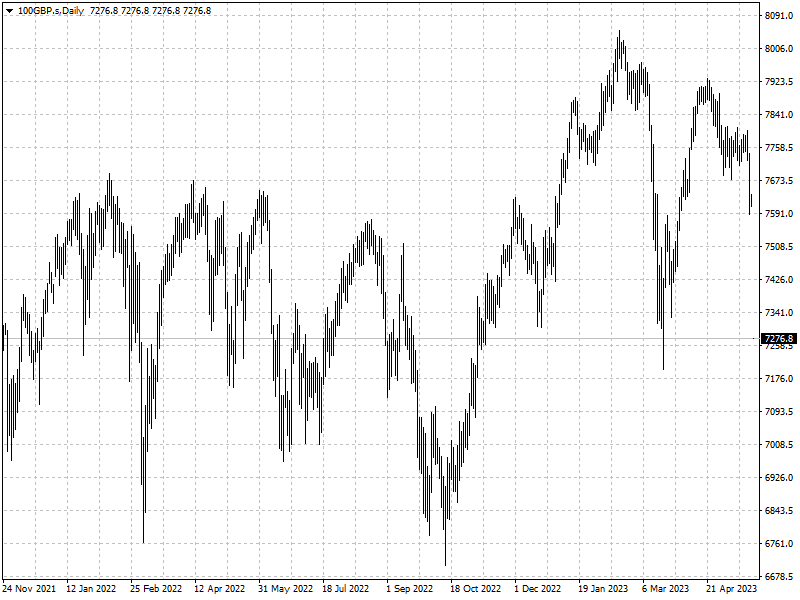

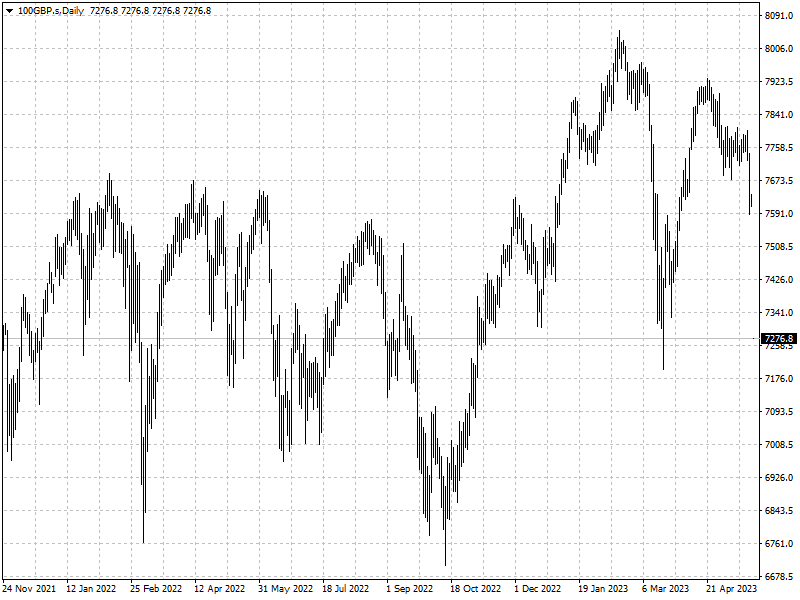

The STOXX Europe 50 has up nearly 10% year to date but saw a significant

pullback this month amid fears that the Chinese economy falters and US interest

rates will stay higher for longer.

Recent moves by China to support the economy did help boost some markets but

confidence receded in the last several days following the report that China’s

new home prices fell for the first time this year in July.

Notably, the UK stock market has started to attract more attention from fund

managers after the FTSE 100 has underperformed other major markets so far in

2023.

A net 24% of managers were overweight early this month, a sharp reversal from

July when the net underweight stood at -8%.

Disclaimer: Investment involves risk. The content of this article is not an

investment advice and does not constitute any offer or solicitation to offer or

recommendation of any investment product.