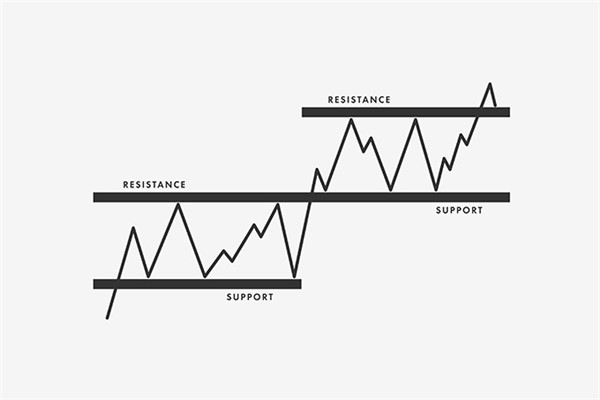

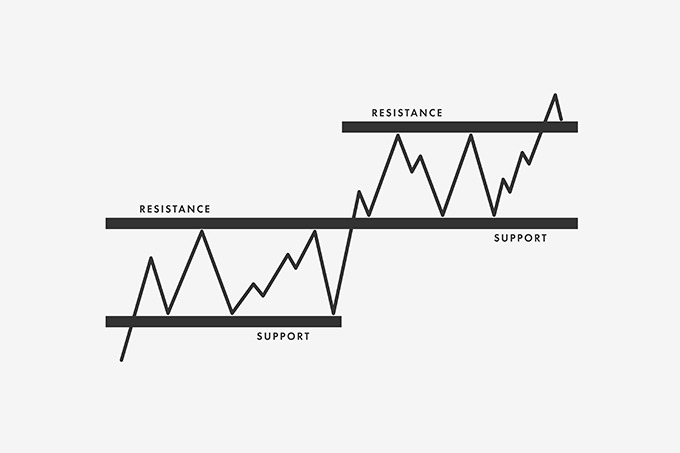

The formation of resistance and support levels is driven by the

supply-and-demand relationship in the market and the behavior of traders.

The principle of generating pressure and supporting positions:

The actual impact of pressure and support is influenced by the relationship

between supply and demand. During the upward trend, the supply from selling

exceeds the demand from buying, which affects the continued upward trend of

Stock Prices and creates pressure. In the process of decline, on the contrary,

it is the demand for buying that is stronger than the demand for selling, which

creates an upward driving force for the stock price.

When the stock price rises, if it encounters a pressure level, it is easy to

be suppressed. At this time, if we pursue a high, it is easy to replace the

previous batch of hold-up stocks and form new hold-up stocks.

When the stock price falls, if it encounters a support level, the stock price

is expected to rise. At this time, the graphics we see are often not very

attractive, and our hearts are also very panicked. We often sell our stocks as

soon as possible, but then we will find that the stock price has risen, and we

will regret it later.

To avoid the above situations, we need to know how to determine support and

pressure levels. Below, we will analyze the reasons for the formation of

pressure and support levels separately.

Reason for support: Due to a large number of transactions and trades in a

certain price range in the previous stage, this position has become the cost

level for many investors to hold positions. Therefore, when the rise of the

stock price turns into a downward decline, near this position, the chips of

profit bearers are basically cleared, and there is no chip in their hands to

sell and suppress the stock price, and supply gradually decreases. Bulls can

precisely engage in bargain hunting at this position, forming a large amount of

demand. Affected by supply exceeding demand, the stock price naturally rebounded

upwards, forming support. If the market turns back at this position multiple

times, it not only confirms the effectiveness of support but also enhances the

confidence of bulls at this position to take a bottom.

The principle of pressure: Due to the influence of short-term profit taking

or the pressure of being eager to unwind in the early stage, when the stock

price rises to a certain price range, a large amount of selling pressure is

generated. As selling is significantly greater than buying, the fact that supply

exceeds demand is formed, causing the stock price to be pressured and fall. If

there are multiple times of pressure drops near this position, without the

release of good news, this position will form an effective pressure level, and

every time there is a large number of bulls turning short and joining the

selling camp near this position.

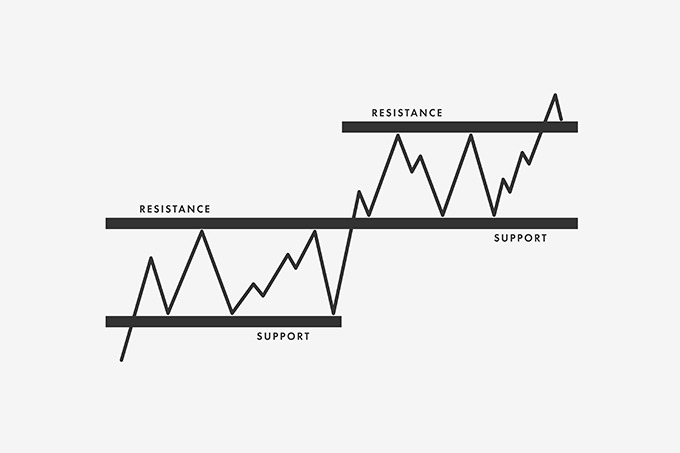

In addition to supply and demand, psychological factors in the market can

also have an impact on the formation of resistance and support levels. When

prices approach an important historical level, traders may have memories of this

because they believe that this level may have an impact on prices. This

psychological memory can increase the reliability of resistance and support

levels and affect traders' decision-making.

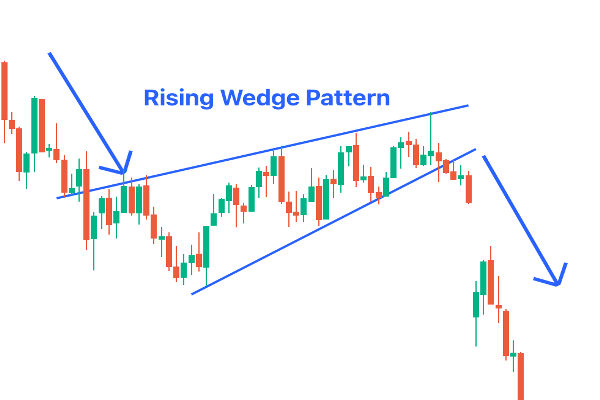

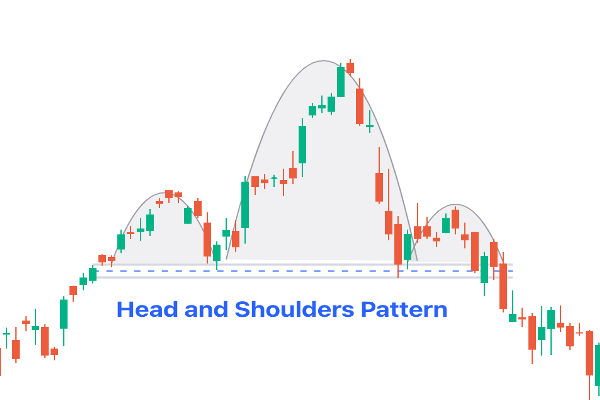

Another important factor is the use of technical analysis tools. Traders use

various technical indicators and Chart Patterns to determine resistance and

support levels. When many traders use the same technical tools, they establish

resistance and support levels at similar levels, further increasing their

reliability.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.