Foreign exchange trading, also known as Forex trading (FX trading), refers to

the buying and selling of different currencies in the international foreign

exchange market. It is the act of exchanging one currency for another currency,

so foreign exchange trading always occurs in the form of currency pairs (you

cannot exchange 10 yuan for 10 yuan). Foreign exchange trading is also known as

Forex, or FX in English. When we travel abroad and exchange RMB for some foreign

currencies, we actually complete a foreign exchange transaction. Foreign

exchange trading is one of the largest and most active financial markets in the

world, with daily trading volumes reaching trillions of dollars.

Participants in foreign exchange transactions include various financial

institutions (such as banks, Securities companies, and insurance companies),

central banks, large multinational corporations, investment institutions, and

individual investors. Trading is usually conducted on a 24-hour global scale, as

different countries have different time zones, so the market can trade almost

24/7.

The main purpose of forex trading is to profit from fluctuations

in currency exchange rates by buying low-priced currencies and selling

high-priced currencies. Trading currency pairs typically appear in a combination

of major currencies (such as the US dollar, euro, pound sterling, and Japanese

yen) and other secondary currencies (such as the Canadian dollar, Australian

dollar, and Swiss franc).

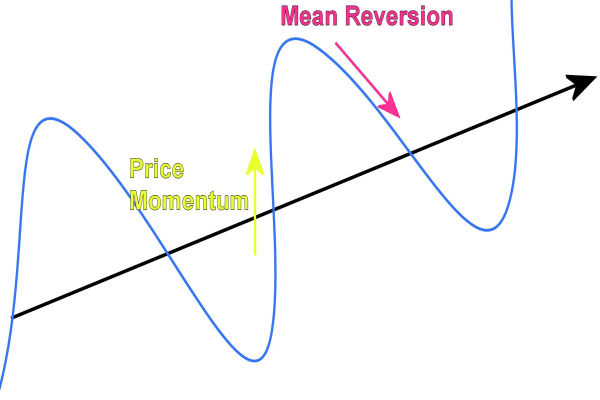

The basic principle of forex trading is to use fluctuations in

exchange rates to obtain profits. The exchange rate is the exchange rate between

two currencies, which is influenced by various factors, such as economic data,

political events, changes in interest rates, etc. Traders analyze these factors,

predict the trend of exchange rates, and make buying and selling operations

based on their own judgment.

The characteristics of the forex market include high liquidity,

large trading volume, high openness, leveraged trading, and extremely sensitive

market changes. The volatility of the forex market is high, and

prices are influenced by many factors, such as economic data, political events,

interest rate decisions, trade policies, etc.

There are many ways of trading forex, the most common of which are

spot trading and futures trading. Spot trading refers to trading in actual

currency, with a delivery time generally of two working days. Futures trading is

conducted in the form of contracts, with delivery time at a future date.

When conducting forex trading, traders can use various forex tools and

strategies, such as technical analysis, basic analysis, chart patterns,

indicators, etc., to predict market trends and make trading decisions. Traders

can trade through the trading platform provided by foreign exchange brokers,

which provides trading tools, real-time quotes, charts, and analysis tools.

Although forex trading has high profit potential, there are also

risks involved. Market volatility and leveraged trading may lead to trading

losses; therefore, risk management is crucial while trading.

Before conducting forex trading, traders should have sufficient

knowledge, skills, and experience and take appropriate risk control measures,

such as setting stop-loss points and target points. Success in trading relies

more on correct trading concepts and concise trading techniques, coupled with

decisive execution, dormant patience, and a healthy mindset.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.