Due to the intense fluctuations in the forex market, traders

often encounter situations where they are unable to enter in time during trading. At this point, instead of just watching the trading point

miss, it's better to try using the order listing operation to enter.

Forex order trading refers to traders issuing trading

instructions to the computer during the process of forex speculation,

including setting the trading currency, determining the trading target point and

investment amount, and setting the stop-loss point. When the market price

reaches the trader's designated point, the computer automatically executes the

entry instruction and completes the trading plan. According to the actual

situation of the forex trading market, listed transactions have a

timeliness, which is usually one week based on the time provided by forex traders. Of course, before the transaction is completed, investors can

voluntarily revoke the order listing. Once a listed transaction is completed,

the amount in the trader's listed order will be immediately frozen, and this

amount cannot be used for other transactions until the transaction is

completed.

It can be said that the use of hanging orders in forex investment

is a way for investors to make correct judgments about the market and hope for

better trading. It should be noted that in the midst of significant fluctuations

in the market, in many cases, traders may not be able to enter the market at a

better point through manual operations. However, by using order placement, when

the market price reaches the trader's designated point, the system will

replace the trader in position-building operations, thus avoiding the

disadvantage of slow manual speed. Moreover, using forex-listed

trading not only gives traders an advantage in the speed and location of

position building but also facilitates them from constantly keeping an eye on

the market, ensuring that traders have a good chance of losing profits when

making correct judgments.

The order function provides traders with more flexible

trading methods. Traders do not need to keep an eye on the market at all times

but can automatically participate in market trading by setting up orders at

specific price points based on their trading plans and expectations. This brings

convenience and flexibility to traders, especially in the 24-hour trading

situation in the forex market.

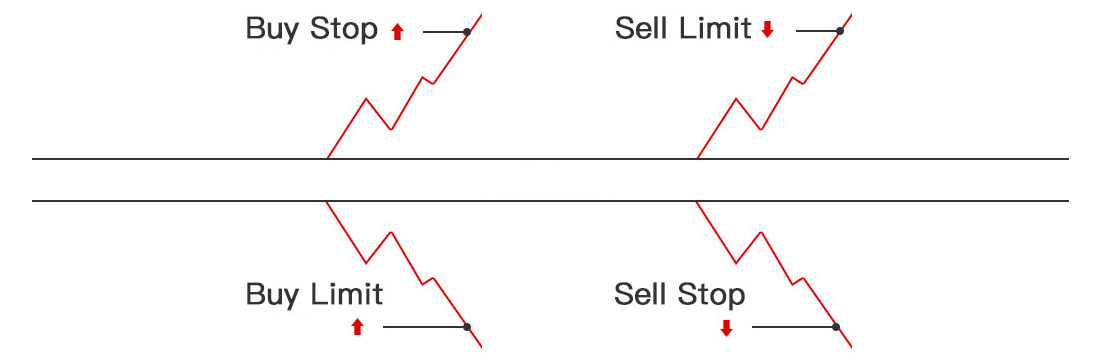

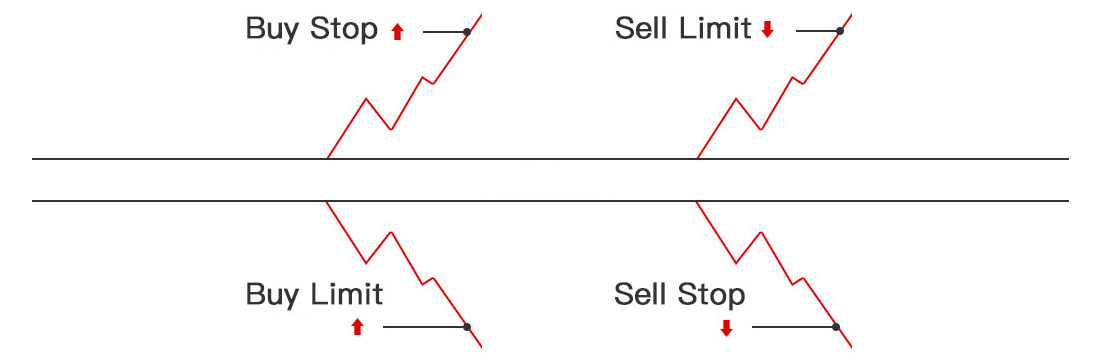

There are Several Types of Forex-Listed Trading:

Buy stop: To buy a stop loss, place a buy order above the current price,

break through, and chase up; that is, place an order above the current price and

chase up.

Sell stop: Sell a stop loss and place a sell order below the current price to

break through short selling, i.e., place an order below the current price to

pursue short selling.

Buy limit: To buy at a limited price, place a buy order below the current

price, buy long on dips, or place an order below the current price to buy

up.

Sell limit: sell at a limited price, place a sell order above the current

price, and sell short at high prices.

The volatility and liquidity of the forex market may lead to

orders not being triggered at expected prices. Therefore, when setting up a

hanging order, traders need to set prices reasonably and consider market risks

and uncertainties. In addition, hanging orders is not a risk-free trading

method, and traders still need to pay attention to market dynamics and adjust

and manage hanging orders in a timely manner.

Disclaimer: Investment involves risk. The content of this article is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.