The iShares MSCI Mexico ETF (EWW) offers traders a direct route to Mexico's dynamic equity market. As economic and political conditions shift in 2025, understanding the evolving trends that impact EWW ETF is essential for traders seeking opportunity and managing risk.

This article examines the most important market trends shaping EWW ETF in 2025, providing traders with actionable insights for navigating this unique market.

What is EWW ETF?

For traders interested in Latin America, the iShares MSCI Mexico ETF (EWW) stands out as a primary vehicle for tracking Mexico's equity market. With the country's economic outlook constantly changing and global factors influencing capital flows, EWW's price action reflects both domestic developments and international sentiment.

Mexico's Economic Outlook: Slower Growth, Rising Uncertainty

Mexico's economy is forecast to grow between 1.5% and 2.3% in 2025, according to government estimates—a downward revision from earlier, more optimistic projections. The adjustment comes amid concerns over declining private investment, ongoing supply chain disruptions, and persistent business hesitancy due to uncertainties in U.S. trade policy. The independent Bank of Mexico and private sector analysts have issued even more conservative forecasts, with some predicting growth as low as 0.5%.

For traders, these macroeconomic headwinds mean that EWW ETF may face periods of increased volatility. A slowing economy can weigh on corporate earnings and investor sentiment, but it can also create short-term trading opportunities as the market reacts to new data and policy announcements.

Technical Analysis: EWW ETF Signals and Price Action

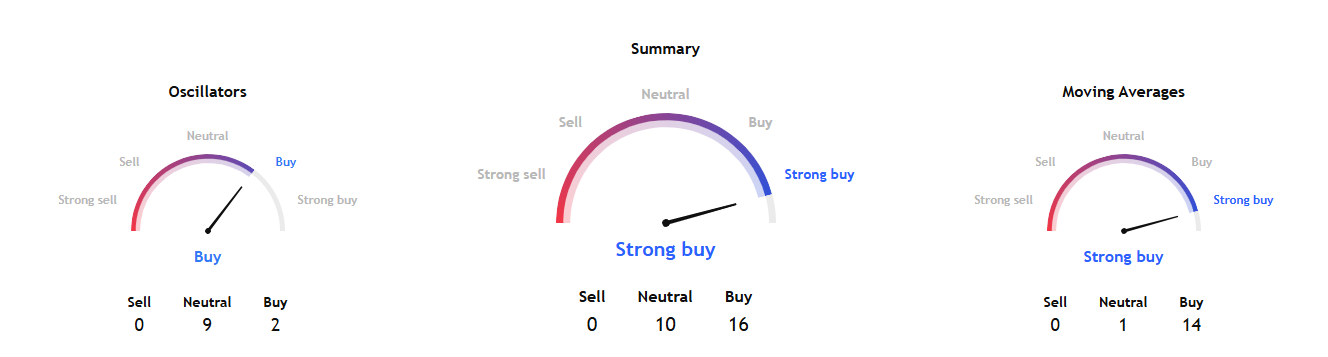

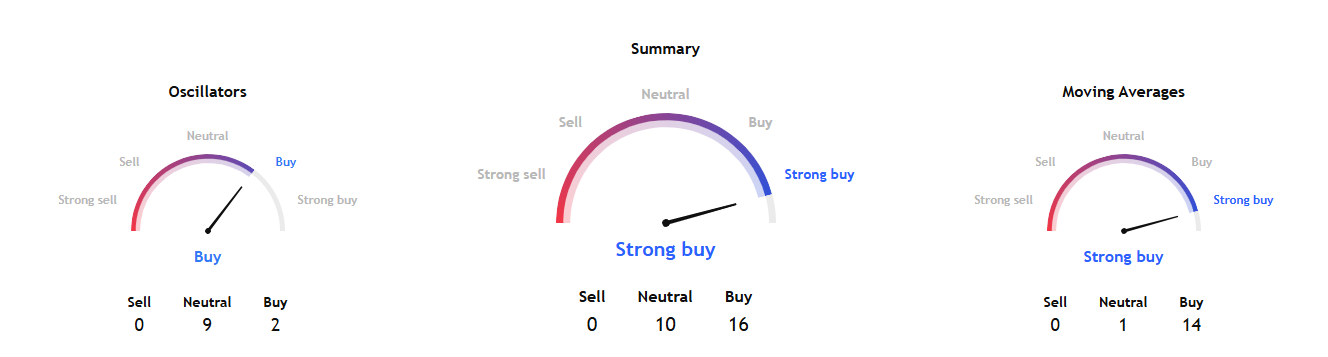

Technical indicators for EWW ETF as of mid-2025 suggest a cautious approach. The majority of moving averages—including the 5-day, 20-day, 50-day, 100-day, and 200-day—are signalling 'Buy', reflecting recent upward momentum.

However, technical summaries also highlight key support and resistance levels that traders should monitor closely. Support is identified near $53.42, while resistance stands at $55.11. Swing trading plans suggest buying EWW slightly over $60.64 with an upside target of $61.92, using $60.46 as a stop loss. Conversely, a short position near $60.64 targets $57.25, with a stop loss at $60.82. These levels provide traders with clear entry and exit points based on price action.

Day traders may find opportunities in the ETF's recent volatility, with intraday buy signals triggered just above $60.34 and short signals near the same level, depending on the direction of the breakout. As always, tight stop losses are recommended to manage risk in a fluctuating market.

EWW ETF Performance and Volatility

EWW has experienced significant volatility over the past year, underperforming the broader market with a return of -23.5% while the SPY ETF remained flat. However, recent months have seen a modest recovery, with EWW returning +8.3% over the last three months, outpacing the broader market's decline. This rebound suggests that traders are beginning to price in stabilisation, but caution remains warranted given the macroeconomic backdrop.

The ETF's beta is 0.74, indicating it is less sensitive to overall market movements, which can be advantageous for traders seeking diversification. EWW's market capitalisation is $1.47 billion, and its daily trading volume remains robust, supporting efficient trade execution.

Key Sectors and Holdings

EWW's portfolio is heavily weighted towards Mexico's financials, consumer staples, and materials sectors, with major holdings in companies such as America Movil, Grupo Financiero Banorte, and Walmart de Mexico. The performance of these sectors is closely tied to domestic consumption, credit growth, and commodity prices.

In 2025, traders should watch for developments in Mexico's banking sector, as well as trends in consumer spending and manufacturing. Any shifts in government policy, monetary tightening or loosening by the Bank of Mexico, or changes in commodity prices can have a direct impact on EWW's underlying holdings.

Macro Risks and Opportunities

Beyond domestic factors, EWW ETF is sensitive to external risks, particularly U.S. trade policy and the strength of the U.S. dollar. Uncertainty around tariffs and cross-border supply chains has weighed on business confidence and investment. Additionally, the Mexican peso is expected to depreciate gradually in 2025, influenced by capital flight and the relative attractiveness of the U.S. dollar. Currency fluctuations can amplify gains or losses for dollar-based EWW investors.

On the opportunity side, any resolution of trade disputes or improvement in U.S.-Mexico relations could provide a catalyst for renewed investment and a rebound in Mexican equities. Traders should also monitor global risk sentiment, as emerging market ETFs like EWW often benefit from increased risk appetite among international investors.

Long-Term Outlook and Price Forecasts

Looking ahead, long-term forecasts for EWW ETF remain cautiously optimistic. Analysts expect EWW to reach an average price of $59.47 in 2025, with a high prediction of $70.90 and a low estimate of $48.05.

By 2030, the average price target rises to $82.37, representing a potential 35.84% increase from current levels. These projections highlight both the upside potential and the risks inherent in trading emerging market ETFs.

Trading Strategies for EWW ETF in 2025

Given the current environment, traders may consider the following strategies:

Swing Trading: Capitalise on price swings between established support and resistance levels, using technical indicators and stop losses to manage risk.

Trend Following: Monitor moving averages and momentum indicators for confirmation of trend reversals or continuations.

Event-Driven Trading: React to economic data releases, central bank decisions, and political developments that could impact Mexican equities or the peso.

Hedging: Use EWW as part of a broader portfolio to hedge exposure to Latin America or emerging markets.

Conclusion

The iShares MSCI Mexico ETF (EWW) offers traders a window into one of Latin America's most important markets. In 2025, the interplay of domestic economic challenges, shifting U.S. policy, and global risk sentiment will shape EWW's performance.

By tracking key technical levels, sector trends, and macroeconomic developments, traders can position themselves to seize opportunities and manage risks in Mexico's evolving market landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.