When it comes to building a solid investment portfolio, index funds and ETFs are two of the most popular choices available today. On the surface, they might seem quite similar—both are designed to track the performance of a market index, they're generally low-cost, and they offer diversification in a single product. But dig a little deeper and you'll find some notable differences that can influence which one is a better fit for your goals.

What Are Index Funds and ETFs?

An index fund is a type of mutual fund that aims to replicate the performance of a particular market index, such as the FTSE 100 or the S&P 500. Rather than trying to beat the market, it tries to match it, making it a popular choice for passive traders.

An ETF, or exchange-traded fund, works in a similar way—it also aims to mirror the performance of an index. However, the key difference is that ETFs are traded on stock exchanges, just like individual shares. That means you can buy and sell them throughout the trading day, and their prices fluctuate just like any other listed asset.

So while both are passive investment vehicles that track an index, one is more traditional (index funds), and the other blends the traits of a fund with the trading flexibility of a stock (ETFs).

How They Operate

This is where things get interesting. With an index fund, you usually buy units directly from the fund provider at the end of the trading day. The price you pay is based on the fund's net asset value (NAV), calculated after the market closes.

ETFs, on the other hand, are traded on exchanges during market hours. Their prices change throughout the day depending on supply and demand. You can use limit orders, set stop losses, and even buy on margin—features that are common with shares but not with mutual funds.

In practice, this means ETFs give you more control over your entry and exit points, while index funds are more set-and-forget, ideal for those who prefer a hands-off approach.

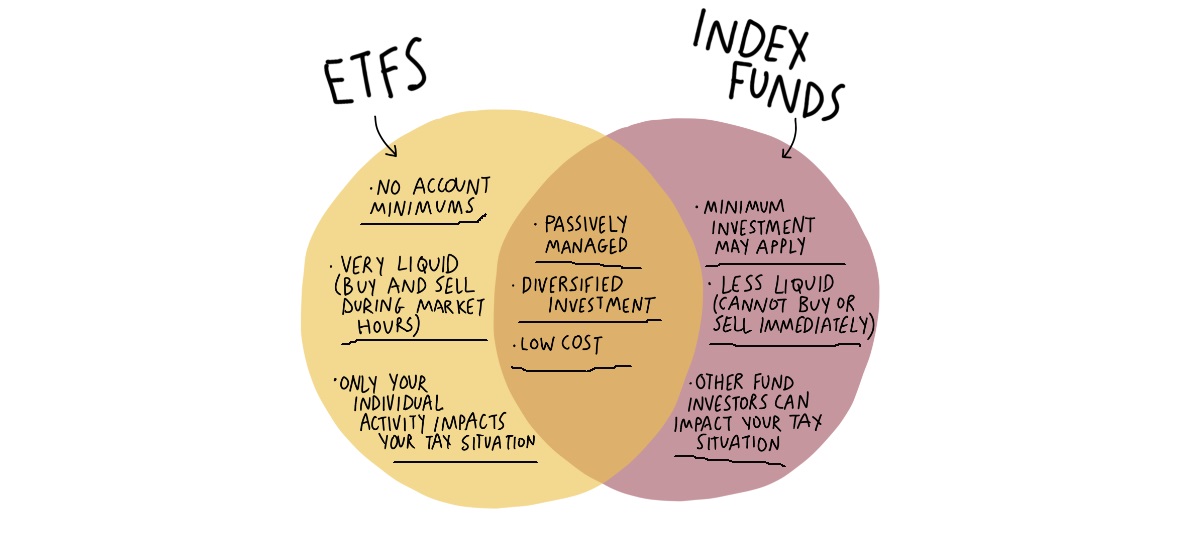

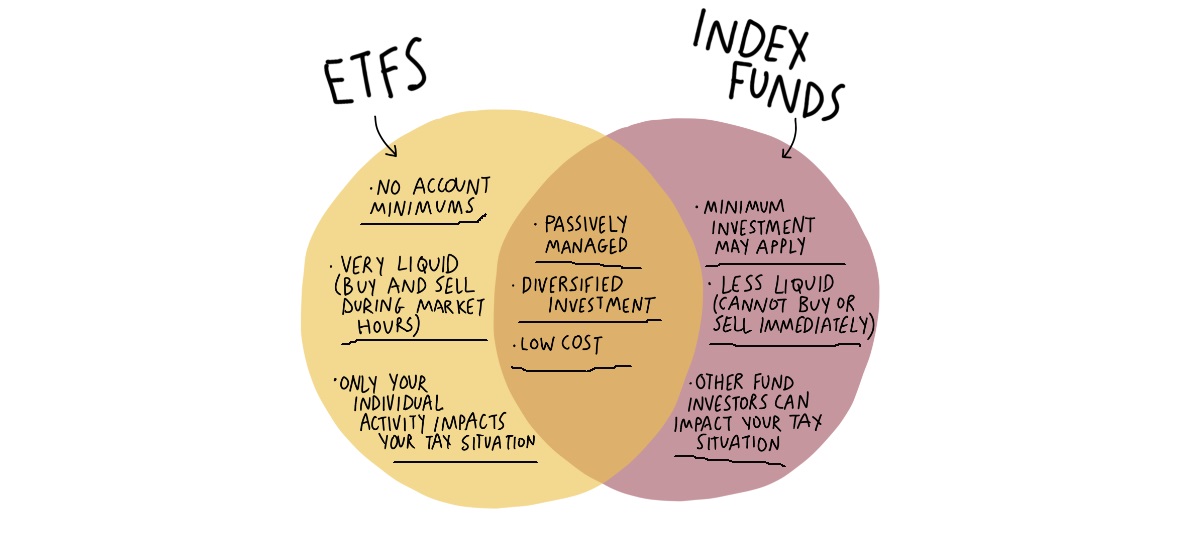

Liquidity and Trading Flexibility

If you want flexibility, ETFs come out on top. Because they're traded like stocks, you can buy or sell them whenever the market is open. That's particularly useful if you're trying to respond to market changes quickly or make tactical shifts in your portfolio.

Index funds, by contrast, don't offer the same liquidity. You place your order during the day, but the transaction is executed at the fund's closing NAV. This might not matter if you're investing for the long term, but it can be frustrating if you want faster access to your money or want to lock in a price right away.

Also worth noting: ETFs may offer tighter spreads and more price transparency during trading hours, which is a plus for more active traders.

Cost Structures

Both index funds and ETFs are known for being cost-effective compared to actively managed funds. That's because they don't require a team of analysts or managers trying to beat the market—they simply follow it.

However, ETFs generally have a slight edge when it comes to ongoing fees. Their expense ratios tend to be lower, partly due to more competitive pricing and efficient structures. That said, ETFs may come with transaction costs, like brokerage fees or spreads, especially if you're trading frequently.

Index funds, by comparison, often don't require a trading account and can be set up directly with the provider—sometimes with no dealing costs at all. So while the annual fees might be a bit higher, you may save on upfront charges, particularly if you're investing regularly through an automatic plan.

Tax Implications

Tax can be a bit of a hidden detail in the index fund vs ETF conversation, but it's important. In many regions, including the UK, capital gains tax and dividend tax rules apply to both. But the structure of ETFs may make them slightly more tax-efficient, especially in markets like the US, where in-kind redemptions help minimise taxable events within the fund.

In the UK, though, the tax efficiency gap is narrower. Both ETFs and index funds are subject to the same tax treatment unless held in a tax-efficient wrapper like an ISA or SIPP. If you're investing within those accounts, the tax issue becomes largely irrelevant—but if you're not, it's worth checking how your provider handles capital gains and distributions.

Final Thoughts

Ultimately, choosing between an index fund and an ETF depends on your priorities. If you want simplicity, automatic investment plans, and don't mind waiting until the end of the day for trades, an index fund could suit you better. But if you prefer flexibility, lower ongoing fees, and real-time trading, an ETF might be the way to go.

Both are strong tools for building long-term wealth, especially for beginners. The good news? You don't necessarily have to pick one over the other—many traders use both to balance their strategies and meet different financial goals. What matters most is understanding how they work and how they fit into your broader investment plan.

Index Funds vs ETFs

| Aspect |

Index Funds |

ETFs |

| Trading |

Once daily at NAV |

Throughout the day |

| Minimum Investment |

Often required |

Usually lower |

| Fees |

Low |

Often lower, may include commissions |

| Liquidity |

Less liquid |

Highly liquid |

| Pricing |

Fixed at day's end |

Fluctuates like shares |

| Auto Investing |

Commonly available |

Rare |

| Tax Efficiency |

Less efficient |

More efficient |

| Access |

Via fund providers |

Via brokerage |

| Best For |

Long-term, passive investing |

Flexible, active management |

| Structure |

Mutual fund |

Exchange-traded fund |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.