Exchange-traded funds (ETFs) have become one of the most popular investment vehicles in global markets. They offer a unique blend of flexibility, diversification, and cost-effectiveness, making them attractive to both new and experienced investors.

But what exactly is the meaning of ETF, and how do exchange-traded funds work? This guide breaks down the essentials so you can understand how ETFs might fit into your investment strategy.

ETF Meaning Explained

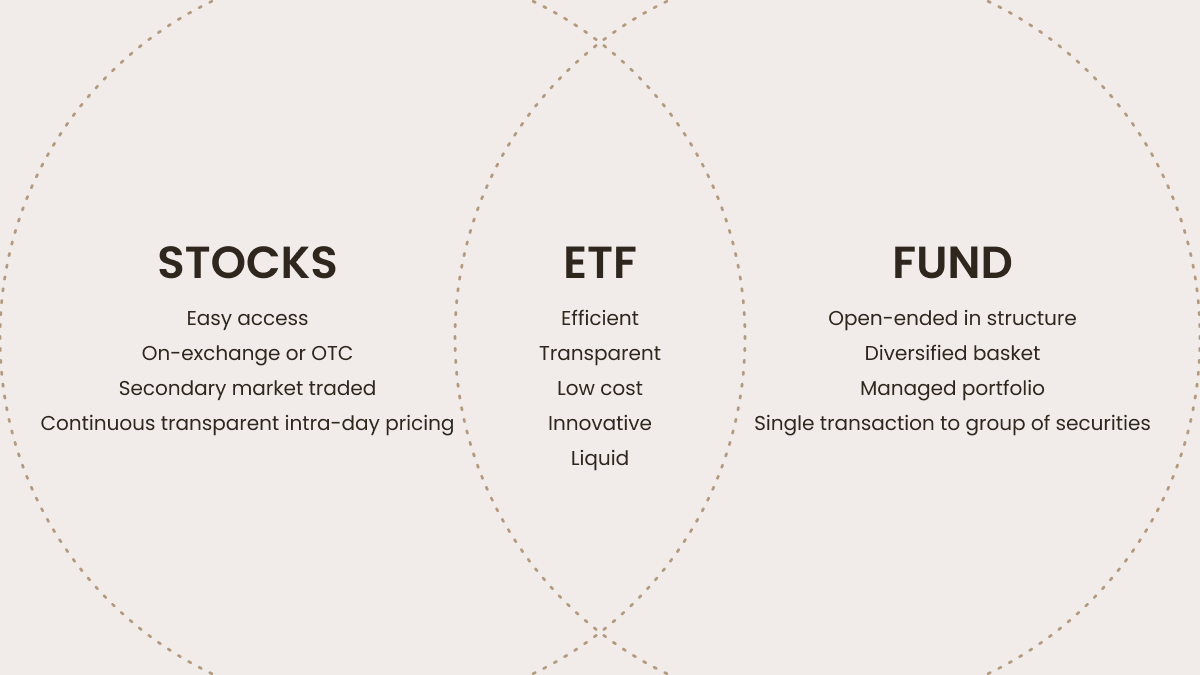

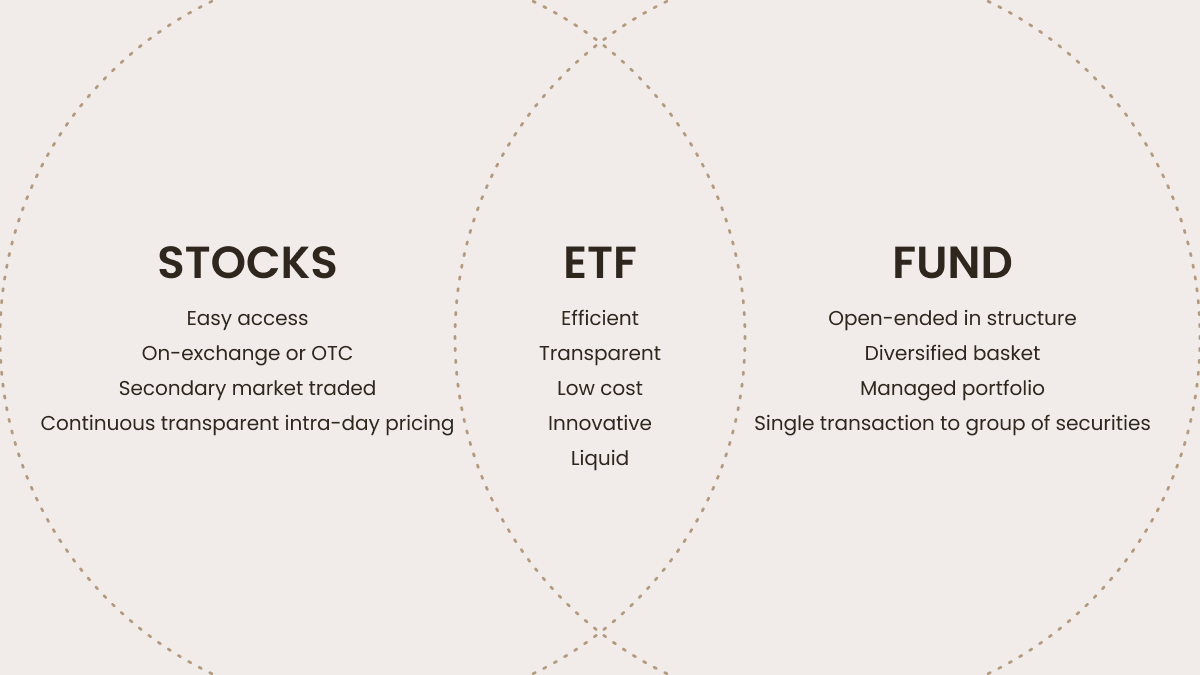

ETF stands for exchange-traded fund. An ETF is an investment fund that holds a collection of assets—such as stocks, bonds, or commodities—and is traded on a stock exchange, much like an individual share. The main idea behind an ETF is to give investors exposure to a broad range of securities or a specific market sector through a single, easily traded product.

Unlike mutual funds, which are only priced once at the end of the trading day, ETFs can be bought and sold throughout the trading day at market prices that fluctuate just like stocks.

How Do ETFs Work?

An ETF provider creates a fund that tracks the performance of a specific index, sector, or asset class. The provider purchases the underlying assets and bundles them into a fund. Investors then buy shares of the ETF, which represent a proportional ownership of the fund's holdings.

Trading: ETF shares are listed on stock exchanges and can be bought or sold at any time during market hours, allowing investors to react quickly to market movements.

Pricing: The price of an ETF share fluctuates throughout the day based on supply and demand, as well as the value of the underlying assets.

Creation and Redemption: Large institutional investors, known as authorised participants, can create or redeem ETF shares in large blocks (creation units) to keep the ETF's price closely aligned with its net asset value (NAV).

Types of ETFs

There are many types of ETFs available, each designed to meet different investment objectives:

Stock ETFs: Track a specific index or sector, such as the S&P 500 or technology stocks.

Bond ETFs: Invest in government, corporate, or municipal bonds.

Commodity ETFs: Track the price of commodities like gold, oil, or agricultural products.

Sector and Industry ETFs: Focus on specific sectors such as healthcare, energy, or real estate.

International ETFs: Provide exposure to markets outside your home country.

Thematic or Smart Beta ETFs: Use rules-based strategies to target factors like value, growth, or volatility.

Benefits of ETFs

ETFs offer several advantages for investors:

Diversification: By holding a basket of assets, ETFs help reduce risk compared to investing in individual securities.

Cost-Effectiveness: ETFs typically have lower management fees than actively managed funds, making them a cost-efficient way to invest.

Liquidity: ETFs can be traded throughout the day, offering flexibility and ease of access.

Transparency: Most ETFs publish their holdings daily, so investors know exactly what they own.

Tax Efficiency: ETFs are generally more tax efficient than mutual funds, due to their unique structure and the way shares are created and redeemed.

Risks and Considerations

While ETFs have many benefits, it's important to be aware of potential risks:

Market Risk: The value of an ETF can rise or fall with the market or sector it tracks.

Tracking Error: ETFs may not perfectly match the performance of their underlying index, due to management fees or imperfect replication.

Liquidity Risk: Some niche or low-volume ETFs may be harder to buy or sell without affecting the price.

Costs: While generally low, ETFs do have management fees, trading commissions, and bid-ask spreads that can impact returns.

How to Invest in ETFs

To invest in ETFs, you need a brokerage account. Once your account is set up, you can search for ETFs that match your investment goals and buy or sell them just like individual shares. It's important to research the ETF's holdings, fees, and performance history before investing.

Conclusion

ETFs combine the best features of stocks and mutual funds, offering investors a flexible, diversified, and cost-effective way to access a wide range of markets and asset classes.

By understanding ETF meaning and how exchange-traded funds work, you can make more informed decisions and build a portfolio that suits your financial goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.