What is a Double Top Pattern?

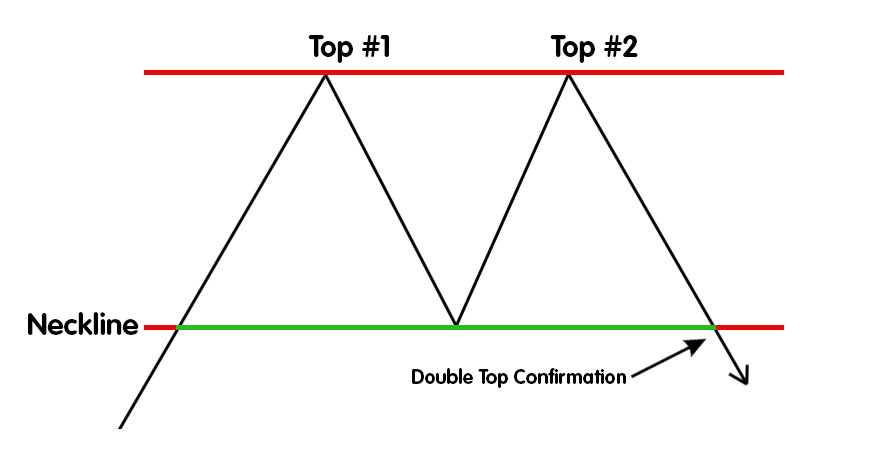

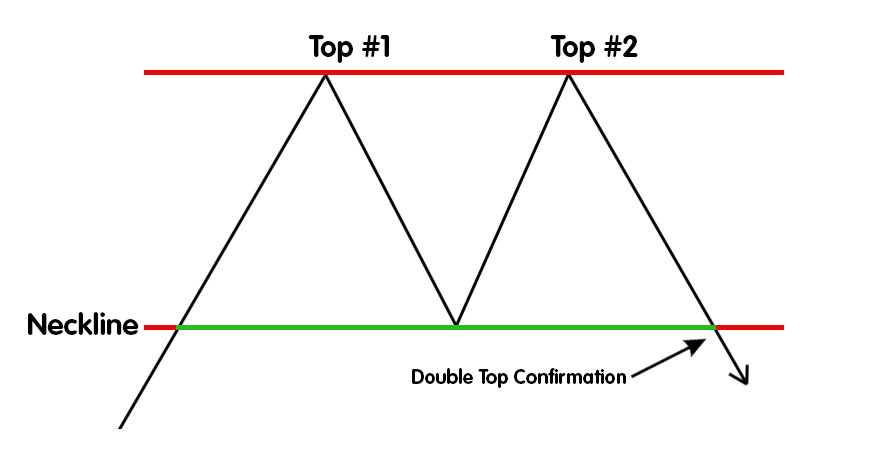

A double top pattern is a bearish reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs.

It is confirmed once the asset's price falls below a support level equal to the low between the two prior highs, signalling a downward movement as sellers gain control and the price decreases.

The double top pattern is an extremely bearish reversal pattern that forms after an asset reaches a high price two consecutive times with a moderate decline between the two highs.

Understanding the Double Top Formation

A double-top formation is a chart pattern that takes the shape of an “M" and is formed when an asset's price moves in a similar pattern as two distinct peaks.

The two peaks or “tops" are formed when the price hits certain resistance levels, and the second top is unable to break the high of the first top, indicating a reversal is imminent.

The double top formation is a crucial note in the market's rhythm, signalling potential trend reversals.

Historical Context and Evolution of the Double Top Pattern

The double-top pattern has been a cornerstone of technical analysis for decades, with its origins dating back to the early 20th century. This bearish reversal pattern was first identified by Charles Dow, a pioneer in technical analysis, who recognised its potential as a signal for impending price declines. Over the years, the double top pattern has evolved to become a widely recognised and respected chart pattern among traders and analysts.

Initially, the double top pattern was primarily utilised by stock traders to identify potential trend reversals in the stock market. However, as the pattern gained popularity, its application expanded to other financial markets, including forex, commodities, and cryptocurrencies. Today, the double top pattern is a staple of technical analysis, used by traders and investors worldwide to spot potential trading opportunities.

With the advent of electronic trading and the proliferation of technical analysis software, identifying and analysing the double top pattern has become more accessible and accurate. These technological advancements have allowed traders to refine and modify the pattern to accommodate different market conditions and trading strategies, making the double top pattern a versatile tool in the trader's arsenal.

Identifying and Trading the Double Top Pattern

Identifying a double-top pattern requires a keen eye to differentiate between genuine patterns and false alarms.

The first peak is shaped when prices achieve a new high before receding, signalling a potential resistance level.

The neckline, illustrated by the support level marked along the lowest points of the trough, is crucial for verifying the pattern when the price breaks through this level.

Trading the double top pattern necessitates a strategic approach to optimise potential gains while mitigating risks.

Double Top vs. Double Bottom

The double top and double bottom pattern are harmonious counterparts in the realm of technical analysis, each signifying potential trend reversals, albeit in opposite directions.

The double top implies a selling opportunity following a confirmed neckline break, while the double bottom, as a bullish reversal pattern, suggests a buying opportunity post a neckline breach above the peak.

Understanding the differences between double top and double bottom patterns helps traders identify potential market reversals and make informed trading decisions.

Trading Strategies for the Double Top Pattern

Entering a trade at the right moment is crucial, often initiating a short position after the confirmation of the pattern and recognising the selling pressure that indicates a potential price dip.

Setting a stop-loss order is equally important in managing risks, placing it slightly above the second peak to protect against sudden price reversals.

Risk management techniques, such as analysing potential stop-loss levels and setting reasonable return goals, are essential when trading double tops.

Trading double tops can be a profitable strategy for traders who know how to identify and interpret these Chart Patterns correctly.

Psychological Aspects of Trading the Double Top Pattern

Trading the double top pattern requires a deep understanding of market psychology and the emotions that drive trader behaviour. This chart pattern is often associated with a shift in market sentiment, as traders and investors begin to lose confidence in the upward trend. Such shifts can be triggered by various factors, including changes in economic conditions, geopolitical events, and market news.

To successfully trade the double top pattern, traders must be adept at recognising and responding to these changes in market sentiment. This necessitates a combination of technical analysis skills, market knowledge, and emotional discipline. Traders must remain calm and objective amidst market volatility, making decisions based on a clear and rational analysis of the market.

One of the key psychological challenges of trading the double top pattern is avoiding the extremes of optimism and pessimism. Overly optimistic traders may fail to recognise the potential for a trend reversal, while overly pessimistic traders may become too cautious, missing out on profitable opportunities. Cultivating a balanced and nuanced view of the market is essential, as is the willingness to adapt trading strategies as market conditions evolve.

Real-World Example of Trading the Double Top Pattern

The double top pattern is a bearish signal that suggests a potential trend reversal, indicating the security is likely to continue declining.

Traders, vigilant of this pattern, observe that RANJY's price broke below the neckline with significant volume, thereby confirming the pattern and signalling a probable bearish reversal.

By following these steps, traders can potentially capitalise on potential bearish reversals in the forex market.

Advanced Double Top Pattern Variations

While the traditional double top pattern is a powerful tool for identifying trend reversals, several advanced variations can refine and enhance trading strategies. One such variation is the “double top with a twist," where the second peak is slightly higher or lower than the first. This subtle difference can indicate more nuanced changes in market sentiment, making it particularly useful in highly volatile markets.

Another advanced variation is the “double top with a false breakout," which involves a price break above the neckline that is quickly reversed. This pattern helps traders identify false signals and avoid potential losses, especially in noisy and volatile markets.

Traders can also combine the double top pattern with other technical indicators and chart patterns to develop more sophisticated trading strategies. For instance, using the double top pattern alongside the relative strength index (RSI) can help identify overbought or oversold conditions. Similarly, combining it with the moving average convergence divergence (MACD) can highlight changes in market momentum. By integrating the double top pattern with other technical tools, traders can create comprehensive strategies that account for a wide range of market factors, enhancing their ability to make informed trading decisions.

Managing Risks and Maximising Profits

Proper risk management techniques are essential when trading double top patterns.

Analysing potential stop-loss levels and setting reasonable return goals can help traders maximise profits and minimise losses.

Understanding the potential risks involved in trading double tops can help traders make informed decisions and avoid significant losses.

Tips for Successful Trading

Wait for confirmation of the pattern before entering a trade, usually indicated by a breakout above or below the neckline.

Take profit by measuring the distance between the neckline and the bottom/top of the pattern and adding it to the breakout point.

Set stop loss orders just below the neckline to limit potential losses if the pattern fails to confirm.

Trading double tops and double bottoms requires patience, discipline, and a thorough understanding of these patterns and their implications.

Conclusion and Next Steps

The double top pattern is a crucial tool for traders seeking to anticipate market reversals. Understanding double top patterns, including their potential drawbacks and subjectivity, is essential for identifying and trading the pattern effectively.

By understanding the double top formation, identifying and trading the pattern, and managing risks, traders can potentially capitalise on profitable moves.

Continuing to learn and refine trading strategies can help traders stay ahead of the curve and achieve long-term success in the markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.