Markets were generally quiet during the trading session on Monday. The dollar

and gold have been stuck in a sideways range, with oil up over 1%.

Traders are unwilling to take positions before Thursday’s GDP and PCE

reading. U.S. growth and inflation is expected to slow further.

Stock indexes barely moved as investors wait for Big Tech quarterly earnings

including Microsoft and Alphabet. Technology and communication sector have been

leading year to date, so any downside surprise could pummel NASDAQ.

Commodities

Oil prices settled higher on Monday, reversing losses as investors grew

optimistic that holiday travel in China would boost fuel demand in the world’s

largest oil importer. Both contracts fell more than 5% last week for their first

weekly declines in five.

Bookings in China for trips abroad during the upcoming May Day holiday point

to a continued recovery in travel to Asian countries, but the numbers remain far

off pre-COVID-19 levels with long-haul airfares soaring and not enough flights

available.

‘There’s a lot of optimism around Chinese holidays as it relates to jet fuel

demand, the first genuine numbers on Chinese demand construction,’ said Bob

Yawger, director of energy futures at Mizuho.

Iraq’s northern oil exports also showed few concrete signs of an imminent

restart after a month of standstill, as aspects of an agreement between Baghdad

and the Kurdistan Regional Government have yet to be resolved, according to four

sources.

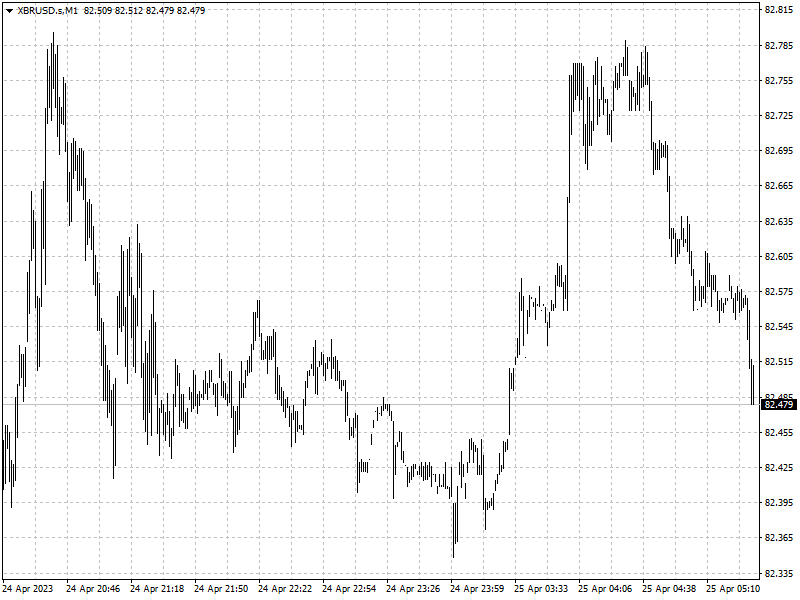

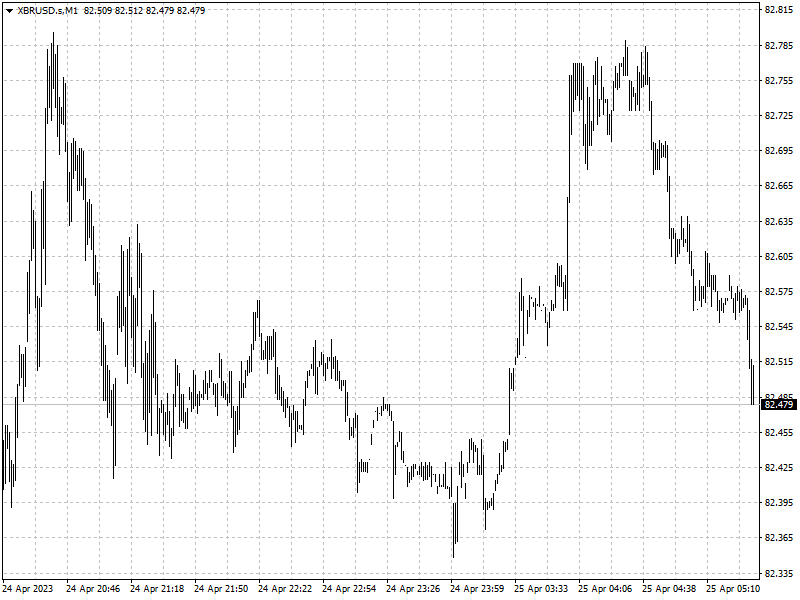

Forex

EUR/USD reclaimed 1.10 with 14-month high of 1.10755 in sight that was

reached earlier this month.

In April, Germany’s business sentiment came in at 93.6 from 93.2 in March,

narrowly missing expectations.

The ECB could consider raising its key interest rate as high as 4% if

underlying inflation in the euro zone remains persistently high, ECB Governing

Council member Pierre Wunsch said.

"The dollar is struggling to build on last week's gain as coming data could

show slower U.S. growth and lower inflation, outcomes that would cement the case

for a mid-year rate pause," said Joe Manimbo, senior market analyst at Convera

in Washington.