The bull flag and bear flag are two of the most reliable continuation patterns among the various Chart Patterns. These patterns help traders predict market direction and position themselves accordingly.

While the bull flag and bear flag are continuation patterns that indicate a brief consolidation before the prevailing trend resumes, they differ in price movement and trends. Understanding how to identify, trade, and manage risk in these patterns can significantly improve trading success.

Understanding the Bull Flag and Bear Flag Patterns

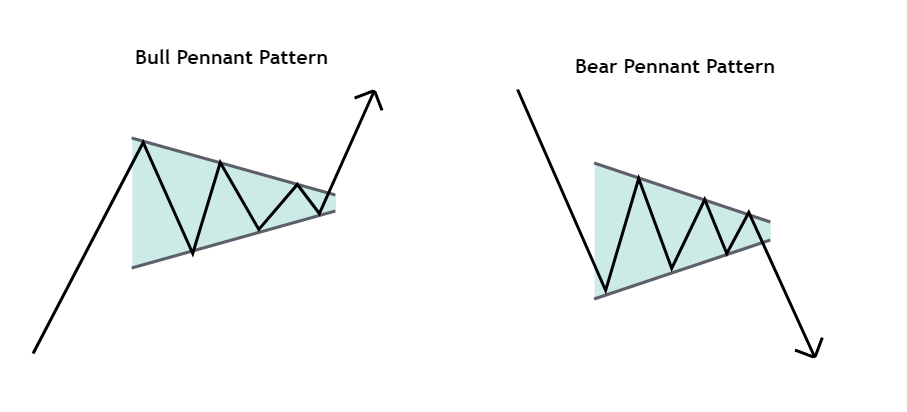

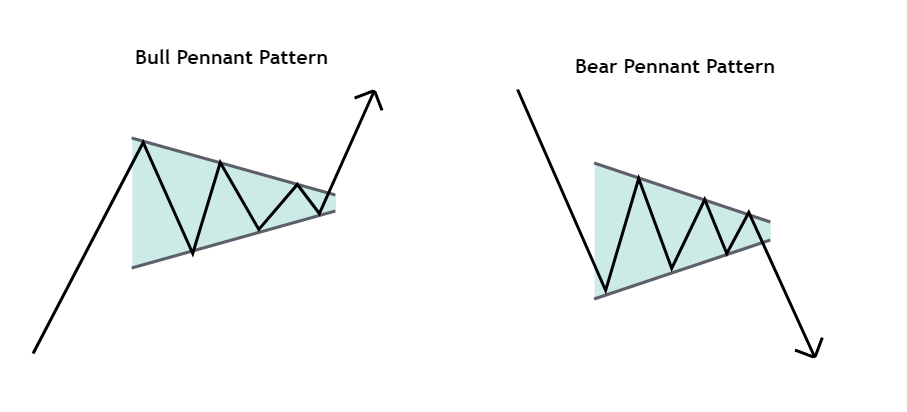

A bull flag is a bullish continuation pattern that forms after a strong price rally. It consists of two main components: a flagpole and a flag. The flagpole is a sharp vertical price movement that represents strong buying momentum. The flag is a consolidation phase where the price moves sideways or slightly downward in a downward-sloping channel.

On the flip side, a bear flag is a bearish continuation pattern that appears after a sharp downward price movement. Despite sharing the same two main components, the flagpole of a bear flag indicates a price drop while its flags move sideways or slightly upward in an ascending channel.

Typically, the bull flag indicates that buyers are taking a short breather before pushing prices higher again. As for bear flags, they are particularly useful for traders looking to profit from downtrends and bearish market conditions.

Bull Flag vs Bear Flag: Identifying the Key Differences

As stated above, a bull flag forms after a strong upward price movement, followed by a pullback or sideways consolidation, creating a rectangular shape that resembles a flag. Conversely, a bear flag appears after a sharp downward price movement, followed by a brief upward or sideways consolidation.

Feature

|

Bull Flag |

Bear Flag |

Trend Direction

|

Uptrend

|

Downtrend |

| Flagpole |

Strong upward move |

Sharp downward move |

| Consolidation Slope |

Downward or sideways |

Upward or sideways |

| Breakout Direction |

Upwards |

Downwards |

| Entry Signal |

Break above upper trendline |

Break below lower trendline |

| Volume Confirmation |

Increased buying Volume |

Increased selling Volume |

Although the bull and bear flag patterns are opposites, they both serve the same purpose: to identify potential trend continuations and provide traders with strategic entry and exit points.

How to Trade the Bull Flag and Bear Flag Properly

Both patterns present excellent trading opportunities when identified and executed correctly. However, before trading, ensure the flag pattern meets the following criteria (upward for bull flags, downward for bear flags). In addition, ensure that the flag follows a strong trend and does not resemble a reversal pattern.

Moreover, traders must ensure that a breakout follows increased volume, as low-volume breakouts may indicate weak momentum and potential reversals. For example, the optimal timing for trading a bull flag is when the price breaks above the upper boundary of the flag with increased volume. As for trading a bear flag, enter a trade when the price breaks below the lower boundary of the flag with increased volume.

Lastly, you must always use stop-loss orders to protect capital. When trading a bull flag, place a stop-loss below the lowest point of the flag to protect against false breakouts. On the other hand, place a stop-loss above the highest point of the bear flag to avoid false signals.

Advanced Strategies for Trading Bull and Bear Flags

Firstly, we recommend using moving averages as an advanced approach in trading bull and bear flags. For context, a bull flag bouncing off the 50-day MA increases breakout reliability, while a bear flag failing to break above the 50-day MA signals continued downside.

In addition, traders can combine with the Relative Strength Index (RSI), as a breakout with an RSI above 50 in a bull flag or below 50 in a bear flag confirms strength.

We also suggest using Moving Average Convergence Divergence (MACD) as a bullish crossover that supports a bull flag, while a bearish crossover supports a bear flag.

Conclusion

In conclusion, bull and bear flag patterns are powerful continuation signals that help traders identify high-probability trading opportunities. The bull flag signals a continuation of an uptrend, while the bear flag indicates a continuation of a downtrend.

Understanding their formation, characteristics, and correct trading strategies enhances the ability to capitalise on market trends.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.