The two most important things for foreign exchange trading are regulation and order execution.

The former determines the safety of funds, while the latter determines the effectiveness of transactions. It can be said that successful trading cannot do without these two factors.

1、 The execution of orders on foreign exchange platforms must depend on the bank

Regulation is a commonplace issue, as long as it is a legitimate regulatory platform, there will be no problem of running away. Generally, these platforms also provide specialized regulatory accounts for investors to check.

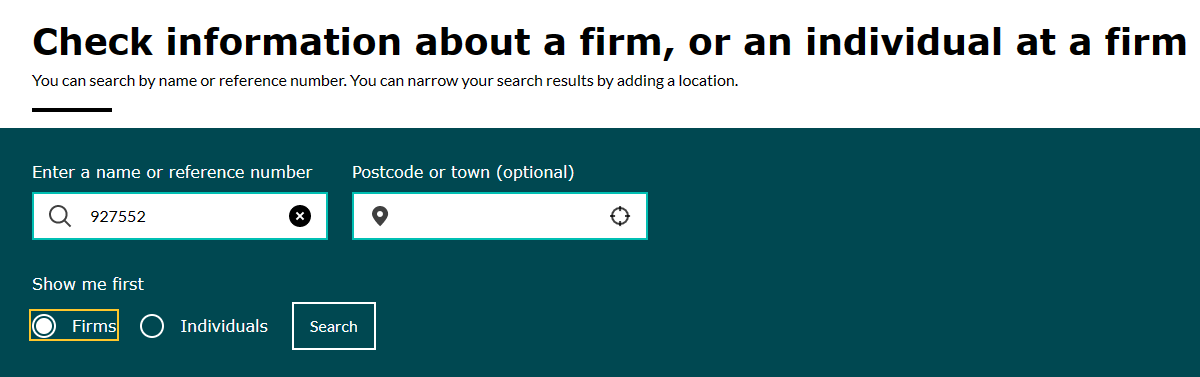

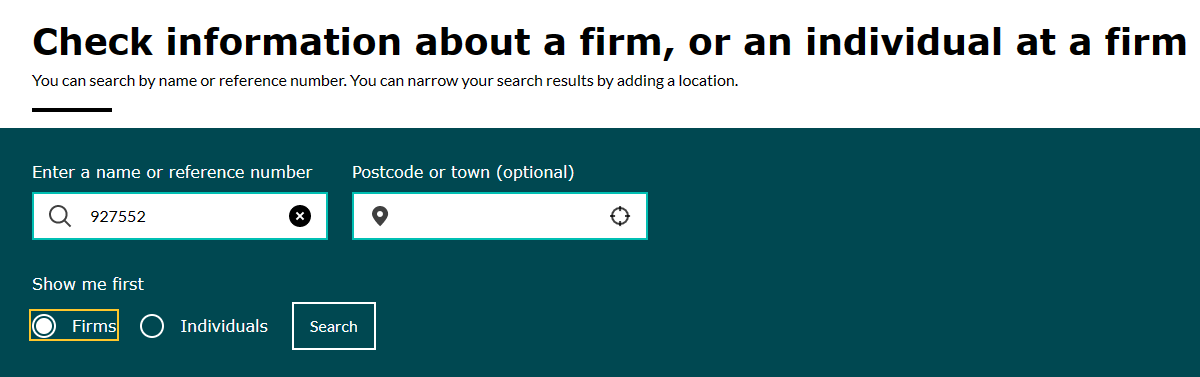

For example, with the FCA licensed institution EBCTaking Group as an example, open the FCA query website: https://register.fca.org.uk/ Enter the regulatory number 927552 of EBC in the search bar and click on firms to query. Then, we can see all the detailed information about EBC, with Authorized and Regulated displayed in the Status and Type columns, respectively, indicating that the company is under effective FCA regulation.

Order execution involves many aspects, such as slip points, spreads, and market stability during order execution. It may sound complicated, but if you understand the process of foreign exchange trading, you will find that it has a great relationship with the banks behind the platform.

The general process of foreign exchange trading is:

Customers place orders with small or primary traders through trading software.

Small traders choose whether to pass orders to primary traders/liquidity providers.

Primary traders/liquidity providers transfer orders in the interbank market.

Simply put, it means that the user places an order, passes it on to the bank through the dealer, and ultimately completes the execution of the order. There is one detail here: if the platform is a primary trader, it can directly connect with the interbank foreign exchange market to complete quotation and order execution.

But if it is a small dealer, it must first be passed on by the small dealer to the primary dealer, and then to the bank.

In fact, in our transactions, the fewer stages of order transmission, the more accurate the order quotation will be, and the resulting costs will naturally be less. The easier it is for us to place an order at the desired point, and the lower the spread we can obtain.

2、 The platform's order execution needs to achieve these three points

Now that we understand this, let's take a look at the issue of platform selection.

Generally, high-quality platforms will directly connect with banks to obtain the most direct liquidity between banks and ensure rapid transaction of orders. But this does not mean that simply accessing interbank liquidity is sufficient.

Firstly, not all quoted orders will be accepted by the bank. If a platform only connects to one bank, once the quotation is rejected, there will be sliding points and other situations, making it impossible to trade at the desired price.

So high-quality platforms usually connect with multiple banks simultaneously to ensure that every quoted order can be executed. For example, EBCThe Group has access to the liquidity pools of over 20 top banks worldwide, thereby obtaining the best quotes in the global market.

Secondly, there are differences in the liquidity of banks, as the liquidity of top banks is much greater than that of large banks that provide liquidity.

A while ago, after the Silicon Valley Bank incident, I found a list of globally systemically important banks. From the fifth level to the first level, the importance decreased in sequence. It can be seen that Credit Suisse is listed, which is also the reason why the Credit Suisse incident is greater than that of Silicon Valley Bank.

For foreign exchange platforms, accessing the liquidity pools of these financial giants is not an easy task, and usually requires a strong credit endorsement, such as a well-established management team or top-level financial qualifications.

There are even fewer platforms that can simultaneously access multiple systemically important banks, such as top banks such as JPMorgan Chase, Goldman Sachs, UBS, Nomura, and Barclays, among the partners of EBC Group.

Overall, the higher the level of banks, the stronger the market liquidity demand they carry, and the better the liquidity they naturally provide. Especially for fourth, third, and second tier banks, there are only 12 in total.

The third point is also very important, it depends on the platform's order optimization ability

Even if connected to the liquidity pools of multiple top banks, the platform itself still needs to optimize orders in order to obtain the optimal quotation.

For example, I placed a gold multiple order near $1950, and Goldman Sachs, JPMorgan Chase, and Barclays all accepted my order, but the quotation was slightly different. At this point, what the platform needs to do is quickly screen out the optimal quotation and close the deal. So, the platform not only serves as a medium for transactions, but also plays a role in optimizing quotes.

In rare cases, banks that provide liquidity will provide better quotes than users, which is often referred to as a positive sliding point. The ability of the platform to identify and execute orders has higher requirements for whether orders can be concluded at a better price.

Regarding the platform's order optimization capabilities, we can leverage some third-party evaluation platforms. For example, Foreign Exchange Tianyan will regularly publish trading environment rankings, and we will focus on the situation of sliding points.

In the comprehensive list of trading environments, the top three currently ranked are Jiasheng, XM, and EBC, with an average sliding point of only -0.1 for EBC, which has better overall stability and stronger order optimization ability. This is mainly due to EBC's trading black box.

From EBCOn the official website of the Group, it can be seen that the main principle of the trading black box is to match more suitable liquidity for each trader through an original and precise optimization algorithm, thereby improving the price optimization rate, order completion rate, and algorithm stability, allowing more than 85% of orders to be completed at a better price. -

Trading is not a castle in the air. A complete transaction actually includes issuing instructions, transmitting orders, and completing execution. The smoother this process is executed, the more accurate our orders will be, the lower transaction costs will be, and the greater the potential for revenue.

Tracing back to the source, foreign exchange platforms can only build a more complete trading ecosystem by deep cooperation with the interbank trading market as the upstream of transactions.

But perhaps more importantly, whether the platform itself can break away from the traditional role of trading media and actively assist users in price optimization can provide investors with the best trading experience.