Wall Street stocks mostly held on to their previous gains on Friday, while

the dollar stayed near 15-month lows, after U.S. inflation data unleashed a wave

of investor optimism that the Fed was nearing the end of its rate-hiking

cycle.

The government reported that U.S. import prices dropped 0.2% last month, and

U.S. consumer sentiment jumped to the highest level in nearly two years.

Oil prices fell more than a dollar a barrel. Gold prices eased, down about

0.3%, but were on track for their biggest weekly gain since April, after signs

of slowing U.S. inflation.

Commodities

Prices softened after both benchmarks last week notched a third straight week

of gains and touched their highest levels since April when output was shut at

oilfields in Libya and Shell halted exports of a Nigerian crude, tightening

supply.

In Russia, oil exports from western ports are set to fall by some

100,000-200,000 bpd next month from July levels, a sign Moscow is making good on

its pledge for fresh supply cuts in tandem with OPEC leader saudi arabia, two

sources said on Friday, citing export plans.

On the economic front, stronger-than-expected consumer sentiment data in the

U.S. dampened expectations that the Federal Reserve was set to end its rate

hiking cycle at next week's FOMC meeting, IG analyst Tony Sycamore said.

There is also some nervousness among traders ahead of another big week ahead

for economic data from China, the UK and Japan, he added.

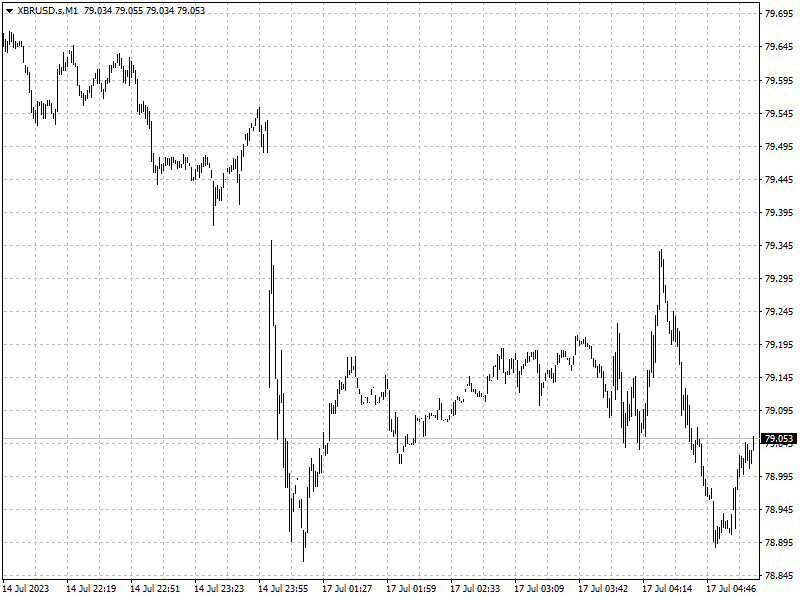

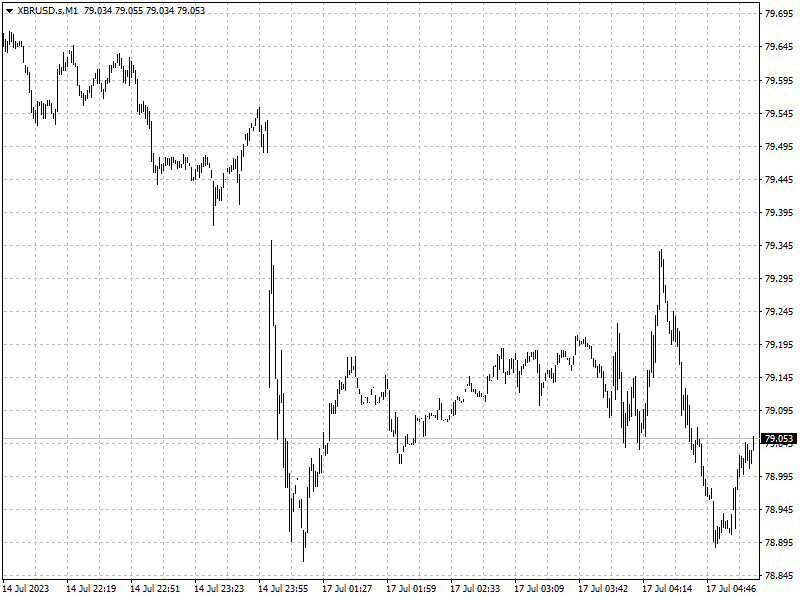

Forex

The dollar was down 2.3% last week, the biggest weekly decline since

November. Markets are still pricing in a 95% chance of a 25 basis point hike

from the Fed this month, CME's FedWatch tool showed, but no more for the rest of

the year.

Investors have been betting on a turn lower in the dollar for months, with

short positions more than doubling over the month to July 7, according to data

from CFTC, although they remain far off the levels in 2021.