Global equities and U.S. Treasury yields were lower on Wednesday as risk-off

sentiment dominated markets, with investors focused on a vote in Congress on

raising the U.S. debt ceiling.

The U.S. dollar retreated from a more than two-month high after a Fed

official warned any decision to hold its interest rate firm at an upcoming

meeting would not mean that it is done tightening monetary policy.

Gold prices firmed despite the dollar's strength, though optimism about the

U.S. debt deal kept bullion on course for a first monthly dip in three. Oil

prices fell amid demand concerns.

Commodities

Gold has lost over $100 from near-record highs scaled earlier in May, but

OANDA senior market analyst Edward Moya said key support around $1,950 could

fuel momentum trade to push gold back to $2,000.

In the U.S., field production of Crude Oil rose in March to 12.696 million

barrels per day, the highest since March 2020, EIA data showed.

Chinese data showed manufacturing activity contracted faster than expected in

May, as weakening demand cut the official PMI down to 48.8.

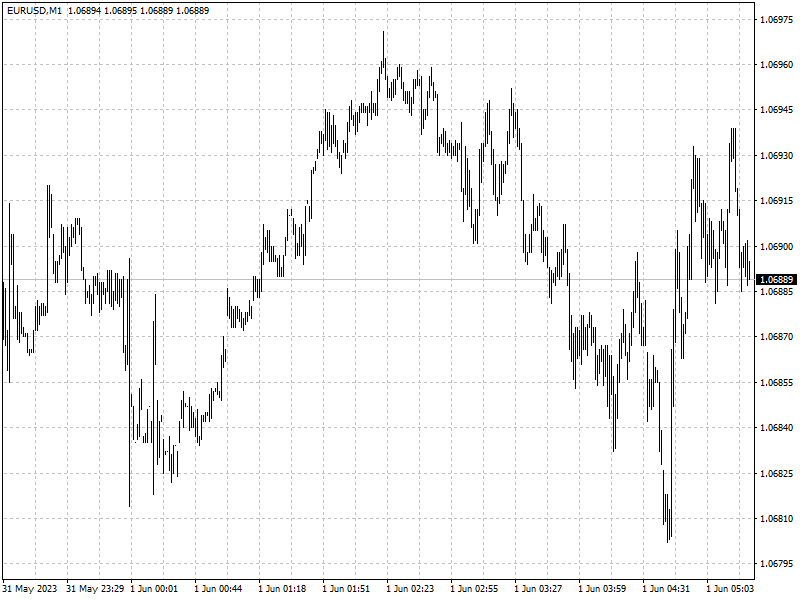

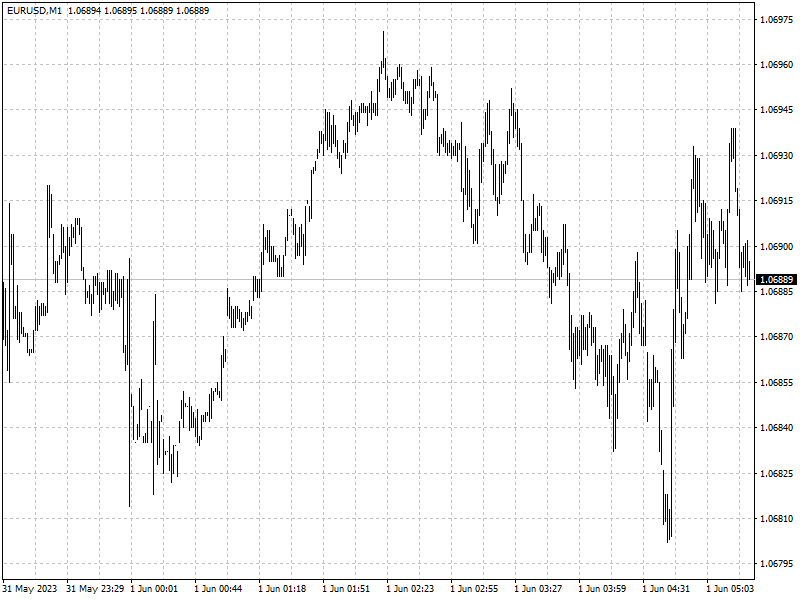

Forex

Fed Governor and vice chair nominee Philip Jefferson said that skipping a

rate hike would allow the Fed ‘to see more data before making decisions about

the extent of additional policy firming.’

Investors reset expectations after Jefferson's comments, with prices of

futures tied to the Fed's policy rate reflecting only a one-in-three chance of a

June rate hike.

The euro fell to $1.066 earlier in the session, the lowest since March 20,

after data showed European inflation is cooling quicker than expected.