Bullion inches down on easing fear

2025-04-29

Summary:

Summary:

Gold fell Tuesday as easing US trade tensions boosted market sentiment, with investors awaiting economic data to evaluate the Fed's policy direction.

Gold fell on Tuesday as softening trade tensions between the US and its

trading partners helped brighten market mood, while investors awaited economic

data to assess the Fed's policy path.

Bessent said in an interview on Monday that it was up to China to de-escalate

on tariffs - the latest in a slew of conflicting signals over progress on trade

talks between the world's two largest economies.

Despite that, both sides in recent days seemed to have softened their

respective stances, with the Trump administration signalling openness to

reducing tariffs and China exempting some US imports from its 125% levies.

Treasury has seen a sell-off, with the 30-year yield hitting the highest

since November 2023 earlier this month. But the traditionally inverse

relationship between Treasury yields and gold are breaking down.

Analysts say the rationale is the dwindling faith in America and the "US

exceptionalism" narrative. Gold's perceived independence from any monetary and

fiscal policy has boosted its appeal.

According to a recent survey conducted by JPMorgan, the dollar is expected to

weaken further by the end of 2025. The bank expects the yellow metal to average

$3,675 by Q4, and reach $4,000 by Q2 2026.

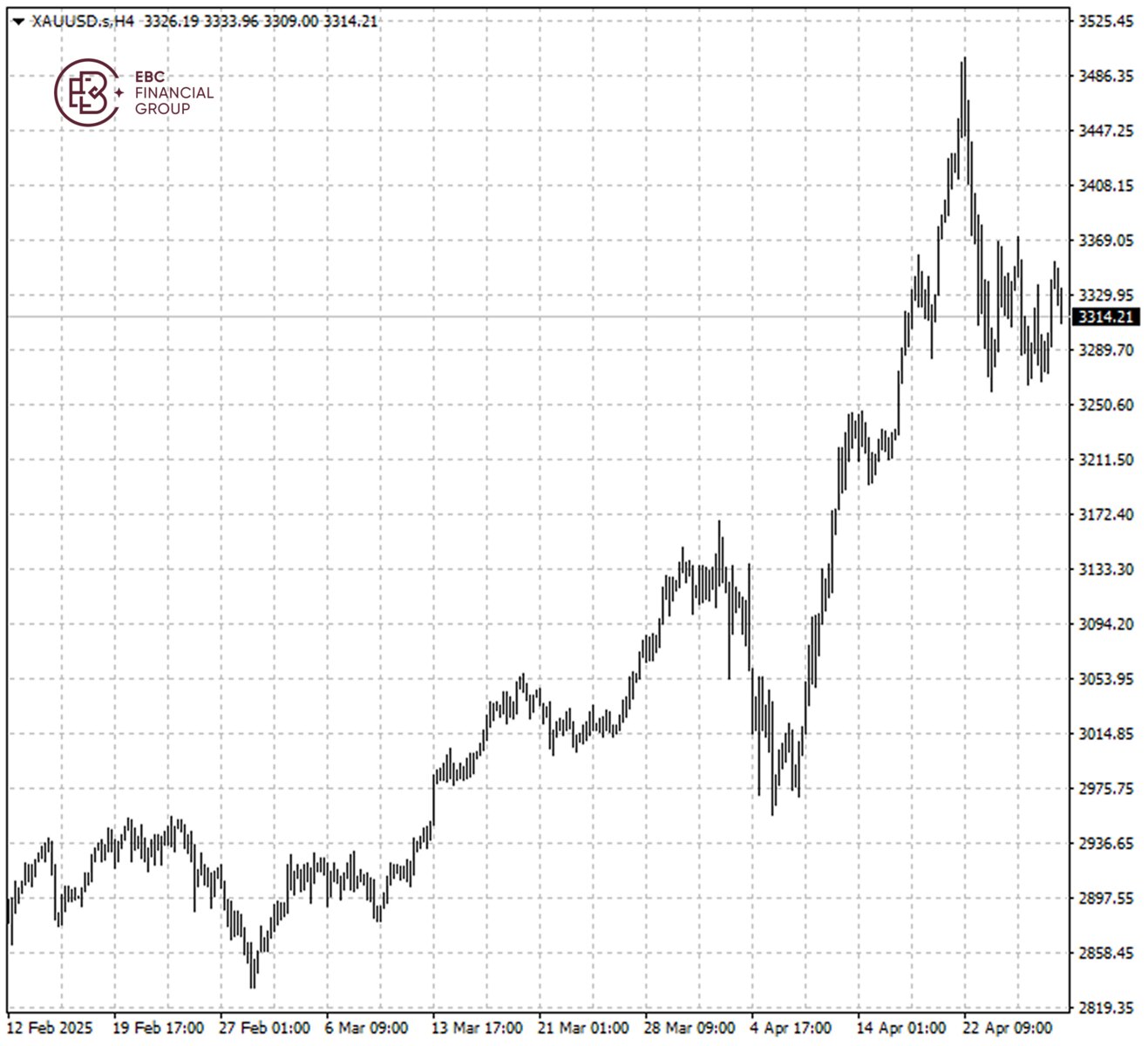

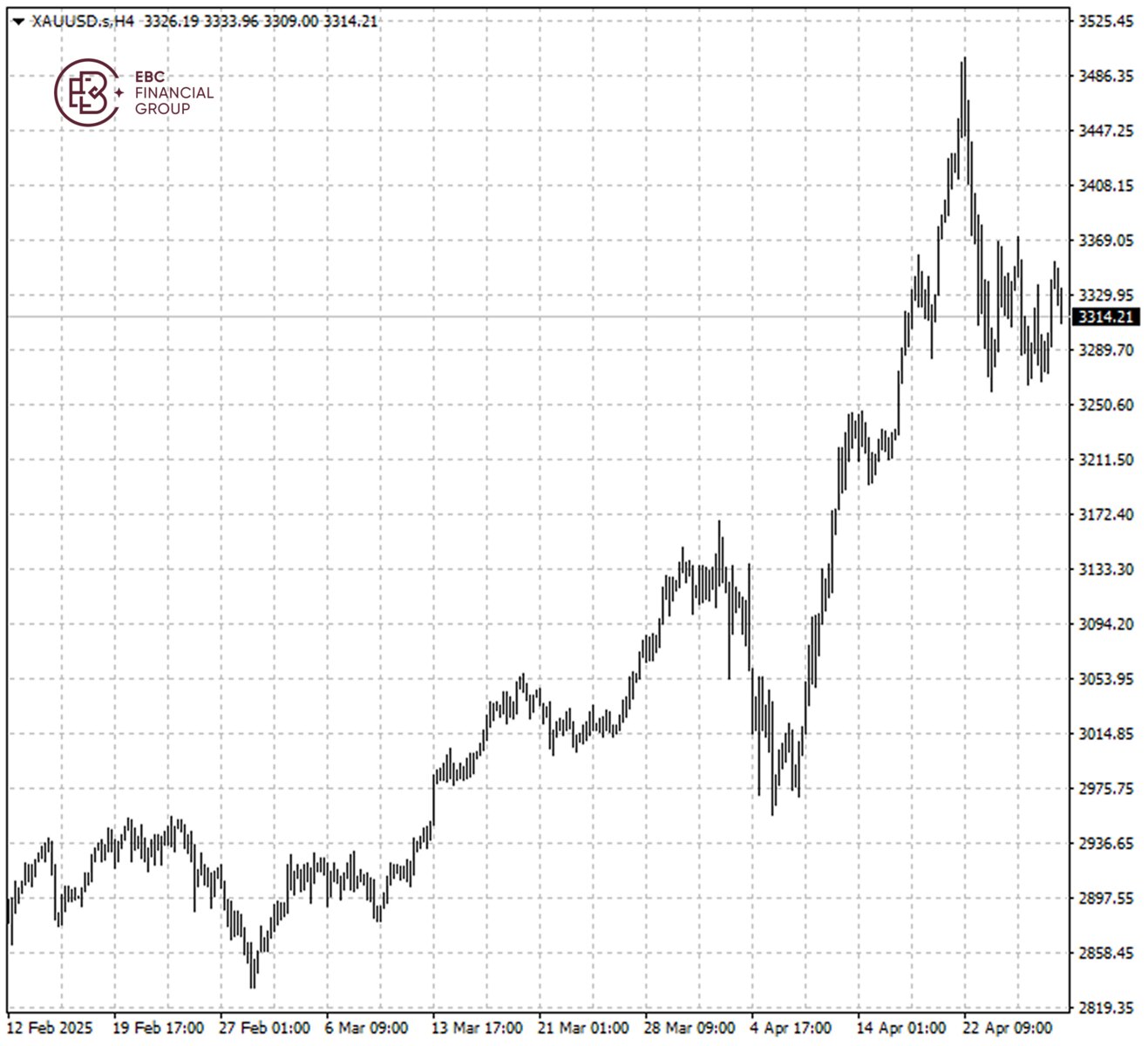

Bullion failed to break above the upper end of trading range, so a deeper

pullback towards $3,287 is more likely than not. Volatility may be limited until

the PCE report is released.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.