The NVIDIA stock split has captured the attention of traders and investors worldwide, especially as the company continues to dominate the AI and semiconductor sectors.

Understanding the timeline of the most recent NVIDIA stock split is crucial for anyone looking to trade or invest in this high-profile stock. Here, we break down the five key dates every trader should know, along with essential insights into what a stock split means for your portfolio.

What Is a Stock Split?

A stock split is a corporate action where a company increases the number of its outstanding shares by issuing more shares to current shareholders. The price per share decreases proportionally, so the total value of a shareholder's investment remains unchanged.

Companies like NVIDIA often use stock splits to make their shares more accessible to retail investors and to boost liquidity in the market.

Why Did NVIDIA Announce a Stock Split?

NVIDIA's rapid share price growth, driven by strong demand for its AI and graphics processing technologies, led to a high price per share. By splitting the stock, NVIDIA aimed to lower the entry barrier for new investors, increase trading activity, and enhance the stock's appeal among employees and retail traders.

When Is NVIDIA Stock Split? 5 Key Dates to Know

1. Announcement Date – 22 May 2024

NVIDIA officially announced its 10-for-1 stock split on 22 May 2024, following its impressive earnings report. This announcement set the stage for the split and signalled to the market that a major change was coming. Traders began to anticipate increased trading volumes and potential price volatility in the lead-up to the split.

2. Record Date – 6 June 2024

The record date is the deadline for shareholders to be eligible for the split. Investors who owned NVIDIA shares at the close of trading on 6 June 2024 were entitled to receive additional shares as part of the split. If you purchased shares after this date, you would not receive the split shares.

3. Distribution Date – 7 June 2024

On the distribution date, NVIDIA issued nine additional shares for every one share held by eligible shareholders. This took place after the market closed on 7 June 2024. The process was automatic—no action was required from shareholders, as brokers adjusted share counts and prices accordingly.

4. Split-Adjusted Trading Begins – 10 June 2024

Trading on a split-adjusted basis began at the market open on 10 June 2024. From this point, NVIDIA shares traded at one-tenth of their previous price, while shareholders held ten times as many shares. This adjustment made NVIDIA's stock more affordable and accessible to a broader range of investors.

5. Dividend Adjustment Date – 28 June 2024

NVIDIA also increased its quarterly dividend in conjunction with the split. The dividend adjustment date, 28 June 2024, marked the first payment of the new post-split dividend. The per-share dividend was recalculated to reflect the higher number of shares, ensuring that total dividend income remained proportional.

What Does the Split Mean for Traders?

-

Increased Liquidity: More shares in circulation typically mean tighter bid-ask spreads and improved trading conditions.

-

Lower Share Price: The reduced price per share makes it easier for retail traders to buy round lots and participate in options trading.

-

No Change in Value: The split does not alter the total value of your holdings or NVIDIA's market capitalisation.

Potential for Volatility: Stock splits can attract new investors and traders, sometimes resulting in short-term price swings.

How to Prepare for a Stock Split

-

Check Your Holdings: Ensure you are a shareholder of record by the record date if you want to receive split shares.

-

Review Broker Communications: Most brokers handle splits automatically, but it's wise to monitor your account for adjustments.

-

Understand Tax Implications: Stock splits are generally not taxable events, but always consult a tax professional for personal advice.

Adjust Trading Strategies: Lower share prices may affect your position sizing, stop-loss placement, and options strategies.

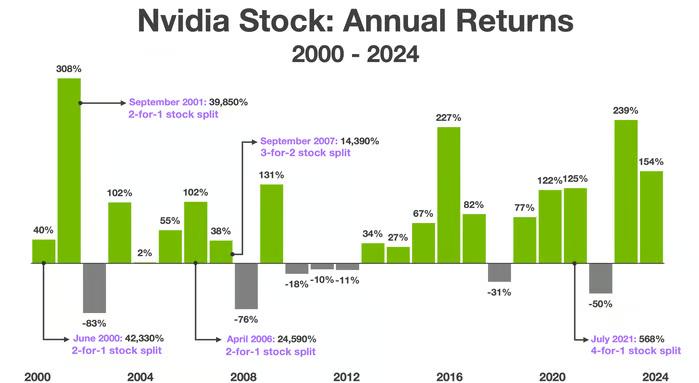

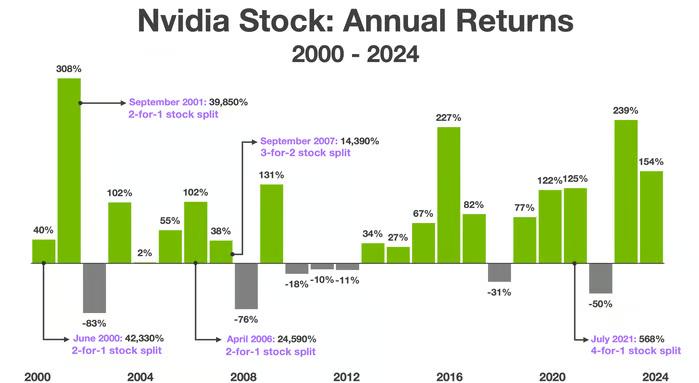

Historical Context: NVIDIA's Previous Splits

NVIDIA has a history of stock splits, with previous splits in 2000, 2001, 2006, 2007, and 2021. The 2024 split is the company's sixth, reflecting its sustained growth and commitment to broadening investor access.

Conclusion

The NVIDIA stock split in 2024 was a significant event for both traders and long-term investors. By knowing the five key dates—announcement, record, distribution, split-adjusted trading, and dividend adjustment—you can better plan your trades and investment strategies.

Stock splits do not change the fundamental value of your holdings, but they can offer new opportunities for engagement and portfolio management.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.