Options trading is a powerful tool in the financial markets, offering traders and investors flexibility, leverage, and the ability to profit in both rising and falling markets.

But what exactly is option trading, and how does it work? This guide breaks down the basics, key terms, and practical examples to help you understand how options can fit into your trading strategy.

What Is Option Trading?

Option trading involves buying and selling options contracts—financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset (such as a stock, index, or ETF) at a predetermined price (the strike price) within a specified period.

The seller (or writer) of the option receives a premium for granting this right and may be obligated to fulfil the contract if the buyer chooses to exercise the option.

Types of Options: Calls and Puts

There are two main types of options:

Call Options: Give the buyer the right to buy the underlying asset at the strike price before or at expiry. Call buyers are typically bullish, expecting the asset's price to rise.

Put Options: Give the buyer the right to sell the underlying asset at the strike price before or at expiry. Put buyers are typically bearish, expecting the asset's price to fall.

How Does Option Trading Work?

When you trade options, you can either buy (go long) or sell (go short) calls and puts. Here's how the process works:

Choose the underlying asset: This could be a stock, index, or ETF.

Select the strike price: The price at which you can buy (call) or sell (put) the asset.

Pick the expiration date: The last date the option can be exercised.

Pay or collect the premium: Buyers pay a premium to the seller for the contract.

Example:

Suppose you think Stock XYZ will rise from $100 to $120. You buy a call option with a $110 strike price, expiring in one month, for a $2 premium. If the stock rises above $112 (strike price + premium), you can profit by exercising the option or selling it to another trader.

If the stock stays below $110, your maximum loss is the premium paid ($2 per share).

Key Terms in Option Trading

Strike Price: The fixed price at which the option holder can buy or sell the asset.

Expiration Date: The date the option contract expires.

Premium: The price paid by the buyer to the seller for the option contract.

In the Money (ITM): When exercising the option would be profitable.

Out of the Money (OTM): When exercising the option would not be profitable.

Why Trade Options?

Options are used for several reasons:

Speculation: Traders can profit from price movements with less capital than buying the asset outright, thanks to leverage.

Hedging: Investors use options to protect against potential losses in their portfolios (for example, buying puts as insurance).

Income Generation: Strategies like covered calls allow investors to earn premium income on stocks they already own.

Risks and Rewards

Limited Risk for Buyers: The maximum loss for option buyers is the premium paid.

Potentially Unlimited Risk for Sellers: Option writers may face significant losses if the market moves against them, especially with uncovered (naked) options.

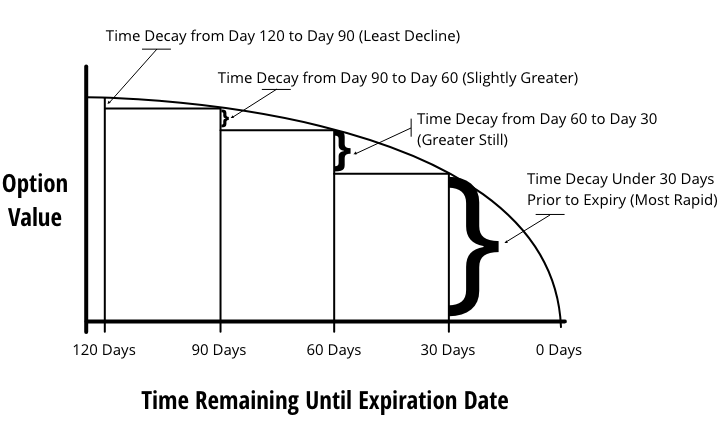

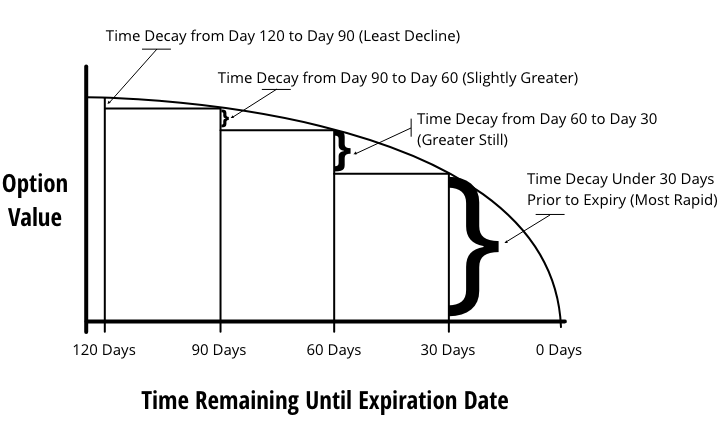

Time Decay: Options lose value as they approach expiration, especially if the underlying asset does not move as expected.

Complexity: Options trading can be complex, with many strategies and moving parts. Beginners should start with simple strategies and fully understand the risks before trading.

Common Option Trading Strategies

Long Call/Put: Buying calls or puts to speculate on upward or downward moves.

Covered Call: Selling a call option on a stock you own to generate income.

Protective Put: Buying a put option to protect a long stock position from downside risk.

Straddle/Strangle: Buying both calls and puts to profit from large price movements in either direction.

Getting Started with Option Trading

To start trading options, you'll need to:

Open an options trading account with a regulated broker.

Learn the basics and practice with a demo account.

Develop a trading plan and risk management strategy.

Start with simple trades before progressing to advanced strategies.

Conclusion

Option trading adds flexibility and depth to your trading toolkit. By understanding how options work, their risks and rewards, and the strategies available, you can use options to speculate, hedge, or generate income in any market environment. Always trade with a clear plan and be aware of the risks involved.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.