What is a martingale? What does Yang mean?

2023-06-05

Summary:

Summary:

A martingale strategy doubles bets after losses to recover and profit, often used in finance. "Yang" embodies positive, active energy in Chinese philosophy.

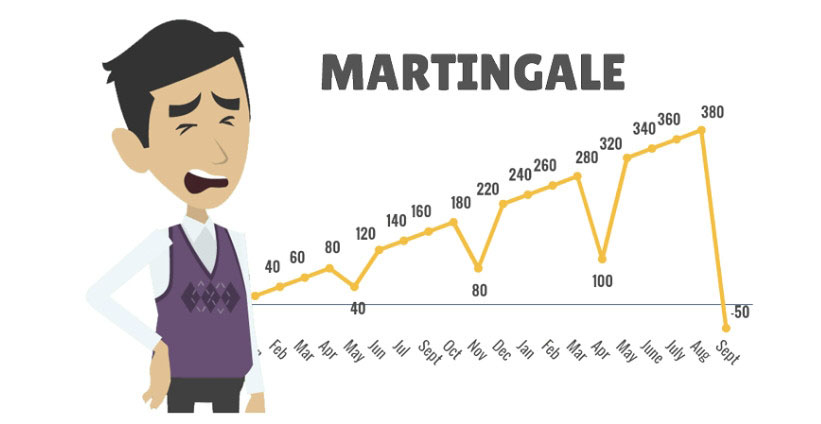

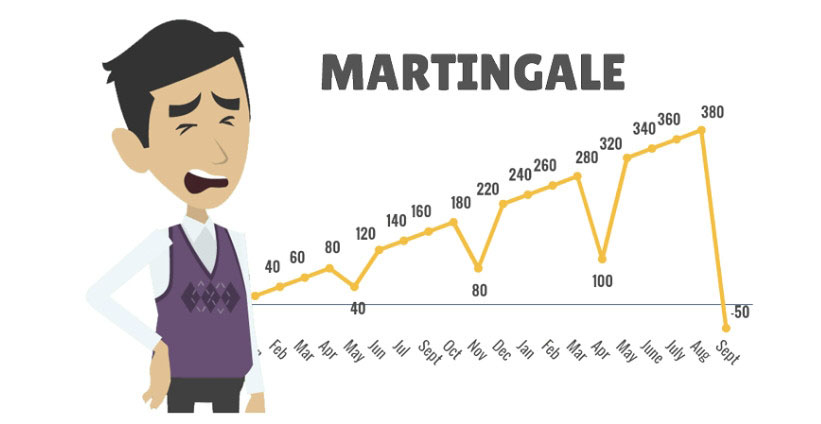

Martingale in Chinese means "a belt worn on the chest when a horse pulls a cart. In probability, it represents a kind of stochastic process process with neither upward nor downward trendProcesses).

Martingales have a broad role in financial modeling, stemming from the assumption of efficient markets that no asset can generate excess returns on average, so their price trends should not have an upward or downward trend relative to risk-free asset prices in the mathematical expectation sense.

The definition of martingales is related to information. We generally record the information accumulated up to time t as Ft, and based on this information, we make predictions about the future price of an asset (in units of risk-free asset price, recorded as Su, at time u ≥ t). In probability theory, we know that the predictive value of minimizing the mean square error is based on the conditional expectation of Su of information Ft, that is, E [Su | Ft]. If the conditional expectation is expected to satisfy, for any 0 ≤ t ≤ u,

E [Su | Ft]=St, we call St a martingale.

For assets whose price trends follow the martingale process, our prediction of future prices at any point in time is equal to their current price, meaning there is no trend.

In reality, different people have different information. For example, if someone may have insider information, TA's information set Ft 'will be larger, thus producing more accurate predictions for Su. In TA's view, St may not be a martingale. So the definition of martingale depends on the selected information set.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.