Real-time trading volume refers to the total trading volume of all

commodities, stocks, currencies, or other assets in the market during a specific

time period. It reflects the level of market activity and the level of interest

of traders in a particular asset.

Real-time trading volume is usually used to measure market liquidity. When

the trading volume is high, it means that there are a large number of purchase

and sale orders submitted in the market, there are more assets available for

trading, and the trading execution speed is faster. On the contrary, when

trading volume is low and market liquidity is low, trading execution may be

slower.

Real-time trading volume can also provide useful information, such as the

emotions and trends of market participants. A higher trading volume may indicate

that market participants have a strong interest in a particular asset and may

represent an upward or downward trend in the market. A lower trading volume may

indicate a lower interest among market participants in assets, which may

represent a sideways or wait-and-see trend in the market.

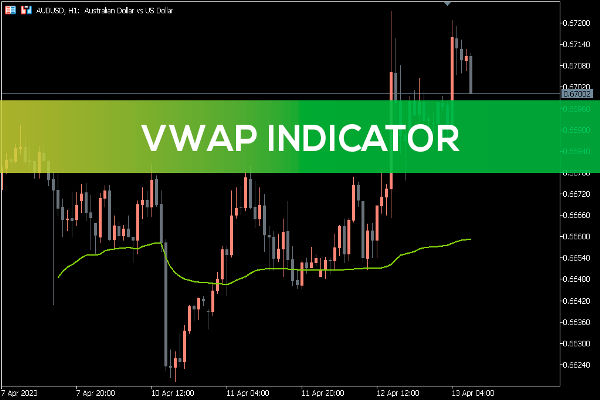

The statistical data of trading volume can be displayed through charts and

indicators, such as trading volume bar charts and trading volume weighted

averages. These tools can help traders analyze market trends and make

corresponding trading decisions.

Real-time trading volume is not a single indicator but an important piece of

data in the financial market. It is usually used in conjunction with other

indicators to provide a more comprehensive basis for market analysis and trading

decisions. For example, investors and traders may conduct comprehensive analysis

based on real-time trading volume, price trend, trading volume, trading volume,

trading volume, and other indicators to better understand the supply and demand

relationship, trading activity, and Market trend of the market.

At the same time, real-time trading volume can also be combined with other

behavioral and emotional indicators of market participants, such as investor

sentiment indices and market volatility indicators, to comprehensively evaluate

market risks and opportunities. Therefore, real-time trading volume is often

used in conjunction with other indicators in market analysis and trading

decisions to provide more accurate market judgments and trading strategies.

A common trading volume indicator is trading volume, which represents the

number of trade during a specific time period. Trading volume can display

the level of market activity and compare it with price trends, helping to

determine market trends and changes.

In addition, there are other trading volume indicators, such as the relative

strength index (RSI), trading volume bar chart, accumulation/distribution line,

etc. These indicators are calculated and analyzed based on trading volume data

to provide more market information and Trading signals.

In short, real-time trading volume refers to the sum of all trading volumes

in the market during a certain period of time, reflecting market activity, asset

liquidity, and the level of interest of traders. Different trading markets and

platforms may have their own trading volume indicators, so the specific

indicator used needs to be determined based on the actual situation.