Alpha and Beta, we may often hear these terms used by financial professionals, especially in measuring trading strategies. But what do these familiar Greek alphabet actually mean?

These two indicators are associated with Nobel laureate and finance professor William Sharpe.He is the"Sharp"himself in"Sharpe Ratio".In the 1960s,in a paper published by Sharp in the Journal of Finance,for the first time,the income of financial assets was divided into two parts:the part that fluctuates with the market is called beta income,and the part that does not fluctuate with the market,The part that has nothing to do with the market is called alpha return.

To facilitate everyone's understanding, a simple formula is written as follows:

Financial return on assets=alpha coefficient+beta coefficient * average market (or benchmark) return

In this short article, we will briefly introduce the role of Alpha and Beta in the investment field. Then, you can observe its performance during investment.

Key points:

Alpha displays the performance of individual assets or investment portfolios relative to the selected benchmark, and high alpha is always good.

Alpha shows how well (or poorly) stocks perform compared to the benchmark index.

The Beta value represents the volatility of Stock Prices compared to the entire market.

Investors in growth stocks may prefer high beta coefficients, but investors seeking stable returns and reducing risk tend to avoid high beta coefficients.

What is Alpha?

Alpha is the excess return of an investment (or entire investment portfolio) after adjusting for market volatility and random fluctuations. It is an indicator of investment performance based on risk adjustment.

Alpha is one of the five risk management indicators for mutual funds, stocks, and bonds. In a sense, it tells investors whether an asset's performance has consistently been better or worse than what Beta predicts.

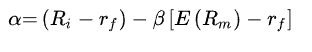

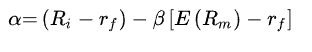

The calculation formula for Alpha coefficient is: Alpha coefficient=actual return on investment - Beta coefficient * (market risk-free interest rate - market return), which is:

If Alpha=0, it means that the asset's performance almost meets expectations and has achieved a return commensurate with the risk.

If Alpha> This means that its performance is superior to the market. An Alpha value of 5 indicates that the asset's performance is better than the benchmark by 5%

If Alpha

As you can see, high alpha is always good. It measures the risk-adjusted performance of related stocks, Securities, or investment portfolios.

That's why financial professionals, especially fund managers, like to talk about how to achieve "high alpha". This indicates that they are able to surpass the benchmark they have chosen.

By the way, what is Beta?

Simply put, Beta is an indicator of the volatility of a specific financial instrument, or systemic risk - a risk assessment tool that refers to the volatility of a security or investment portfolio relative to the overall market.

This volatility is measured relative to a specific benchmark, such as the comparison of a fund's volatility with the overall market volatility.

Therefore, Beta will tell us the inherent risk of the asset display relative to the selected benchmark.

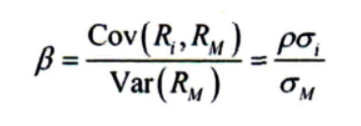

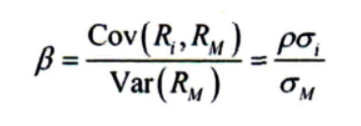

Beta is the covariance of fund returns and market portfolio returns divided by the variance of market returns, which is:

Among them, Cov (ra, rm) is the covariance between fund a's return and market return; It is the variance of market returns.

If β= 1. represents that the volatility of this fund remains consistent with the benchmark. So when the market rises by 5%, the fund also rises by 5%; The market fell by 5%, and the fund correspondingly fell by 5%.

If β& Gt; 1. This indicates that the volatility of this fund is greater than the benchmark. such as β= 2. When the market rises by 5%, the fund rises by 2 * 5%=10%; When the market drops by 5%, the fund will fall by 10%.

If β& Lt; 1. This indicates that the fluctuation range of this fund will be smaller than the benchmark. such as β= 0.5, when the market rises by 5%, the fund rises by 0.5 * 5%=2.5%; When the market drops by 5%, the fund will only fall by 2.5%.

For example, it can also be reflected in the stock market that during periods of good performance, high beta stocks often outperform the overall market. Similarly, when the stock market performs poorly, low betaStocks often outperform the market (because they have a smaller decline).

Let's use some examples of US stocks:

The Beta value of Alphabet (Google) is 1.03. This means that its volatility is very close to that of the S&P 500 index.

tesla's Beta value is 1.89. This means that its volatility is 89% (almost double) of the benchmark index.

The Beta value of GameStop is -1.79. This means that when the index falls, it often rises, and vice versa. And the volatility is also 79% higher than the benchmark.

At this point, you may have noticed that when calculating Beta, it is important to pay attention to the benchmark being used. Changing the baseline will change your Beta value.

For example, if the Beta value of an asset is relatively low relative to a very unstable benchmark value, it may still be unstable in itself. The reverse is also true.

The Beta coefficient reflects the sensitivity of a fund to market changes, and can also be said to be the correlation between individual stocks and the market, or commonly referred to as "stock characteristics". Funds with different Beta coefficients can be selected based on market trends to obtain additional returns, making them particularly suitable for band operations.

When predicting with great confidence the arrival of a bull market or a certain stage of a major uptrend in the market, you should choose funds with high beta coefficients, which will amplify market returns and bring you high returns; On the contrary, when a bear market or a decline stage of the market arrives, you should adjust your investment structure to resist market risks and avoid losses by choosing funds with low beta coefficients.

Risk Reminder and Disclaimer: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.