A contract for price difference is actually a contract between the buyer and the seller regarding the price difference. The contract stipulates that the seller pays the difference between the contract price and the settlement price of a certain commodity to the buyer in cash (if the price difference is negative, the buyer needs to pay the seller), and the entire process does not involve transactions with the entity of the commodity, Therefore, we can also say that this is an investment behavior completed by calculating the difference between the opening value and closing value of a certain commodity.

The trading mechanism of price difference contracts

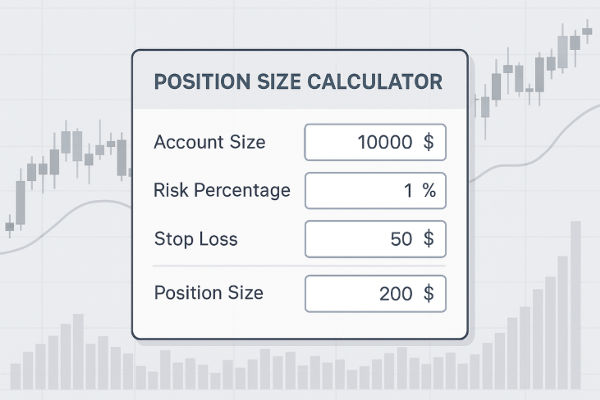

The general trading method of price difference contracts is for customers to pay a certain amount of margin to market makers or brokers according to the agreement, in order to ensure that the transaction has the ability to resist risks, and to trade and settle according to the agreed trading price and settlement price pricing method. During trading, the market maker or broker freezes a certain proportion of the margin in the customer's margin account according to the agreed transaction volume, while the remaining portion is provided with credit support by the market maker or broker for financing or short selling. During the period when customers hold trading contracts, interest gains and losses will be deducted from the margin (or added to the total equity fund).

A contract for price difference is a non deliverable contract, which means that the underlying goods in the contract will not be physically delivered, and only cash settlement of the price difference will be made during settlement. Therefore, a contract for price difference has no term. The settlement price will be settled according to the market value at the time of settlement. At this time, if the purchase price plus interest gain/loss of the goods traded by the customer is lower than the selling price, there will be profits, otherwise there will be losses. The profit and loss of a transaction are settled based on the transaction size of the contracted commodity, so the amount of profit and loss for the margin of a customer's transaction will be expanded.

Calculation method for price difference contracts

1、 T+0 stock calculation method

In the T+0 stock price difference contract, stocks are traded in RMB but settled in US dollars, with a unit price of 0.01 for stock fluctuations and a unit price of 100 RMB for stock fluctuations. The transaction adopts a unit of hands, with one hand representing 10000 shares. For example, if one hand purchases a 10 yuan RMB stock, a 20 yuan leverage (5% margin) model is used.

1. Calculation of frozen guarantee amount

The required amount for placing an order is 10000 shares in one hand, with a stock price of X10 yuan and a stock price of X5%=5000RMB. As most of the investment company's servers are registered abroad and traded in US dollars, the exchange rate is 6.468 to convert them into US dollars, which is 773.04 USD.

2. Handling fee calculation (generally 4.5 ‰ for orders and 1.5 ‰ for sales)

When placing an order, the handling fee is 10000 shares per hand, X10 yuan, and the stock price is X4.5 ‰=450RMB (converted to 69.57 USD in US dollars at the 6.468 exchange rate)

At the time of sale, the handling fee is 10000 shares per hand, and the stock price is X10 yuan. The stock price is X1.5 ‰=150RMB (converted to USD at the exchange rate of 6.468, which is 23.19 USD, and the minimum fee for the investment company is 50 USD).

3. Profit and loss calculation

Calculated at a price of 0.5RMB for a 10 yuan stock, 0.5RMB is 50 units, equivalent to a profit and loss of 5000RMB (converted to USD 773.04 at the exchange rate of 6.468).

2、 Calculation method for international spot gold and silver

Spot gold and silver are traded in US dollars and settled in US dollars, with each hand as the unit. The deposit for one hand of gold and silver is a fixed 1000USD. Generally, the gold handling fee for an investment company is 50USD per hand, with a spread of 50 points equivalent to 50USD; Silver has no handling fee, but there is a difference of 5 points, with a difference of 100 USD per point.

If the gold price on the US Stock Exchange is 1174 USD, the next gold handling fee is 100 USD, which is equivalent to a loss of 100 USD after placing an order in the account.

If the price of silver on the US Stock Exchange is 12 USD, the next silver handling fee is 500 USD, which is equivalent to a loss of 500 USD after placing an order in the account.

【 EBC Platform Risk Reminder and Disclaimer 】: There are risks in the market, and investment needs to be cautious. This article does not constitute investment advice.