Weekend trading is gaining popularity among active investors who want to seize opportunities beyond the traditional Monday-to-Friday market hours.

While most global stock exchanges close for the weekend, several dynamic markets remain open, offering traders the chance to react to news, hedge positions, or simply keep their strategies active. Here are five markets you can access for weekend trading right now.

4 Markets for Weekend Trading

1. Forex Markets

While the interbank forex market is officially closed on weekends, some brokers offer limited weekend forex trading. These platforms provide access to major currency pairs, allowing traders to hedge positions or speculate on price gaps that may occur when the market reopens.

Key points:

Weekend forex trading is typically available as CFDs (Contracts for Difference).

Liquidity may be lower, and spreads can be wider than during the week.

Useful for managing risk or reacting to geopolitical events that break over the weekend.

2. Gold and Silver CFDs

Precious metals like gold and silver are popular safe-haven assets, and some brokers offer weekend trading via CFDs. This enables traders to take positions in response to global news, central bank announcements, or geopolitical developments that might impact metal prices.

Benefits:

Ability to hedge against market shocks outside regular hours.

Gold and silver often move on macroeconomic headlines, making weekend trading attractive for active traders.

CFDs allow for both long and short positions, increasing flexibility.

3. Oil and Energy Commodities CFDs

Oil and other energy commodities can be traded as CFDs on certain platforms during the weekend. Price movements may be influenced by OPEC meetings, geopolitical tensions, or unexpected supply disruptions, all of which can occur outside standard trading hours.

Why consider oil and energy CFDs on weekends?

React to breaking news or sudden changes in supply and demand.

Diversify your trading portfolio with commodities exposure.

Take advantage of volatility when traditional markets are closed.

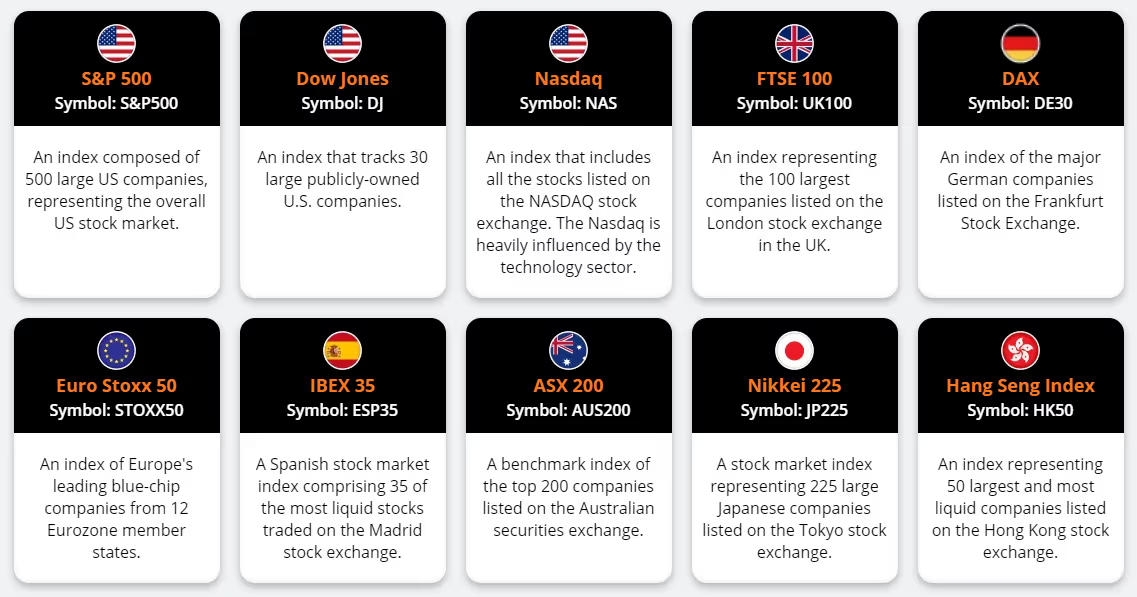

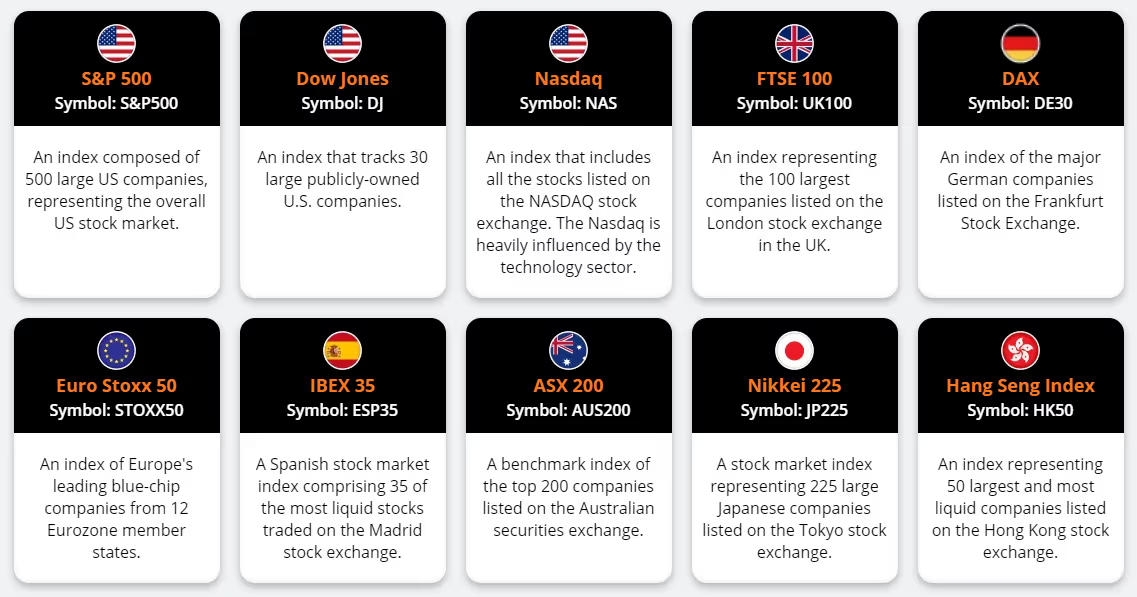

4. International Stock Indices CFDs

Some brokers offer weekend trading on major global indices such as the Dow Jones, Nasdaq, FTSE, or Nikkei via CFDs. This can be particularly useful for traders who want to anticipate Monday's market open or hedge positions ahead of key events.

Key features:

Trade index CFDs even when underlying exchanges are closed.

Useful for managing risk or speculating on global macro events.

Weekend price movements can provide early signals for the week ahead.

Tips for Successful Weekend Trading

Check broker availability: Not all brokers offer weekend trading for every asset, so review what's available on your chosen platform.

Be mindful of liquidity: Spreads may be wider and liquidity lower during weekends, so adjust your position sizes and risk management accordingly.

Stay informed: Monitor global news and events, as weekend markets can be highly sensitive to unexpected developments.

Use stop-loss orders: Protect your capital from sudden price swings, especially in volatile markets like crypto and commodities.

Conclusion

Weekend trading opens up a world of opportunity for proactive traders. Whether you're interested in select forex pairs, precious metals, energy commodities, or global indices CFDs, there are several markets open for business even when the world's major exchanges are closed.

Explore EBC's platform to see which market fits your strategy and take your trading to the next level—seven days a week.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.