Price action trading is a method that strips trading back to its most essential element: the movement of price. Rather than relying heavily on technical indicators or complex algorithms, traders who follow price action trading focus purely on price behaviour over time. Candlestick formations, trend lines, and support or resistance levels all provide signals that traders use to make informed decisions.

Understanding the top strategies used in price action trading can give any trader, novice or advanced, a clearer insight into market psychology and potential entry or exit points.

Understanding the Foundations of Price Action

At the heart of price action trading is the belief that all necessary information about a market is reflected in its price. Traders observe the chart and analyse recent highs and lows, candlestick formations, and market structure to predict future movements.

This form of analysis eliminates the lag caused by most technical indicators and allows for a more immediate response to market changes. Because it focuses on what the price is doing now rather than what it did previously, price action trading is considered a real-time method of interpreting the market.

The Pin Bar Strategy: Spotting Reversals Early

One of the most widely used strategies in price action trading is the pin bar setup. A pin bar, or "price rejection bar", is characterised by a small body and a long wick in one direction. This pattern suggests that the market rejected a certain price level and could be about to reverse.

Traders look for pin bars that form at key support or resistance levels, as these areas often attract strong reactions from market participants. Once a pin bar is identified, traders typically enter a trade in the direction opposite to the wick, expecting a reversal.

The Inside Bar Strategy: Waiting for the Breakout

Another effective approach in price action trading is the inside bar strategy. An inside bar is a candle that is completely contained within the range of the previous candle. It represents consolidation and a temporary pause in market movement.

Traders use inside bars as a signal that a breakout may soon follow. The key to success with this strategy is identifying inside bars that form at important price levels or during strong trends. Once the market breaks above or below the inside bar's range, it often leads to a sharp move, providing an opportunity for entry.

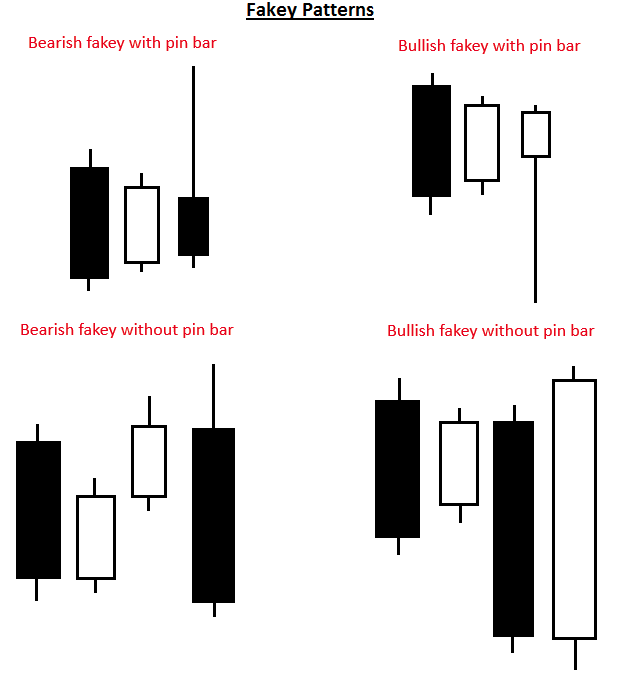

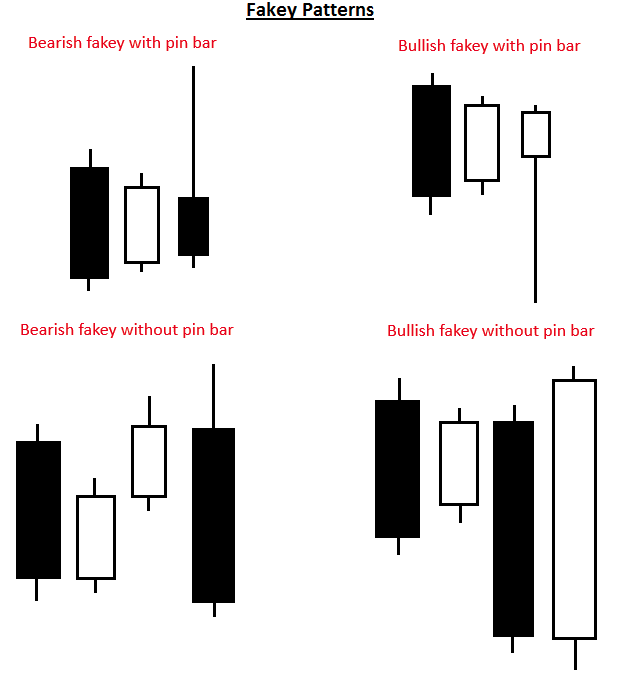

The Fakey Pattern: Outsmarting the Market

The fakey setup is a more advanced strategy used in price action trading. It involves a false breakout from an inside bar, followed by a rapid move in the opposite direction. This pattern often traps traders who entered too early, providing a perfect setup for those waiting for confirmation. Recognising a fakey pattern requires patience and careful observation of how price reacts to certain levels.

When a false breakout is confirmed, traders look to enter in the direction of the reversal, using the failed breakout as a signal that the market sentiment has shifted.

Support and Resistance Levels: The Building Blocks

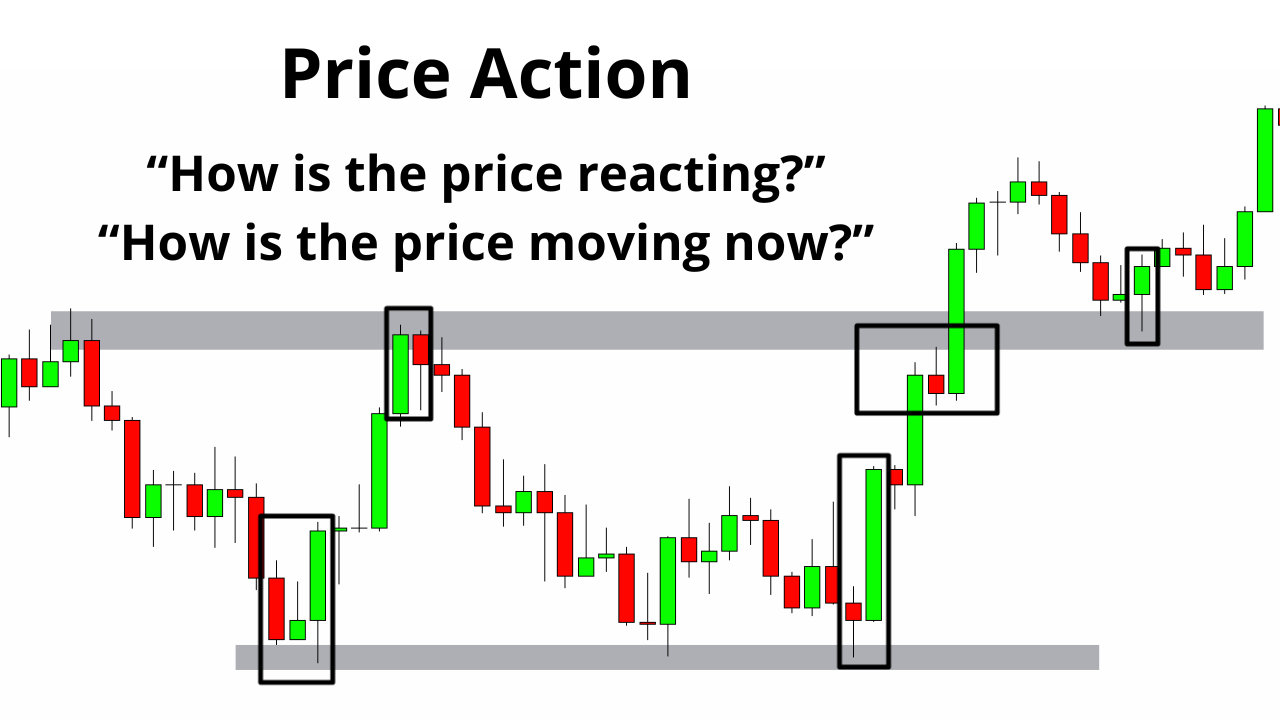

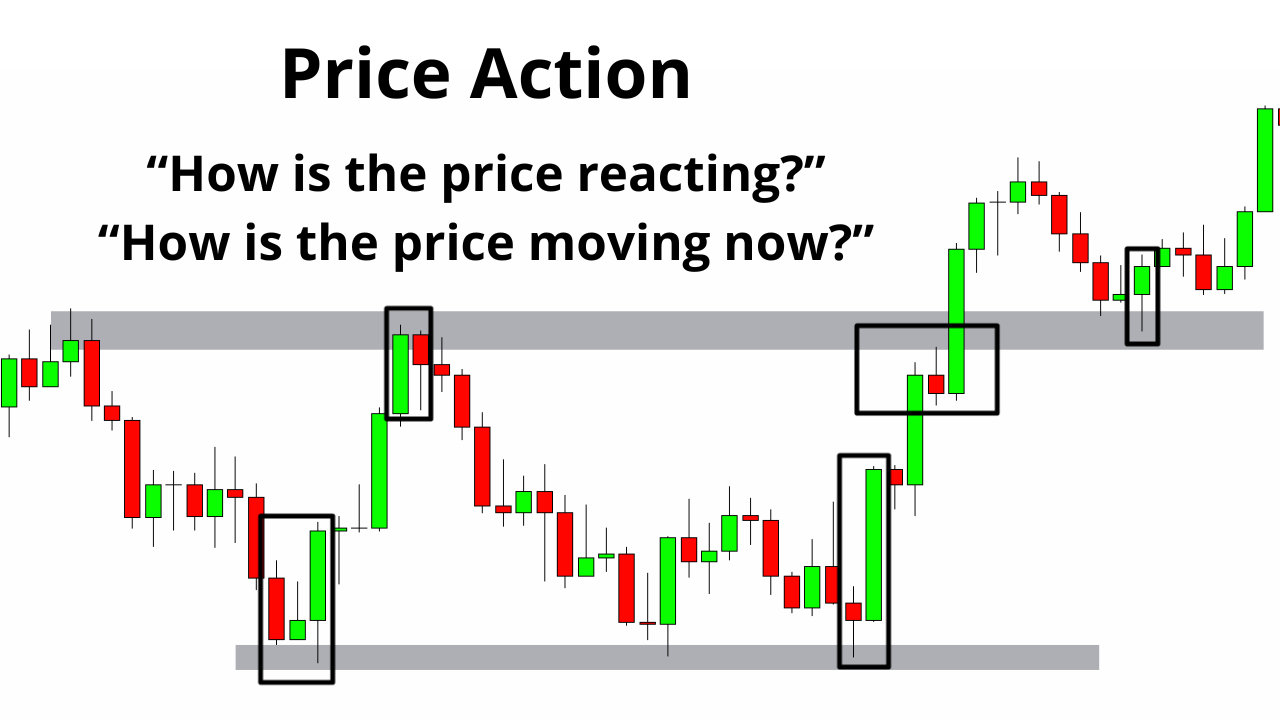

Support and resistance levels form the foundation of nearly every price action trading strategy. These levels indicate where price has previously reacted, either reversing direction or pausing. Traders use these levels to anticipate future reactions.

For example, if price approaches a level that has acted as support multiple times in the past, it may again find buyers at that point. Similarly, resistance levels often attract sellers. Traders mark these areas on their charts and look for price action confirmation, such as a pin bar or inside bar, before placing a trade.

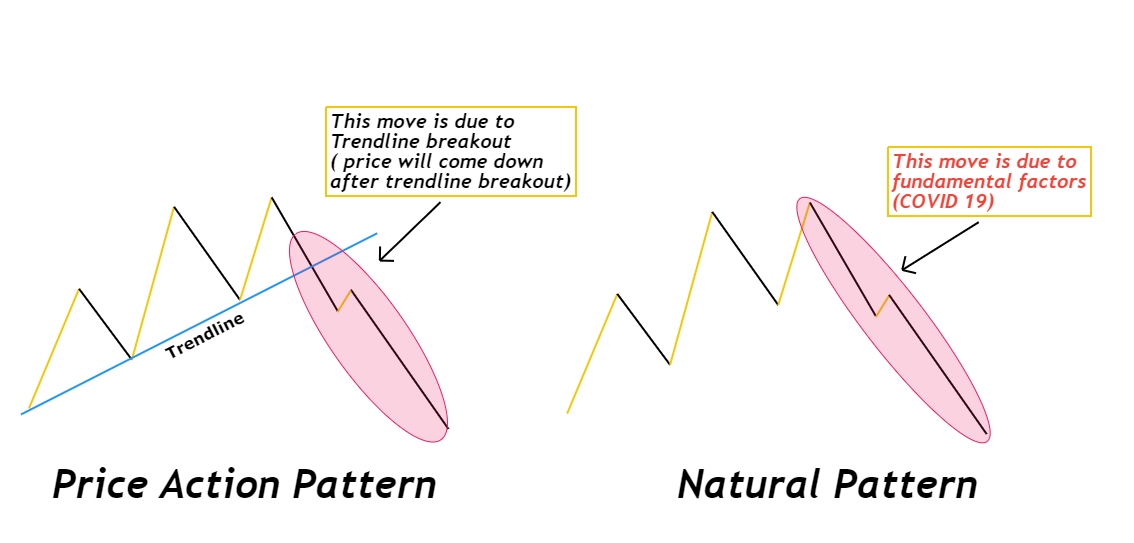

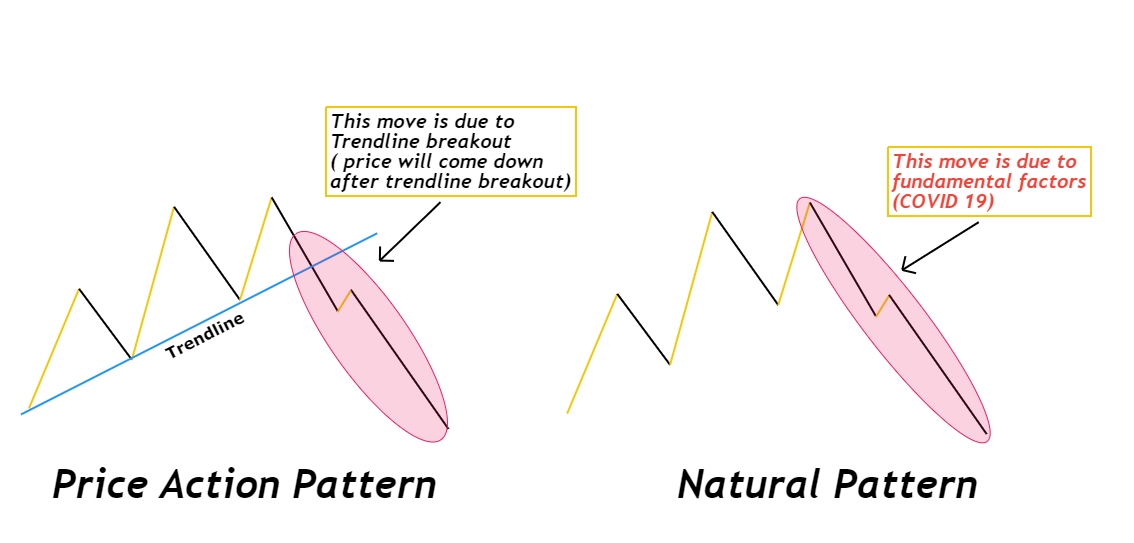

Trend Line Analysis: Following the Path of Least Resistance

Trend lines are a key component in many price action trading strategies. Drawing a trend line involves connecting a series of higher lows in an uptrend or lower highs in a downtrend. These lines act as dynamic support or resistance and help traders visualise the market's direction.

When price bounces off a trend line, it often signals a continuation of the current trend. Traders use trend lines to time entries, place stop-loss levels, and set targets, always watching how price interacts with these lines during live trading sessions.

Combining Strategies for Better Confirmation

One reason price action trading is so effective is that it allows for the combination of multiple strategies. For example, a pin bar forming at a key support level or along a trend line carries more weight than a pin bar appearing randomly on the chart.

Similarly, if an inside bar forms after a strong trending move, followed by a breakout, the trade has a stronger likelihood of success. By combining strategies and watching for multiple confirmations, traders can reduce false signals and improve their risk-to-reward ratio.

Why Price Action Trading Appeals to Many Traders

The simplicity and clarity of price action trading make it an appealing method for many traders. It does not rely on lagging indicators, which can delay decisions or cloud judgement. Instead, price action trading empowers traders to read the raw movement of the market and make logical decisions based on current conditions.

This method also works across all timeframes and markets, from forex and stocks to commodities and indices. The flexibility, combined with a focus on discipline and patience, is what makes price action trading a cornerstone of many successful trading strategies.

Conclusion

Mastering price action trading takes time, focus, and repetition. Learning to read candlestick patterns, understand market structure, and identify key price levels is a skill developed through consistent practice. While it may seem simple on the surface, the best traders understand the nuance behind each move and adjust their approach based on context.

By applying the top strategies used in price action trading and sticking to a well-developed trading plan, traders can navigate the markets with greater confidence and clarity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.