Tonix Pharmaceuticals Holding Corp. (NASDAQ: TNXP) has garnered significant attention in 2025, with investors keenly observing its stock performance and future prospects.

As of April 29, 2025, TNXP stock trades at $17.03 per share, reflecting a 4.43% decline from the previous day.

Despite recent volatility, analysts and investors are evaluating whether TNXP can offer substantial returns in the coming months.

TNXP Stock Financial Overview

In 2024, Tonix reported net sales of $10.1 million, primarily from its migraine product line. The company ended the year with approximately $98.8 million in cash and cash equivalents, a decrease from the previous year's $102.0 million. Operating expenses totalled around $60.9 million, down from $102.0 million in 2023, indicating improved cost management. Capital expenditures were significantly reduced to $0.1 million from $29.1 million the prior year.

Tonix remains debt-free, having repaid its facility mortgage. They anticipate that its cash reserves, $30.4 million raised through an at-the-market offering in Q1 2025, will fund operations into the first quarter of 2026.

For 2025, the company is expected to report approximately $91.1 million, with revenue projections of around $71.4 million. While these figures indicate ongoing investments in research and development, they also highlight the company's commitment to advancing its pipeline.

TNXP Stock Forecast 2025: Expert Analysis

1) Technical Analysis and Financial Projection

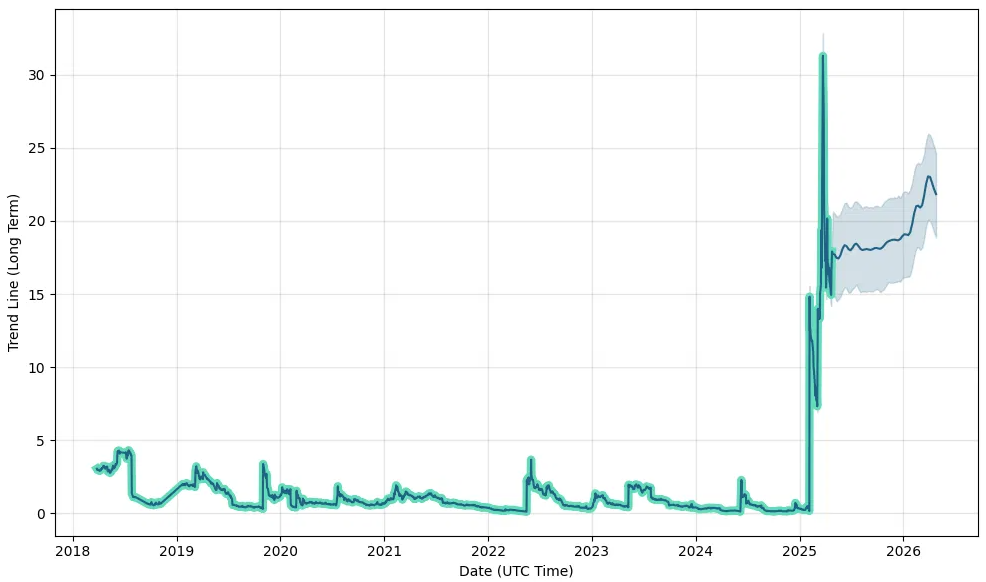

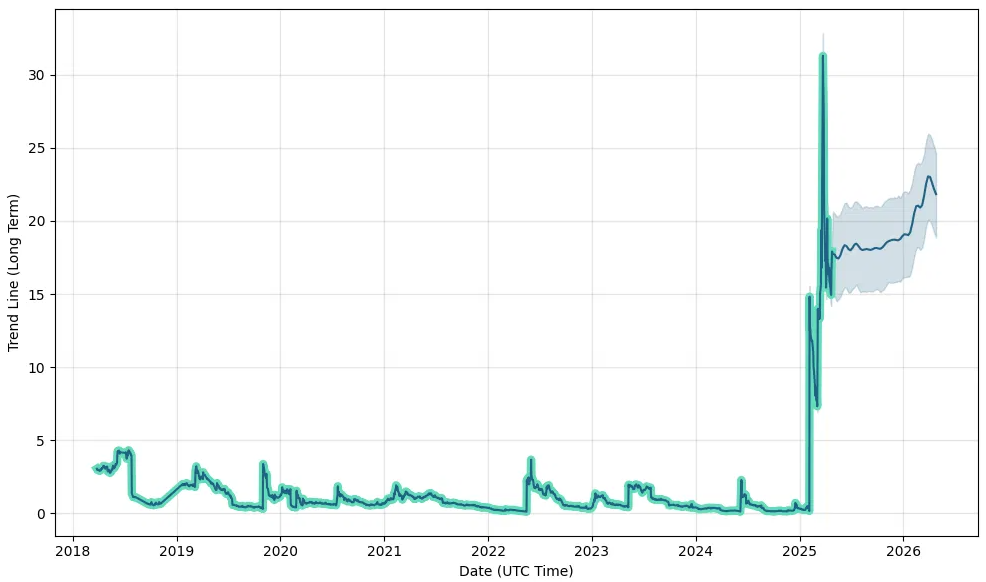

From a technical standpoint, TNXP has experienced notable volatility. The stock's price fluctuated between $16.71 and $17.66 on April 28, 2025. Despite short-term fluctuations, the stock lies in the middle of a broad rising trend, suggesting potential for future gains.

CoinCodex's analysis indicates that TNXP will trade between $16.84 and $17.02 throughout 2025, with an average annualised price of $16.91. While this suggests modest short-term movement, long-term prospects remain tied to clinical and regulatory milestones.

Looking forward, analysts forecast significant revenue growth, with projections reaching $635.1 million in 2026 and $846.2 million in 2027. Such growth is contingent upon successful clinical trial outcomes and subsequent product approvals.

2) Analyst Ratings and Long-term Stock Forecast

Analyst sentiment towards TNXP is predominantly positive. According to Public.com, 71% of analysts rate the stock as a "Strong Buy," while the remaining 29% recommend a "Buy," with no analysts suggesting a "Hold" or "Sell." The consensus price target is $17.21, closely aligning with the current trading price.

However, some analysts project more optimistic scenarios. TradingView reports a price target of $70.00, indicating a potential upside of over 300% from current levels. Such projections are based on anticipated advancements in Tonix's clinical trials and potential FDA approvals.

For example, StockScan projects an average price of $2,984.15 in 2025, with potential highs reaching $3,277.07. Such projections imply a staggering increase from current levels, though they should be approached cautiously due to inherent uncertainties in biotech developments.

Similarly, Fintel reports an average one-year price target of $414.80, with estimates ranging from $50.50 to $1,155.00. These wide-ranging forecasts underscore the speculative nature of investing in clinical-stage biotech firms.

Why Experts Project a Positive TNXP Stock Forecast

Tonix's lead candidate, TNX-102 SL, is a sublingual formulation of cyclobenzaprine HCl intended for treating fibromyalgia. The FDA has accepted the New Drug Application (NDA) for TNX-102 SL, assigning a Prescription Drug User Fee Act (PDUFA) goal date of August 15, 2025. If approved, TNX-102 SL would be the first new fibromyalgia treatment in over 15 years, addressing a significant unmet medical need for the estimated 10 million U.S. adults affected by the condition.

Beyond TNX-102 SL, Tonix is advancing TNX-1500, a monoclonal antibody targeting organ transplant rejection, showing positive Phase 1 results. Additionally, TNX-801, a potential mpox vaccine, has received government grant funding and demonstrated promising preclinical data.

The company also secured a Department of Defense contract worth up to $34 million for developing broad-spectrum antivirals over five years.

Risks and Considerations

Investing in TNXP carries several risks:

Clinical Trial Outcomes: The success of Tonix's pipeline depends on positive clinical trial results.

Regulatory Approvals: FDA approvals are critical for commercialisation.

Market Competition: The biotech sector is highly competitive, with numerous firms targeting similar indications.

Financial Sustainability: Ongoing R&D expenses may necessitate additional funding.

Conclusion

In conclusion, Tonix Pharmaceuticals presents a compelling, albeit speculative, investment opportunity. The company's strong cash position, debt-free status, and diversified pipeline provide a solid foundation for potential growth.

While the stock has experienced volatility, the upcoming FDA decision represents a critical point that could significantly impact Tonix's financial performance and investor returns.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.