Since Russia's invasion of Ukraine, it has caused turmoil in global financial markets. As tensions in Ukraine continue to escalate, the Russian financial market is facing increasing isolation and economic sanctions.

As one of the world's largest energy producers, Western sanctions against Russia may seriously disrupt economies around the world.

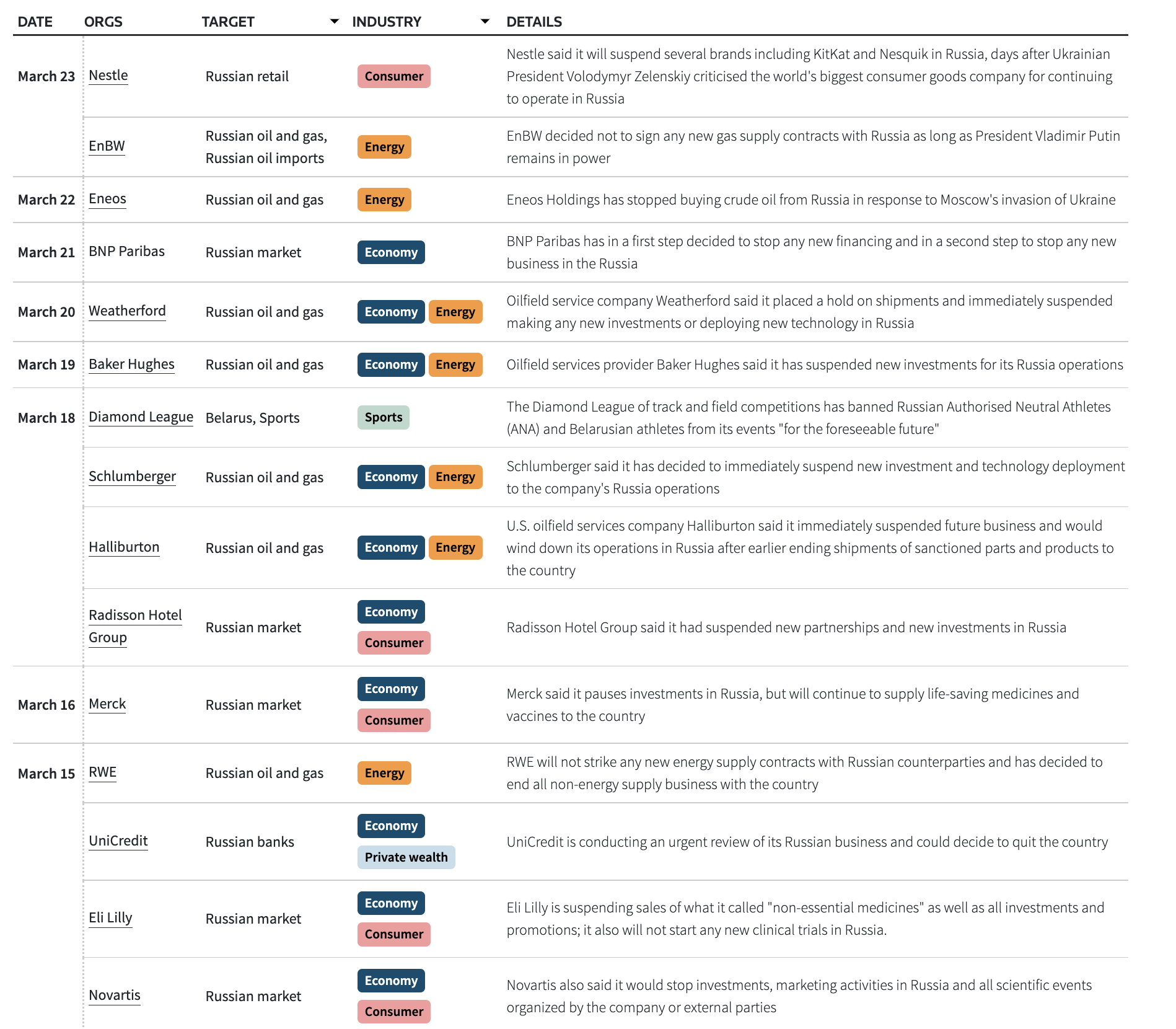

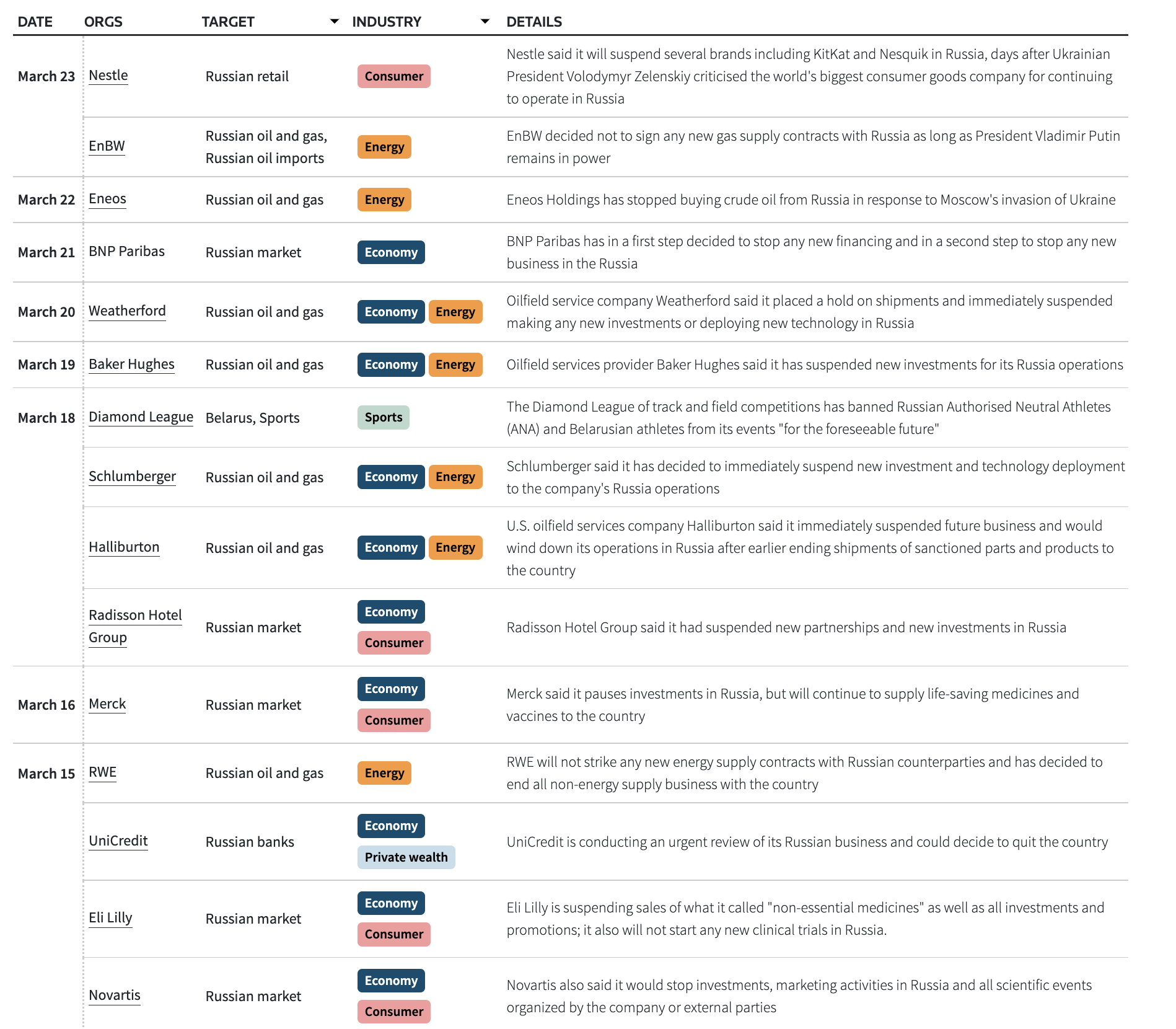

Reuters is tracking government sanctions and actions taken by major groups and organizations around the world against Russia before and after its invasion of Ukraine

Since the outbreak of the Covid-19 pandemic in March 2020, stocks and commodities have been experiencing unprecedented fluctuations.

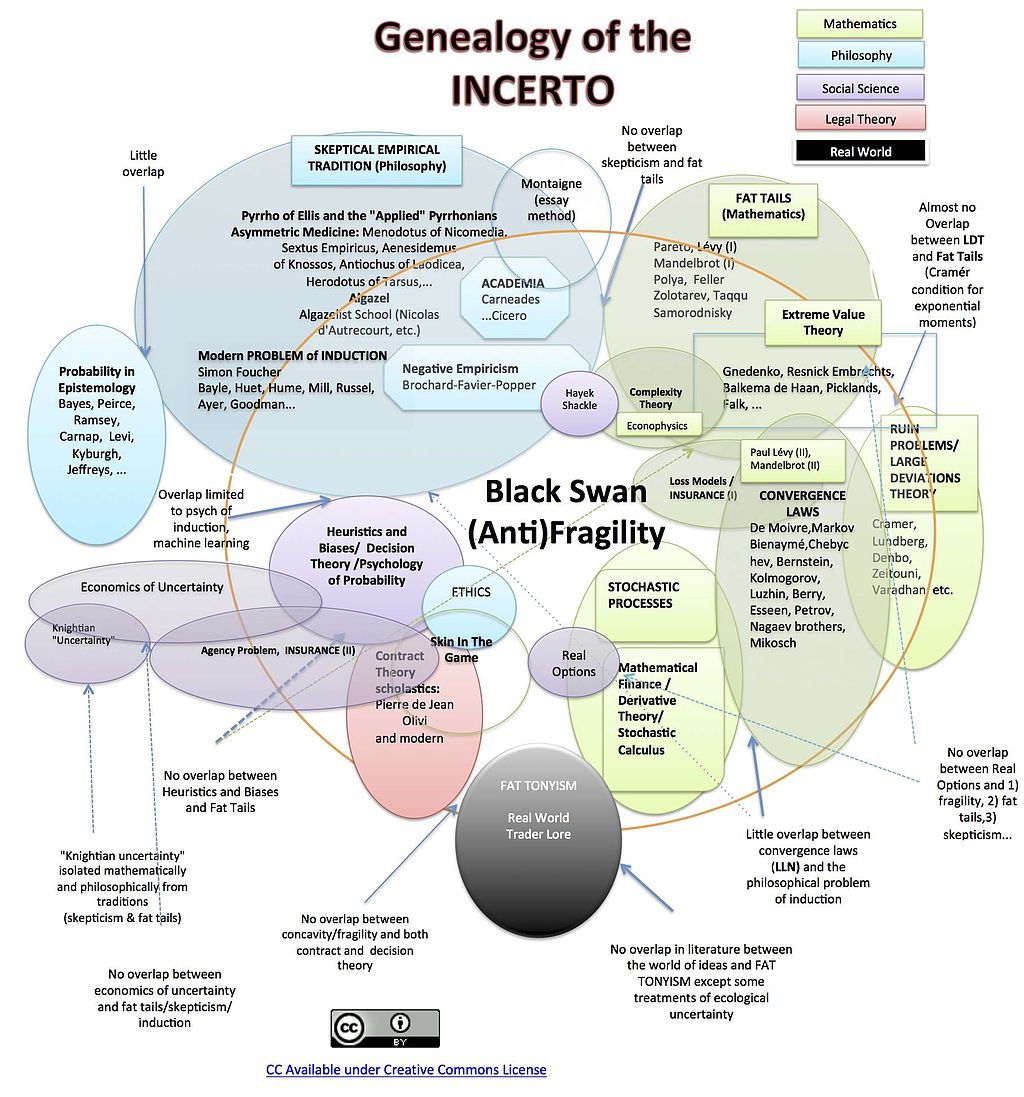

Some people refer to the current situation as the 'Black Swan' incident, which means it may cause serious damage to the entire market. What will be the future direction of the financial market in an uncertain market situation?

EBC will attempt to answer this question in this article.

What is the Black Swan Incident?

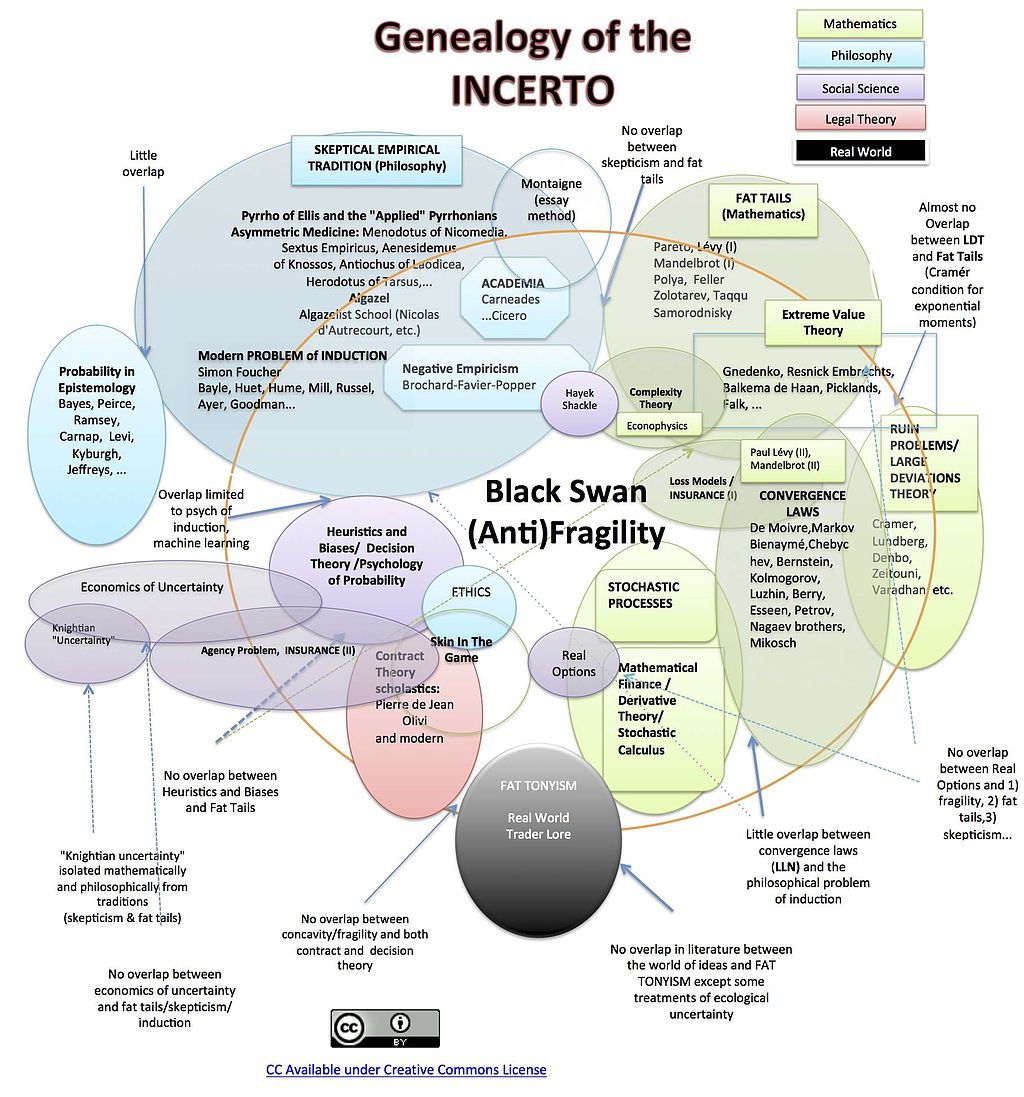

For those unfamiliar with it, the black swan is an unexpected phenomenon that exceeds people's general expectations of a certain situation and may have a significant impact. The Black Swan incident was led by finance professor NassimProposed by Nicholas Taleb.

Taleb coined the term after experiencing the civil war in Lebanon. This conflict sparked a dispute among Maronite Christians, Sunni Muslims, Shia, Druze, and Syrians, which lasted for fifteen years and resulted in 90000 deaths.

In 2008For example, Taleb described the Black Swan event as an event that could not be predicted in advance and could have a profound impact on the entire market. Therefore, Taleb believes that investors should consider the possibility of the Black Swan incident and develop plans in advance.

The COVID-19 and the Russia Ukraine war subvert the concept of globalization and push the world into division

A woman passes by a closed Louis Vuitton store in Moscow. After Russia invaded Ukraine, many US and European countries ceased their operations in Russia.

At the end of the Cold War in Washington, governments and businesses around the world believed that strengthening global economic ties would bring greater stability. But the Ukrainian war and pandemic are pushing the world in the opposite direction, overturning these concepts.

US and European officials are now using sanctions to cut off the main part of the Russian economy from global commerce, and hundreds of Western companies have voluntarily stopped doing business in Russia - the 11th largest economy in the world.

The war between the two countries may spiral out of control and cause serious damage to the global economy.

As the world's largest economy, the United States has experienced supply chain disruptions due to the pandemic in the past 18 months.

Similarly, in what later became known as the 'big resignation wave', employees began to leave in droves, leading to wage increases in various industries.

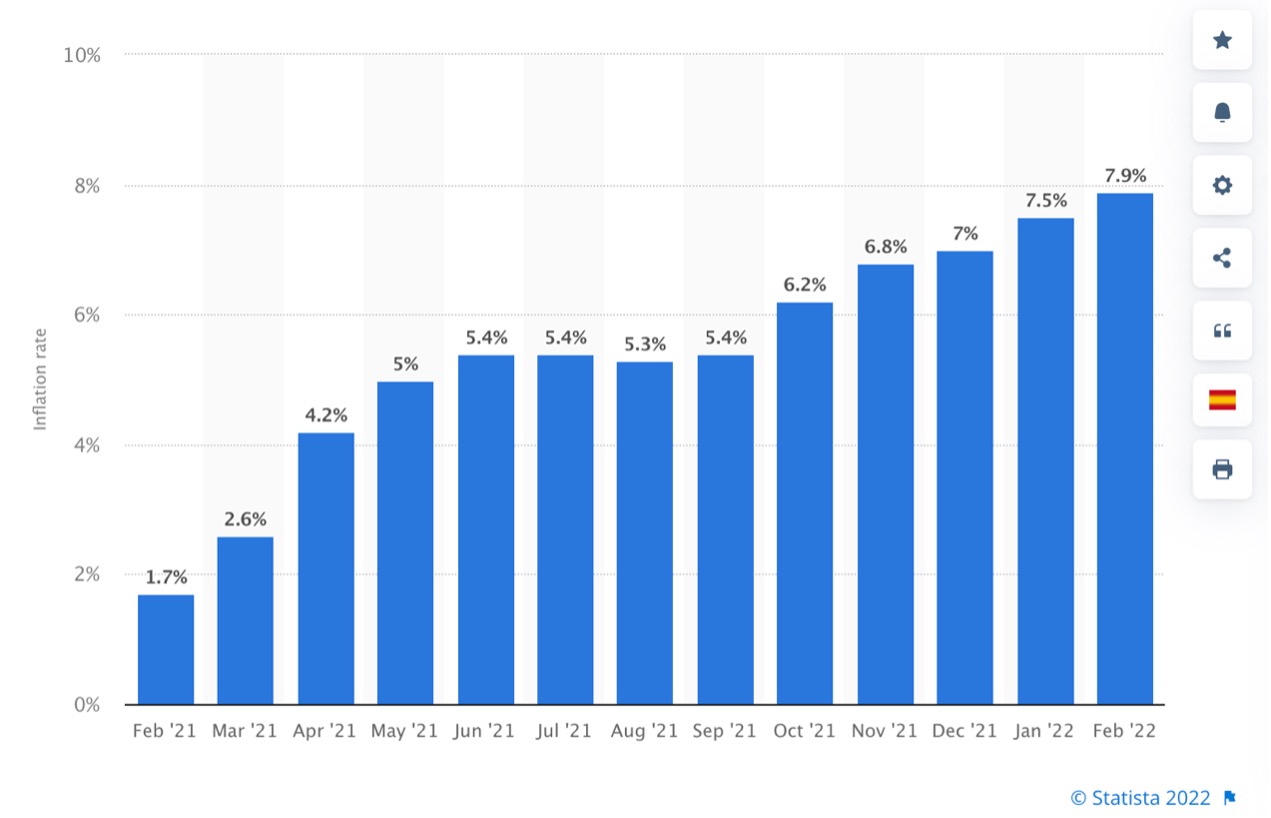

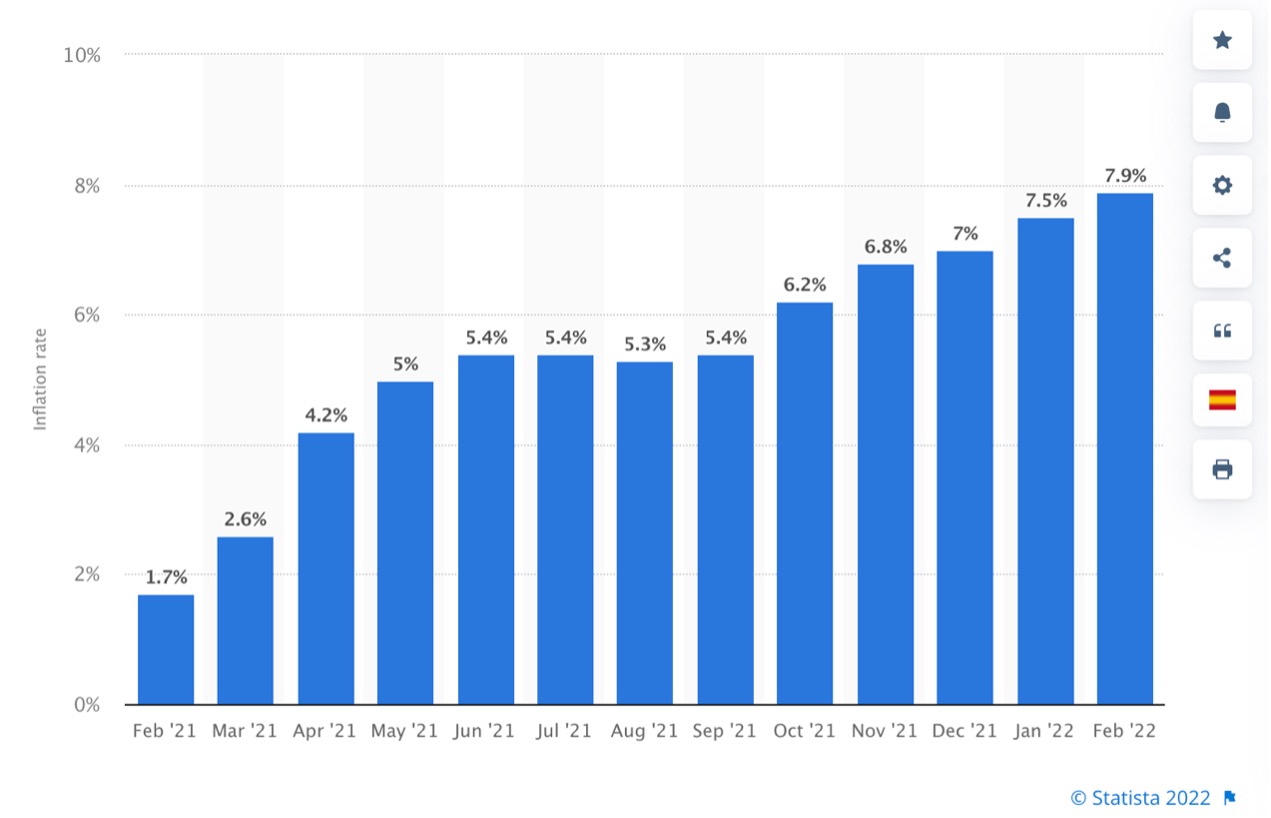

Currently, inflation is still at a record high, commodity prices are skyrocketing, and "real" growth seems to be slowing down. The market began to plummet in November, and it is expected that the Federal Reserve will adopt a hawkish policy this year (expected to raise interest rates by 7%)But the worst moment has not yet arrived.

Monthly Inflation rate in the United States from February 2021 to February 2022

Wars and conflicts may have profound impacts, not only in Europe, but also around the world

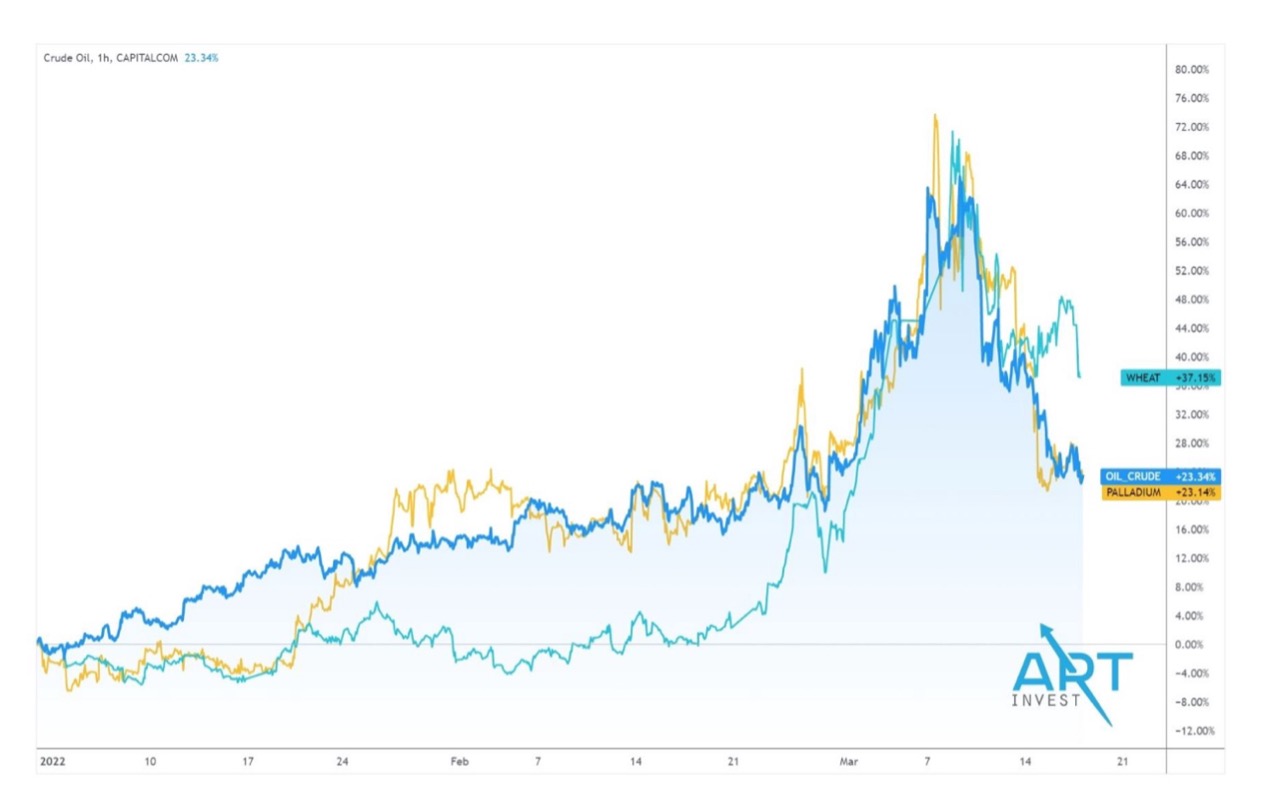

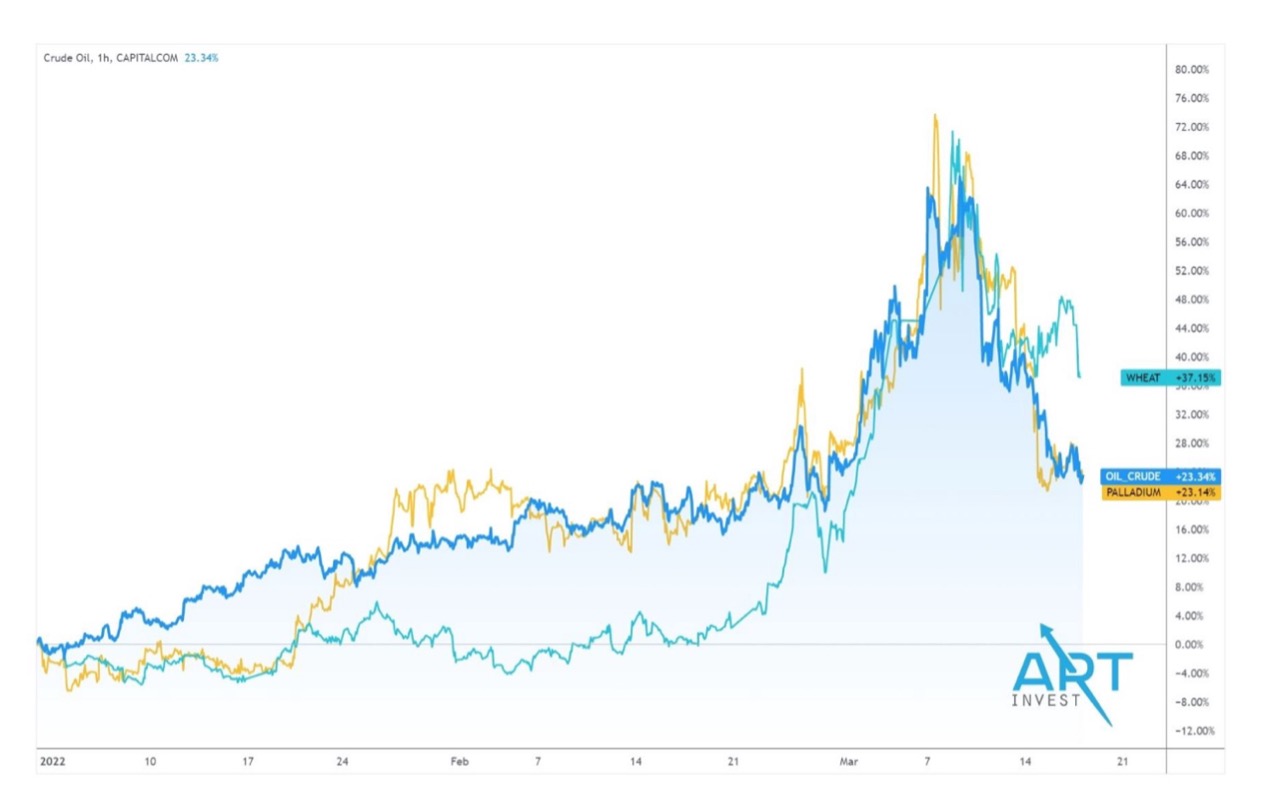

Due to the sanctions imposed by the United States and Europe on Russia and the invasion of Ukraine, raw material prices have skyrocketed to multi-year highs. These two countries account for nearly a quarter of global wheat exports, and prices have increased by 40% since the beginning of the war.

In addition, other commodities such as corn and sunflower oil, as well as Precious metals such as palladium, nickel and aluminum, have seen significant investment in the past two months.

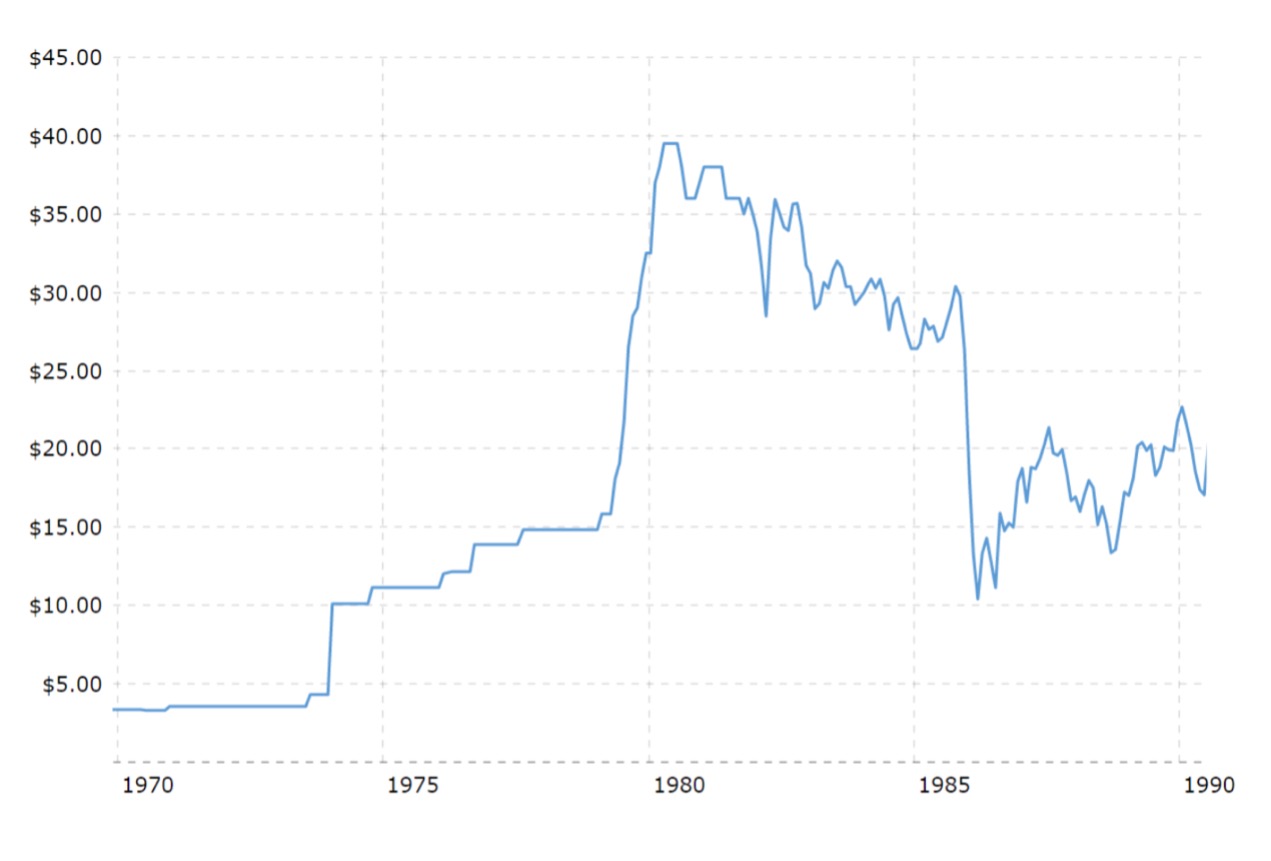

The biggest damage caused by conflicts may be in the energy sector. Moscow is one of the world's largest oil exporting countries, exporting approximately 7.5 million barrels per day.

The sanctions imposed by the United States and its allies on the Russian banking system have triggered a fierce reaction from banks, buyers, and transporters towards Russian oil. About two-thirds of Russian oil is still struggling to find buyers, and if this is not the case, Crude Oil prices may hit a barrel by the end of this year185 US dollars (the price briefly hit 140 US dollars last week, and then fell due to the domestic epidemic lockdown).

Black swan or is history repeating itself?

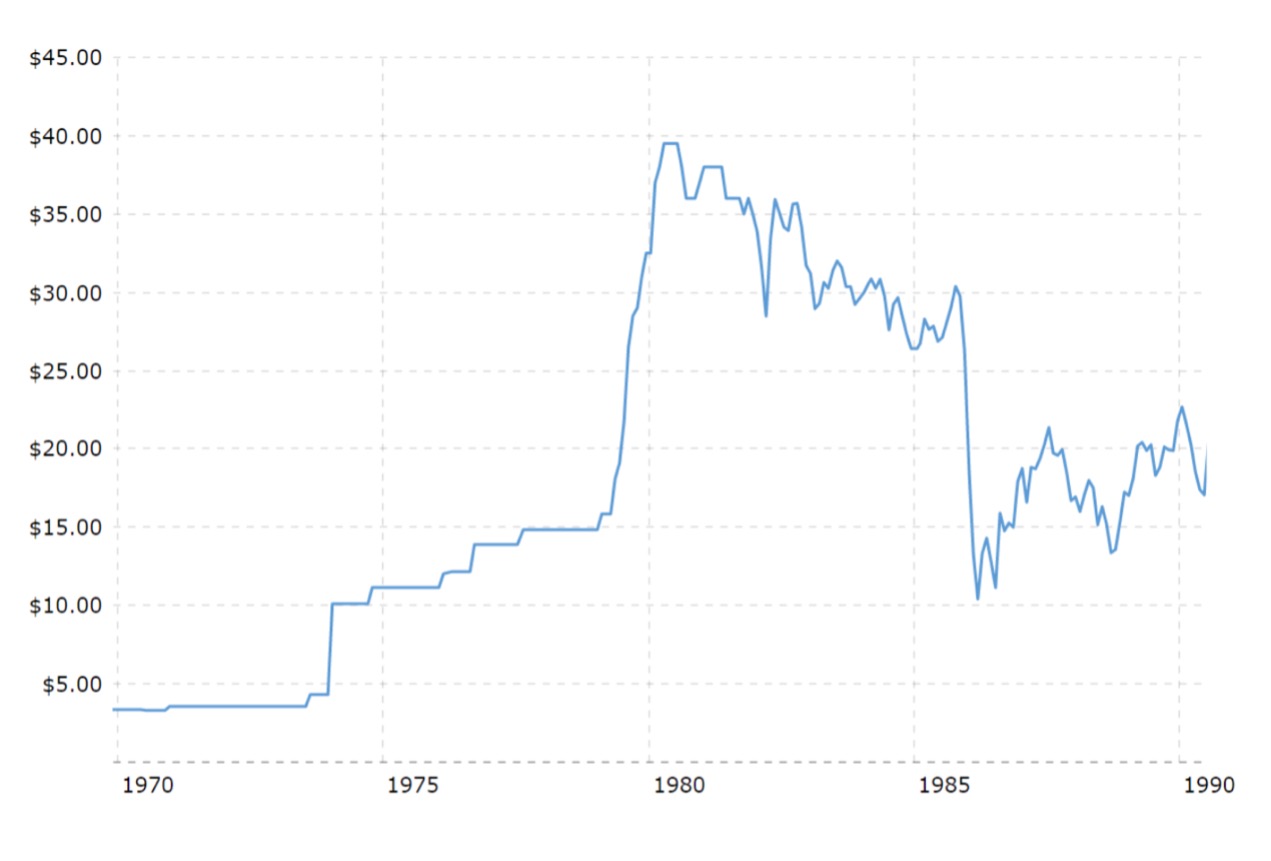

The rise in commodity prices after Russia's invasion of Ukraine established an interesting connection between the 2020 and 1970s.

The conflict in Eastern Europe may have economic effects similar to the oil embargo five years ago. This means that reducing inflation will be a slower and more painful process than policymakers initially expected.

The current scenario is similar to the macroeconomic conditions of the late 1960s and early 1970s. At that time, inflationary pressure was accumulating, mainly driven by high government spending and rapidly rising wages.

Then, in 1973In, OPEC banned the United States from exporting oil on the grounds of its participation in the Arab Israeli War. As a result, oil prices have skyrocketed. However, as it occurs at a time when inflationary psychology has already risen, it has contributed to the consolidation of expectations of rising prices.

How will the current crisis proceed?

In the short term, as long as the current crisis continues to occur, market participants can expect significant fluctuations.

Goldman Sachs predicts that the combined impact of economic sanctions and military losses may force President Putin to step down with a 5% to 10% probability.

Such an event may lead to a rebound in the entire stock market (between 10-15%), especially in high growth technology stocks that have been sluggish over the past month.

However, the most likely scenario is to maintain the status quo, where the ongoing economic measures of the current sanctions weaken the opportunity to continue invading Ukraine. It is expected that this will lead to increased inflation in the short term, especially in commodities such as oil, wheat, and corn, as well as metals such as nickel (prices rose last week)90%, trading temporarily suspended) and palladium.

The last unlikely but highly likely scenario (estimated by experts to be 1%) is to end the war through nuclear weapons. This situation will cause serious damage and destroy financial markets globally.

Although the possibility of World War III is still very small, Putin has warned that countries assisting Ukraine in the current conflict will face unprecedented consequences.

The current crisis in Ukraine may be worrying, but in the long run, financial markets generally overlook geopolitical conflicts. A CFRA study reviewed 20 major geopolitical political event since World War II, and showed that stocks recovered completely within an average of 47 trading days after an average maximum decline of 5%.

conclusion

The current crisis may seem like a 'black swan' event for many people, but the situation is similar to that of the late 1960s to the 1970sThe situation between the early eras. The market has been shaky due to runaway inflation, soaring oil prices, and geopolitical uncertainty in Europe.

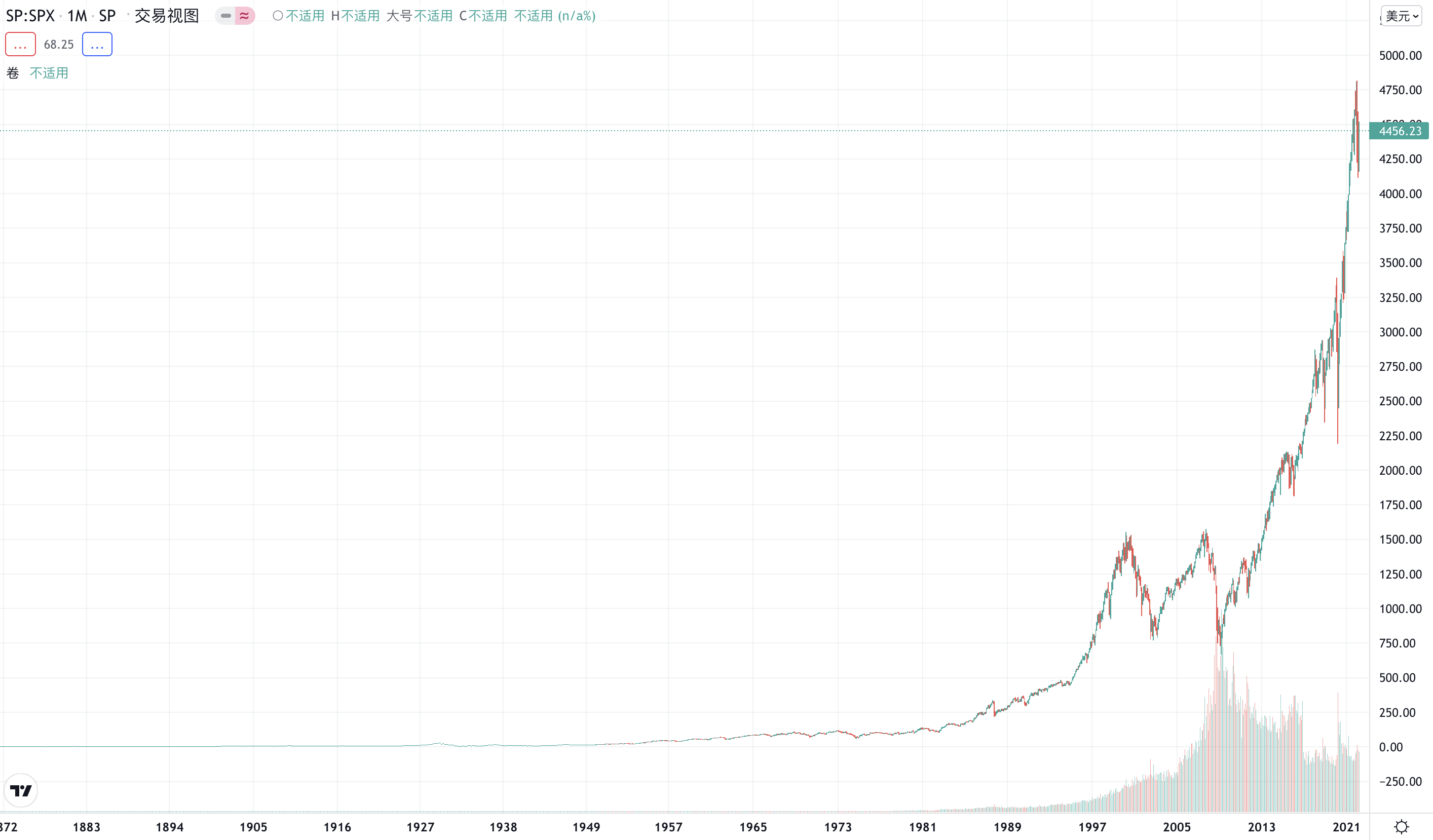

However, history shows that despite all negative factors in the short term, the market often rebounds in the end.

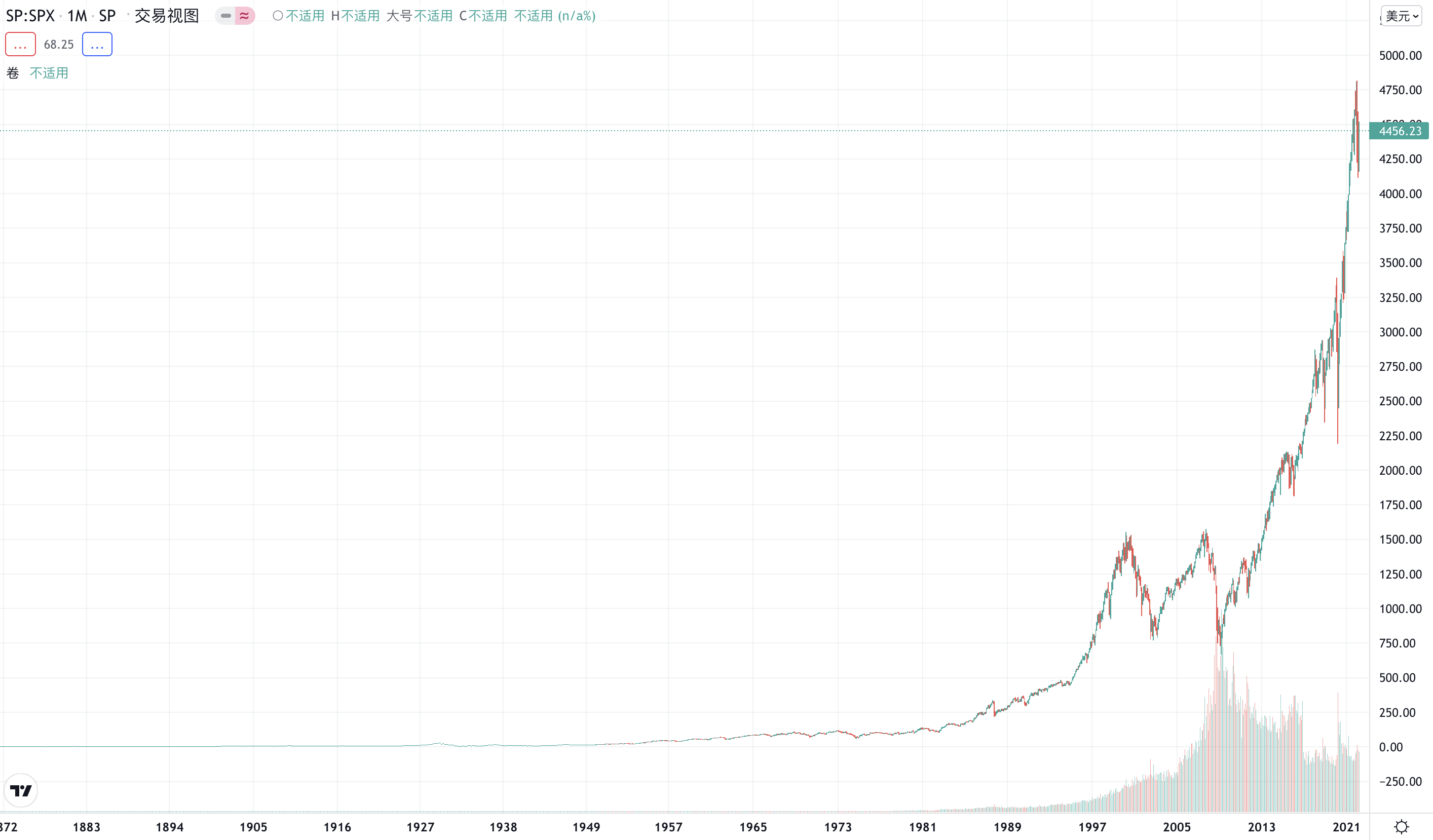

In the long run, just looking at the S&P 500 index shows everything:

The above content is not investment advice and is for reference only.

If you like this article, please share your views in the comments section.