Hedge funds are another form of investment for high net worth investors, with exponential growth over the years. It is estimated that there are over 10000 hedge funds worldwide.

Nowadays, there are over 3691 hedge funds in the United States, accounting for 75% of assets under management (AuM).

The hedge fund market has attracted great attention in the investment field, and the current hedge fund industry is rapidly growing and has now been used as a strategic tool for almost all types of companies and investors. Companies are increasingly using hedge funds to manage their risk, liquidity, volatility, and performance.

Hedge funds cover a wide range of asset classes and investment strategies. Having a wide range of tools and technologies available, including Derivatives trading, investing in illiquid markets, and establishing short positions.

Hedge funds have been around for a long time. Their history can be traced back to the early 1950s.

In this article, we will review the history of hedge funds and understand how they have evolved.

1926: Graham Newman Company

During the bull market of the 1920s in the United States, several high net worth private investment vehicles emerged. Graham Newman is one of the most famous companies, which was founded by Benjamin GrahamGraham was founded in partnership with his long-term business partner Jerry Newman.

In 1926, Graham established an investment partnership with Jerome Newman and began fine-tuning his deep value investment strategy. Until 1929In, they achieved great success, but the market crash of that year wiped out most of their profits. Graham Newman later became heavily indebted.

A group photo of Benjamin Graham and Jerry Newman

The Great Depression brought many lessons to Graham, as he began to hold Securities with lower risk of permanent capital loss. By 1937, they used deep value investment strategies to compensate for most of the losses.

After 1936, the Graham Newman Partnership was transformed into Graham Newman Corporation and operated as a mutual fund. In addition to its net asset value and dividends, the company also announced its earnings per share for the year.

However, many people believe that the company's business style is similar to that of hedge funds. Warren Buffett addressed the Museum of Finance in 2006American Finance) said: "Benjamin Graham, a respected investor and writer, was back in 1920I managed a hedge fund in the mid-1990s

1949: The Birth of "Market Neutral" hedging Strategy

Alfred Winslow Jones is regarded in the financial market as the creator of the first hedge fund strategy in 1949, through his company AWJones founded the fund with a capital of $100000.

Australian investor and sociologist Jones aims to differentiate between overall market risk and specific stock risk by creating market neutral investment portfolios.

Photos of Alpred Winslow Jones

Jones creates a market neutral strategy by purchasing assets that will increase in value compared to overall market performance and selling assets that he expects to decrease in price. Jones also used leverage to increase the returns of his fund.

The performance of his investment portfolio depends on choosing the right stocks, rather than focusing on market direction. Due to his portfolio hedging against market trends, he is known as a "hedge fund".

1950s: The Birth of Costs and Leverage

In 1952, Jones transformed his fund from a general partnership to a limited partnership. This is the first collective investment tool in the hedge fund industry to combine hedging strategies.

Jones' hedge fund has two key elements - leverage and fees. When he expects certain stocks to rise, he borrows money to bet. Jones also introduced 20% and 2%Many hedge fund managers have earned a portion of their profits from performance fees.

According to Alexander Ineichen's book "Absolute Returns," in his second year after establishing the fund, the return was 17.3%, and in the following decade, it outperformed all mutual funds87%.

Jones claimed that his fee structure was inspired by the Phoenician merchant ship and gained 20% from successful voyagesProfit. This is to avoid the IRS policy of setting a maximum marginal tax rate of 91% on profits, while maintaining a return on capital of 25%.

1966: The Rise of Hedge Funds

In 1966, an article in Fortune magazine emphasized the outstanding performance of Alfred W. Jones' investment vehicles, elevating the hedge fund industry to another level.

The article described Jones as the "best professional fund manager" of that era, and said that his performance in the past decade was 87% higher than the best performing Alfred Dreyfus Fund.

In the past five years, even after considering costs, its performance has exceeded 44% of the fund.

Article author Carol LoomisElaborate on the two partnership enterprises operated by Jones, with slightly different investment objectives. However, in each case, the basic investment strategy is to leverage and "hedge" the fund's capital. LoomisHe also coined the term 'hedge fund'. The two funds each have approximately 60 investors, with an average investment amount of $460000.

1968: 140 hedge funds enter the market

After 1968, the US Securities and Exchange Commission conducted an investigation and recruited 215 investment partnerships, of which 140 were classified as hedge funds. The total assets of these funds are 13Billion US dollars, focused on corporate equity investment, with speculative nature. The median of speculative funds is 3250, with an average account size of $3787.

As the market climbs, hedge fund managers begin to use leverage because hedging investment portfolios through short selling is challenging and costly. As a result, managers used hedge fund strategies such as token hedging, which put the fund in the face of 1968The risk of market downturn after the year.

Afterwards, many famous fund managers launched their hedge funds, including Michael Steinhardt and George SorosSoros). However, as the hedge fund industry began to expand, they began to use leverage to hold more long positions, rather than offsetting them through short selling.

Therefore, significant losses occurred between 1969 and 70. During the bear market of 1973-74, many hedge fund companies went bankrupt.

1969: Fund Of Hedge Funds established

In 1969, George Karlweis, founder of Edmond de Rothschild, a senior bankerThe leveraged capital holding company created was the first fund of a hedge fund. The fund was launched in Geneva, Switzerland. The second is Grosvenor, a partner based in the United States, established in 1971 by Richard Eldon.

It is worth noting that the conceptualized fund's funds are attributed to BernieHowever, in 1962, Cornfield launched a mutual fund related to the United States, rather than a hedge fund.

Funds in Funds (FOF)It is a strategy that involves holding investment portfolios of other funds (mutual funds or hedge funds) rather than stocks, bonds, or other securities. This type of investment is commonly referred to as a multi manager fund. Funds in a fund can invest in hedge funds of the same or different investment institutions.

At that time, the philosophy behind the fund was to invest in the best managers, such as George Soros and Michael Stanhart.

No matter how outstanding, hedge fund managers will make erroneous judgments that may affect fund performance. Therefore, the creation of Fund of Funds is aimed at achieving homogeneous returns through diversification.

Although this is a formal fund structure fund, many people believe that when Alfred Jones began to allocate assets to external managers in 1954, the first multi manager plan came into being.

1970: First Hedge Fund Crash

The economic recession of 1969 to 1970 and the stock market crash of 1973 to 1974 led to the collapse of many hedge funds, as the industry has always been struggling with market risks. From June 1969 toIn May 1970, the decline of small stocks was greater than that of large stocks, which was one of the main reasons why hedge fund performance was particularly affected.

In a 1970 article in Fortune magazine, hedge funds were in trouble, and journalist Carol Loomis said, "6In January, based on the overall average of the market, the market fell by 6.9%, and the data collected by Hatwell from eight hedge funds (including his own two) fell by an average of 15.3%.

In July, when the market fell by 6.4%, the average fund fell by 10%. In August, when the market briefly rebounded, the seven funds with data from Hartwell saw an average increase of only 4.2%, while the overall average increase was4.5%

In the 12 months ended May 31, 1970, Jones' funds suffered losses more than 10% higher than the Standard&Poor's index. Interestingly, in its 30Jones suffered losses in just three years of his life cycle.

1975: Ray Dalio's Bridgewater Fund Bridgewater Associates Rise

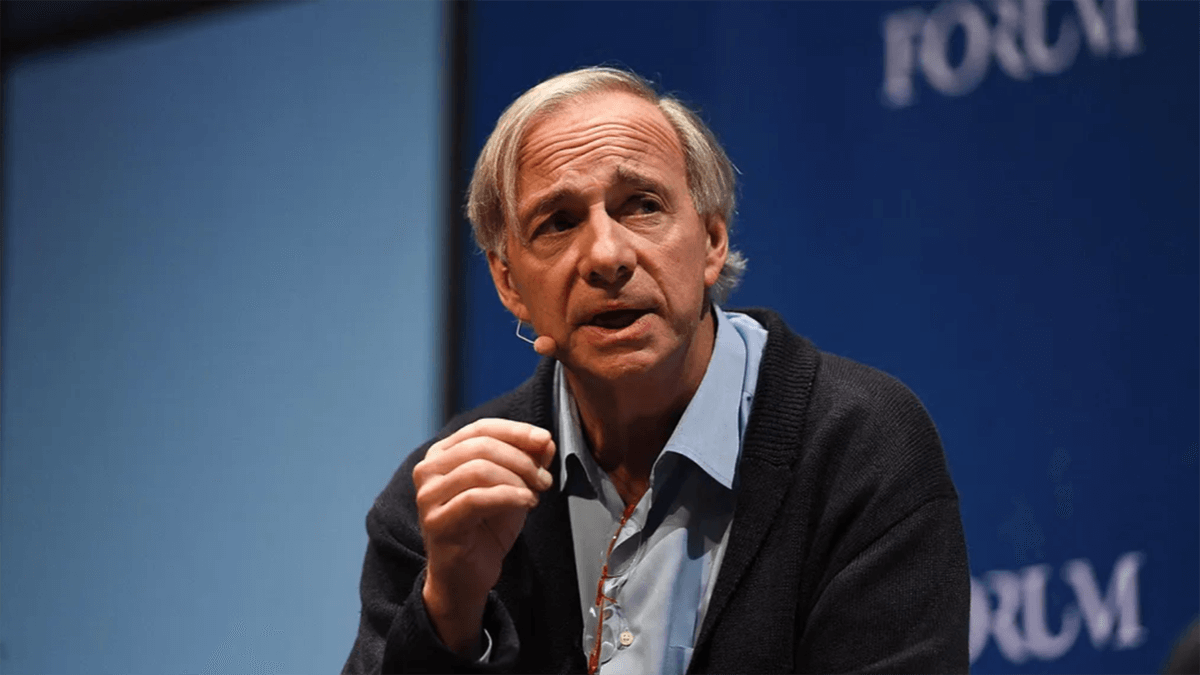

In 1975, Ray Dalio founded the Bridgewater Fund in his two bedroom apartment in New York CityAssociates provides currency and bond advisory services for institutional investors. The World Bank, McDonald's, and Eastman Kodak are some respected clients of Bridgewater Consulting.

In 1982, Dario confidently but wrongly predicted a global economic depression and traded accordingly.

Photo of Ray Dalio

To everyone's surprise, there has been a bull market in the stock market, and the US economy has entered the most significant period of non inflationary growth in nearly two decades of history. Ray DalioWithin eight years of founding an investment company, he suffered great misfortune and went bankrupt. Due to the huge losses, Dario was forced to disband all employees and seek financial assistance from his family.

The 1980s: The Revival of Hedge Funds

The 1980s was the fastest growing period for hedge funds. Due to strong performance and increased interest from wealthy investors, some hedge funds have experienced extraordinary growth.

eightyThe constantly developing market in the 1990s has provided many new opportunities for hedge funds. They can try new investment methods, use leverage tools, and develop hedge fund strategies based on significant fluctuations in currency and commodity markets, providing investors with generous returns.

The structure of hedge funds in the 1980s was relatively small, but they generated considerable returns. It is almost similar to stocks because the industry is flexible, operates freely, and is far from the attention of media, regulatory agencies, and investors.

In 1980, when Julian Robertson and Thorpe McKenzie founded the Tiger Fund, the hedge fund attracted a lot of attention. The fund usesLaunched at $8 million, with a market value of over $22 billion, it became the largest hedge fund at the time.

The fund was established in 2000At the beginning of the year, when the Internet foam collapsed, the legacy of Tiger Fund continued. After Robertson's employees emerged from their difficulties, they launched some of the best performing funds in the industry. This group is collectively referred to as the "tiger cubs".

To be continued